Experian 2014 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2014 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

44 Strategic report • Financial review

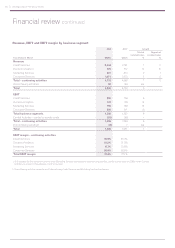

Financial review continued

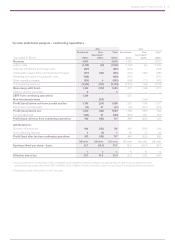

Exchange rate movements from last

year have decreased our reported

revenue for the year ended 31 March 2014

by US$107m and our EBIT by US$39m.

This is primarily as a consequence of

the weakness of the Brazilian real and

its impact on the reported results of our

Latin America region.

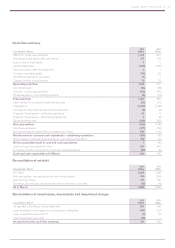

Group cash flow commentary

Cash flow summary

We generated very strong cash flow

in the year with operating cash flow of

US$1,321m (2013: US$1,175m) and a

cash flow conversion of 101% (2013: 94%).

We manage working capital and capital

expenditure with the aim of converting at

least 90% of our EBIT into operating cash

flow. This target is a key performance

indicator and our five-year track record for

this metric is shown in that section of the

Strategic report. Note 39(i) to the Group

financial statements reconciles cash

generated from operations, as reported

in the Group cash flow statement, to

operating cash flow as reported in the

cash flow summary table.

As the cash flow summary table shows,

free cash flow in the year ended 31

March 2014 was US$1,067m (2013:

US$891m). The net cash outflow in the

year of US$570m (2013: US$1,018m) is

after acquisition spend of US$1,250m

(2013: US$1,549m) and equity dividend

payments of US$349m (2013: US$322m).

Note 39(e) to the Group financial

statements analyses our acquisition

spend. Acquisitions in the year ended

31 March 2014 included the two

significant transactions in North America.

Acquisition spend in the prior year

principally comprised the additional

stake in Serasa in November 2012. The

Group ran a share purchase programme

from May 2013 until late October 2013,

when it was discontinued following the

announcement of the acquisition of

Passport Health Communications.

Funding

In light of the above and our redemption

of the £334m 5.625% Euronotes 2013 at

maturity in December 2013, we

undertook two significant corporate

financing initiatives in the second half

of the year. We initiated a commercial

paper programme in January 2014 and

we issued £400m 3.50% Euronotes 2021

in February 2014.

Both these initiatives were well

supported by the financial markets.

Our outstandings under the commercial

paper programme were US$576m at

31 March 2014.

Capital expenditure

Capital expenditure was US$402m (2013:

US$460m) including data and software

to support our future growth. An

analysis of our expenditure by operating

segment is given in note 9(a)(iii) to the

Group financial statements. Later in this

review we provide a chart comparing

capital expenditure to amortisation and

depreciation charges in each of the two

years ended 31 March 2014.

We subject our capital expenditure

to rigorous internal review processes

on both a pre-investment and a post-

investment view. We have reduced capital

expenditure as a percentage of revenue

from 9.7% in the prior year to 8.3% in the

year under review.

Net debt and covenants

At 31 March 2014, net debt was

US$3,809m (2013: US$2,938m) with

undrawn committed borrowing facilities

of US$2,216m (2013: US$1,624m). Our

net debt at 31 March 2014 was 2.27 times

EBITDA, compared to a target ratio of 1.75

to 2.0 times.

A summary reconciliation of the movement

in net debt is provided below and a more

detailed reconciliation is included in note

27(c) to the Group financial statements.

Note 26(b) to the Group financial

statements shows the maturity profile

of our borrowings and facilities.

We have not breached any covenants

given on borrowings in the year under

review or the prior year and have no

undue concentration of repayment

obligations in respect of borrowings.

Foreign exchange – average rates

The principal exchange rates used to translate revenue and EBIT are shown in the

table below.

At 31 March

2014 2013 Changed

against the US$

US$ : Brazilian real 2.25 2.01 (11.9%)

Sterling : US$ 1.59 1.58 0.6%

Euro : US$ 1.34 1.29 3.9%

P157

P158

P141

P123

P140