Experian 2014 Annual Report Download - page 133

Download and view the complete annual report

Please find page 133 of the 2014 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178

|

|

Financial statements • Notes to the Group financial statements 129

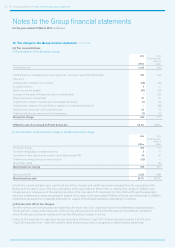

(d) Interest rate risk

The following table shows the Group’s sensitivity to interest rate risk on the basis of the profile of net debt at the balance sheet dates

and an assessment of reasonably possible changes in the principal interest rates, with all other variables held constant. In making

this assessment, the Group has considered movements in relevant interest rates over the most recent three-year period and has

applied a consistent methodology for both years presented. An indication of the primary cause of the reported sensitivity of profit for

the financial year is included.

(Loss)/gain

2014

US$m

2013

US$m

Effect of an increase of 0.1% (2013: 0.1%) on US dollar denominated net debt:

Due to fair value gains on interest rate swaps offset by higher interest on floating rate borrowings (11) 4

Effect of an increase of 0.1% (2013: 0.1%) on sterling denominated net debt:

Due to the revaluation of borrowings and related derivatives (1) (3)

Effect of an increase of 2.4% (2013: 2.4%) on Brazilian real denominated net debt:

Due to higher interest income on cash and cash equivalents 2 2

Effect of an increase of 0.5% (2013: 0.6%) on euro denominated net debt:

Due to fair value gains on interest rate swaps offset by higher interest on floating rate borrowings (1) (3)

16. Tax charge in the Group income statement

(a) Analysis of Group tax charge

2014

US$m

2013

(Re-presented)

(Note 3)

US$m

Current tax:

Tax on income for the year 159 224

Adjustments in respect of prior years (20) (40)

Total current tax charge 139 184

Deferred tax:

Origination and reversal of temporary differences 171 (47)

Adjustments in respect of prior years (8) 14

Total deferred tax charge/(credit) 163 (33)

Group tax charge 302 151

The Group tax charge comprises:

UK tax 71 4

Non-UK tax 231 147

302 151