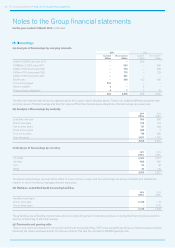

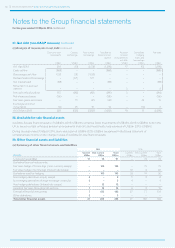

Experian 2014 Annual Report Download - page 144

Download and view the complete annual report

Please find page 144 of the 2014 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial statements • Notes to the Group financial statements

Notes to the Group financial statements

for the year ended 31 March 2014 continued

140

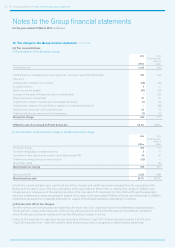

26. Borrowings

(a) Analysis of borrowings by carrying amounts

2014 2013

Current

US$m

Non-current

US$m

Current

US$m

Non-current

US$m

£334m 5.625% Euronotes 2013 – – 529 –

US$600m 2.375% notes 2017 – 599 – 602

£400m 4.75% Euronotes 2018 – 718 – 693

€500m 4.75% Euronotes 2020 – 775 – 729

£400m 3.50% Euronotes 2021 – 661 – –

Bank loans – 816 100 590

Commercial paper 576 – – –

Bank overdrafts 4 – 3 –

Finance lease obligations 4 7 3 12

584 3,576 635 2,626

The effective interest rates for bonds approximate to the coupon rates indicated above. There is no material difference between the

carrying values of the borrowings and their fair values. Other than finance lease obligations, the borrowings are unsecured.

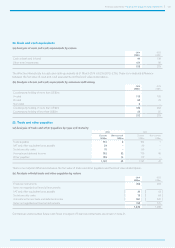

(b) Analysis of borrowings by maturity

2014

US$m

2013

US$m

Less than one year 584 635

One to two years 105 103

Two to three years 717 493

Three to four years 599 3

Four to five years 718 605

Over five years 1,437 1,422

4,160 3,261

(c) Analysis of borrowings by currency

2014

US$m

2013

US$m

US dollar 3,432 2,557

Sterling 662 542

Euro 23 46

Other 43 116

4,160 3,261

The above analysis takes account of the effect of cross currency swaps and forward foreign exchange contracts and reflects the

manner in which the Group manages relevant exposures.

(d) Undrawn committed bank borrowing facilities

2014

US$m

2013

US$m

Facilities expiring in:

One to two years 2,216 114

Two to three years – 1,510

2,216 1,624

These facilities are at floating interest rates and are in place for general corporate purposes, including the financing of acquisitions

and the re-financing of other borrowings.

(e) Covenants and gearing ratio

There is one financial covenant in connection with the borrowing facilities. EBIT must exceed three times net interest expense before

financing fair value remeasurements. The Group monitors this and the net debt to EBITDA gearing ratio.