Experian 2014 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2014 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

87

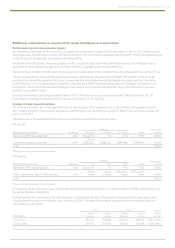

Additional requirements in respect of the single total figure of remuneration

Performance against annual bonus targets

The Committee set targets for the annual bonus based on profit growth in respect of the year ended 31 March 2014, which required

stretching levels of performance to earn the maximum bonus. The Committee considered a profit growth metric to be appropriate as

it reflects one of Experian’s key performance indicators (EBIT).

The Benchmark PBT growth, for bonus purposes, of 8%, was at the target level of the performance range. Accordingly, a bonus

equivalent to 100% of salary (as against a maximum of 200%) is payable to the executive directors.

The Committee considers that this level of bonus payment is appropriate in the context of the underlying performance of the Group.

The Committee has not disclosed the annual bonus target calibration for the year ended 31 March 2014 as this continues to be

considered commercially sensitive. Whilst we acknowledge that shareholders would like targets to be disclosed, the Committee

believes that this is not in shareholders’ longer-term interests given that it would be damaging to the Company and useful to our

competitors. If the Committee decides that targets have ceased to be commercially sensitive, they will be disclosed in the next

available remuneration report.

Don Robert and Brian Cassin have elected to defer 100% of their annual bonus for the year ended 31 March 2014 into the CIP.

Chris Callero is retiring as a director of the Company with effect from 16 July 2014.

Vesting of share-based incentives

The amount included in the 2014 single total figure of remuneration is the combined value of the CIP and PSP awards granted in

2011. Vesting for both of these awards depended on performance over the three years ended 31 March 2014 and continued service

until 15 June 2014.

The performance achieved against the performance targets is shown in the following tables.

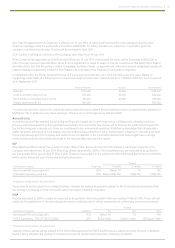

CIP awards

Performance measure Weighting

Vesting*

Actual

Percentage

vesting No match 1:1 match 2:1 match

Benchmark PBT (annual growth) 50% Below 7% 7% 14% 13.1% 46.8%

Cumulative operating cash flow 50%

Below

US$3.0bn US$3.0bn US$3.4bn US$3.6bn 50.0%

Total 96.8%

*Straight-line vesting between the points shown.

PSP awards

Performance measure Weighting

Vesting*

Actual

Percentage

vesting 0% 25% 100%

Benchmark PBT (annual growth) 75% Below 7% 7% 14% 13.1% 67.8%

TSR of Experian vs. TSR of FTSE 100 Index 25%

Below

Index

Equal

to Index

25% above

Index

18.8% above

Index 20.3%

Total 8 8.1%

*Straight-line vesting between the points shown.

PSP awards will also only vest where, in the judgment of the Committee, the return on capital employed (‘ROCE’) performance over

the period has been satisfactory.

As these awards had not vested at the date this report was finalised, the value of the awards is based on the average share price

of the last three months of the financial year, which was £10.83. The value of the awards, as included in the single total figure of

remuneration, is as follows.

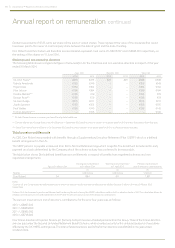

Participant

CIP PSP Value of

shares

vesting*

Shares

awarded

Shares

vesting

Shares

awarded

Shares

vesting

Don Robert 443,046 428,868 233,006 205,278 US$11.373m

Chris Callero 284,160 275,066 149,124 131,378 US$7.289m

*The value of the shares has been converted into US dollars at a rate of £1:US$1.66, which is the average rate over the last three months of the financial year.

Governance • Report on directors’ remuneration