Experian 2014 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2014 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

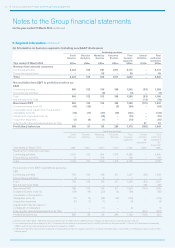

Financial statements • Notes to the Group financial statements

Notes to the Group financial statements

for the year ended 31 March 2014 continued

114

5. Significant accounting policies continued

(l) Borrowings (note 26)

Borrowings are recognised initially at fair value, net of any transaction costs incurred. Borrowings are subsequently stated at

amortised cost except where they are hedged by an effective fair value hedge, in which case the carrying value is adjusted to reflect

the fair value movements associated with the hedged risk.

Borrowings are classified as non-current to the extent that the Group has an unconditional right to defer settlement of the liability for

at least one year after the balance sheet date.

(m) Trade payables (note 25)

Trade payables are recognised initially at fair value. Where the time value of money is material, payables are then carried at amortised

cost using the effective interest rate method.

(n) Post-employment benefit assets and obligations (note 34)

Defined benefit pension arrangements – funded plans

The post-employment benefit assets and obligations recognised in the Group balance sheet in respect of funded plans comprise

the fair value of plan assets of funded plans less the present value of the related defined benefit obligation at that date. The defined

benefit obligation is calculated annually by independent qualified actuaries using the projected unit credit method. Under this

method, and in view of the fact that the principal Experian funded plan is closed to new entrants, the current service cost increases

as members approach retirement due to the plan’s ageing active membership.

The present value of the defined benefit obligation is determined by discounting the estimated future cash outflows, using

market yields on high-quality corporate sterling bonds with maturity terms consistent with the estimated average term of the

related pension liability.

Remeasurement gains and losses arising from experience adjustments, and changes in actuarial assumptions, are recognised

immediately in the Group statement of comprehensive income.

The pension cost recognised in the Group income statement comprises the cost of benefits accrued and interest on the opening

net defined benefit asset or obligation. Service costs and the net financing income or expense are recognised separately in the

Group income statement. Plan expenses are charged within labour costs.

Defined benefit pension arrangements – unfunded plans

Unfunded pension obligations are determined and accounted for in accordance with the principles used in respect of the

funded arrangements.

Defined contribution pension arrangements

The assets of defined contribution plans are held separately from those of the Group in independently administered funds. The

pension cost recognised in the Group income statement represents the contributions payable by the Group to these funds in

respect of the year.

Post-retirement healthcare obligations

Obligations in respect of post-retirement healthcare plans are calculated annually by independent qualified actuaries using an

actuarial methodology similar to that for the funded defined benefit pension arrangements. Remeasurement gains and losses

arising from experience adjustments, and changes in actuarial assumptions, are recognised in the Group statement of

comprehensive income. The cost recognised in the Group income statement only comprises interest on the obligation.

(o) Own shares (note 38)

Shares in the Company purchased in connection with any share buyback programme, and held as treasury shares, are shown

as a deduction from total equity at cost.

The Group has a number of equity-settled, share-based employee incentive plans and, in this connection, shares in the Company

are held by The Experian plc Employee Share Trust and the Experian UK Approved All-Employee Share Plan. The assets of these

entities mainly comprise Experian shares, which are also shown as a deduction from total equity at cost.

(p) Revenue recognition

Revenue represents the fair value of consideration receivable on the provision of services, net of value added tax and other sales

taxes, rebates and discounts. Revenue includes the provision and processing of data, subscriptions to services, software and

database customisation and development and the sale of software licences, maintenance and related consulting services.