Experian 2014 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2014 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

84

Directors’ remuneration policy continued

In the case of an external appointment to the Board, the Committee may offer further one-off cash and/or share-based remuneration,

when an individual would be forfeiting remuneration awarded to them by their former employer. In establishing the value and

conditions attached to such remuneration, the Committee would seek to provide equivalence in value by taking into account the

likelihood of vesting, and the timeframe in which such vesting was scheduled to occur. Such awards may be granted under the terms

of UK Listing Rule 9.4.2.

Service contracts and policy on payment for loss of office

The policy for new hires is that service contracts will generally be limited to 12 months’ notice of termination of employment and will

follow the UK Corporate Governance Code guidelines.

The Committee believes this policy is in line with best practice, remains market competitive and allows Experian to recruit key

individuals who we identify as critical to our future performance.

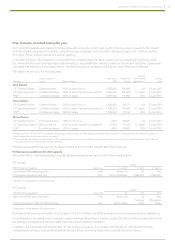

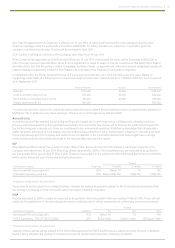

The Committee’s policy for the treatment of executive directors leaving the Group (subject to the current contractual commitments

described below) is set out in the table below. For executive directors who leave the Group in other circumstances, the treatment will

normally fall between the two treatments described. In any event, the overall treatment will be subject to the Committee’s judgment.

The Committee reserves the right to make additional exit payments to discharge an existing legal obligation (or by way of damages

for breach of such an obligation) or by way of settlement or compromise of any claim arising in connection with the termination of a

director’s office or employment.

Voluntary resignation or termination

for misconduct or poor performance

Other circumstances such as death, ill health, retirement, disability or redundancy or

any other reason as defined by the Committee

Base salary, pension

and benefits

Paid up to the date of termination and for

any untaken holidays as at that date.

Paid up to the date of death or leaving and for any untaken holidays as at that date.

If, in the judgment of the Committee, exceptional circumstances apply, such as in the

case of death, the Committee may agree to a different approach from that outlined

above, for example not applying time pro-rating to a payment.

Annual bonus Normally no annual bonus is paid in

respect of the year in which the date

of termination falls.

Annual bonus will usually be paid on the normal bonus payment date, in line with

performance achieved, pro-rated for the proportion of the financial year worked. If, in the

judgment of the Committee, exceptional circumstances apply, in the case of death for

example, the Committee may agree that it is not appropriate to apply time pro-rating to

the annual bonus payment. Any election already made to defer annual bonus under the

CIP will not apply.

CIP invested shares Invested shares will be transferred

to the individual.

Invested shares will be transferred to the individual.

CIP matching shares

and PSP awards

Unvested awards will lapse. Any vested

awards structured as nil-cost options

which have not been exercised may be

exercised up to the normal lapse date.

In the case of death, performance conditions will cease to apply and unvested awards

will vest immediately. The number of shares that vest are pro-rated for time unless, in the

judgment of the Committee, exceptional circumstances apply.

In all other cases, subject to the Committee’s discretion, unvested awards will vest at

the end of the performance period and remain subject to the relevant performance

conditions.

In all circumstances, the number of shares vesting will normally be reduced pro rata,

to reflect the number of months from the start of the performance period to the date of

cessation of employment as a proportion of the performance period.

Vested awards structured as nil-cost options which have not been exercised may be

exercised up to the normal lapse date.

Executive share

options

Unvested share options will lapse.

Vested options will not lapse and will

remain exercisable for six months, unless

the reason for leaving is dismissal for

misconduct, in which case, subject

to Committee discretion, the options

will lapse on the date of cessation of

employment.

In the case of death, unvested share options will vest immediately and will remain

exercisable for 12 months. Any vested share options will also remain exercisable

for 12 months.

In all other cases, any vested options will remain exercisable for six months following

cessation of employment. Unvested options, subject to the Committee’s discretion,

will vest at the end of the performance period and remain subject to the relevant

performance conditions. The number of options vesting will normally be reduced pro

rata, to reflect the number of months from the start of the performance period to the

date of cessation of employment as a proportion of the performance period. These

options will be exercisable for six months following vesting.

Awards under All

Employee Plans

In accordance with the relevant tax

regulations or plan rules.

In accordance with the relevant tax regulations or plan rules.

Other None. At the Committee’s discretion, leavers may receive disbursements such as legal

fees and outplacement.

Note: All descriptions of policy in relation to share plans are in line with the relevant plan rules.

Governance • Report on directors’ remuneration