Experian 2014 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2014 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

26 Strategic report • Protecting our business

Protecting our business continued

EXPOSURE TO THE UNPREDICTABILITY OF FINANCIAL MARKETS (FOREIGN EXCHANGE, INTEREST RATE AND

OTHER FINANCIAL RISKS)

Our operations expose us to the unpredictability of international financial markets.

Performance indicator

Profit before tax

Strategic alignment

• Geographic expansion

Further information

• Financial review

section and financial

statements notes

Description of risk

• We are exposed to foreign exchange risk from future commercial

transactions, recognised assets and liabilities, and investments in,

and loans between, undertakings with different functional currencies.

• We face interest rate risks arising from our borrowings.

• Credit and liquidity risks arise from our derivative financial

instruments and borrowing facilities.

Potential impact

• Changes in financial market conditions could adversely

affect our business, operations and profitability.

How we manage this risk

• We operate conservative currency hedging strategies, to

minimise the impact of currency volatility.

• We use fixed and floating rate borrowings, of varying durations.

• We have long-term committed bank borrowing facilities.

• Our treasury and insurance activities are only with institutions with

strong credit ratings, within limits we set for each organisation.

Change from 2013

Increasing risk

2014 update

Tapering of the US quantitative

easing (‘QE’) policy could

contribute to ongoing currency

volatility. Changes in the value of

sterling, the euro, the Brazilian

real or other Group operating

currencies, relative to the US

dollar, could affect our EBIT.

Reduction in QE could also result

in higher global interest rates,

making our debt more expensive

to service in the future.

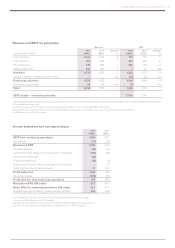

ADVERSE MARKET CONDITIONS COULD AFFECT OPERATIONAL RESULTS

Our operations are exposed to adverse market conditions resulting from concerns about the large sovereign debts and/or fiscal deficits

of a number of European countries and the US or an economic slowdown in high-growth markets such as Brazil and China.

Performance indicator

EBIT and percentage of

revenue from customer

segments other than

financial services

Strategic alignment

• Geographic expansion

Further information

• Regional reviews

Description of risk

• The default, or a significant decline in the credit rating, of one

or more sovereigns or financial institutions could cause severe

stress in the financial system.

• An economic slowdown could hit our high-growth markets.

Potential impact

• We could see sluggish demand for our products and services,

affecting our operations and profitability.

• Financial instability of our customers, suppliers, counterparties

or creditors could affect our profitability.

How we manage this risk

• Our business is diversified by region and clients.

• We continue to develop counter-cyclical products and services.

• We monitor our counterparty relationships.

Change from 2013

Stable

2014 update

Concerns over the state of sovereign

debt have moderated, along with

governments taking measures to

promote economic growth. We

continue to benefit from a diversified

portfolio of clients, in many

countries. For 2014, businesses in

North America accounted for 50%

of global revenue, Latin America

19%, the UK and Ireland 20% and

the remaining countries, comprising

the EMEA/Asia Pacific regions, 11%.

EXPOSURE TO COUNTRY AND REGIONAL POLITICAL, FINANCIAL, ECONOMIC OR SOCIAL RISKS, PARTICULARLY

IN THE US, BRAZIL AND THE UK

Our global footprint subjects our businesses to risks associated with international sales and operations.

Performance indicator

EBIT

Strategic alignment

• Geographic expansion

Further information

• Our corporate

responsibilities –

working in partnership

with communities

• Exposure to legislation or

regulatory reforms risks

and uncertainties

Description of risk

• Changes in a country’s or region’s political, economic or social

risks or geopolitical turmoil could result in loss of services

and prevent us meeting agreed service levels or fulfilling other

obligations. These risks are generally outside our control.

• We could face increased effective tax rates due to changes in

some countries’ tax laws.

How we manage this risk

• We have a diverse portfolio by geography, product, sector

and client.

• We help communities to realise their social and economic

potential, by using our business skills, products and services

to promote financial education, financial inclusion and support

small business entrepreneurs.

• We retain internal and external tax professionals, who monitor

the likelihood of future tax changes.

Change from 2013

Stable

2014 update

We have seen isolated instances of

social and political unrest in Brazil,

Turkey and Thailand, which have

had minimal effect on us. Cyclical

economic weakness in Brazil

has contributed to a slowdown

in organic growth during 2014.

Latin America accounted for 19%

of global revenue.

P47

P120

P34

P57

P24