Experian 2014 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2014 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

47

Strategic report • Financial review

Share price and market capitalisation

Experian’s share price ranged from

£10.20 to £12.90 during the year. On

31 March 2014, the mid-market price

was £10.81, giving a market capitalisation

of US$18.5bn at that date.

Accounting policies

and developments

The principal accounting policies are

shown in note 5 to the Group financial

statements and we have applied them

consistently. We support initiatives in

the UK financial reporting community

to ‘cut the clutter’ in published financial

statements. Accordingly we have adopted

this principle this year in preparing both

the Group and parent company financial

statements, while working within formats

that are broadly unchanged from earlier

annual reports.

The year under review has seen little

impact on the Group from developments

in accounting standards. Experian

adopted IAS 19 (revised) ‘Employee

benefits’ with effect from 1 April 2013 and

we have re-presented the comparative

information in this report as necessary.

Note 3 to the Group financial statements

gives further details and the impact of

adoption is modest.

Accounting estimates and

assumptions

Note 6(a) to the Group financial

statements shows details of our critical

accounting estimates and assumptions.

The most significant of these relate to tax

and goodwill and the key features can be

summarised as follows:

• Estimates made in respect of tax

assets and liabilities include the

consideration of transactions in

the ordinary course of business for

which the ultimate tax determination

is uncertain.

• The assumptions used in the cash

flow projections underpinning the

impairment testing of goodwill

include assumptions about

profitability and future growth,

together with pre-tax discount

rates specific to the Group’s cash

generating units.

Financial risk management

The Protecting our business section

of this report sets out the risks and

uncertainties that are specific to our

business, together with more general

risks. Our financial risk management

continues to focus on the unpredictability

of financial markets and seeks to

minimise potentially adverse effects on

our financial performance.

We look to reduce our exposures to

foreign exchange, interest rate and

other financial risks. The mitigation of

our exposure to the unpredictability of

financial markets includes the use of

currency hedging strategies to minimise

the impact of currency volatility. However

we do not currently intend to undertake

borrowings in Brazilian real.

Detailed narrative and numerical

disclosures in respect of our financial

risks are included in the notes to the

Group financial statements, with the key

features summarised below.

Foreign exchange risk is managed by:

• entering into forward foreign

exchange contracts in the relevant

currencies in respect of investments

in entities with functional currencies

other than US dollars, whose net

assets are exposed to foreign

exchange translation risk;

• swapping the proceeds of certain

bonds issued in sterling and euros

into US dollars;

• denominating internal loans in

relevant currencies to match the

currencies of assets and liabilities

in entities with different functional

currencies; and

• using forward foreign exchange

contracts for certain future

commercial transactions.

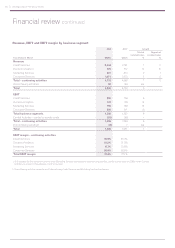

2014 NET FUNDING BY INTEREST RATE

2014 NET FUNDING BY CURRENCY

2014 EBIT BY CURRENCY

Fixed 77%

Floating 23%

Fixed 76%

Floating 24%

US dollar 81%

Sterling 17%

Euro 1%

Other 1%

US dollar 79%

Sterling 16%

Euro 1%

Other 4%

US dollar 56%

Brazilian real 24%

Sterling 13%

Other 7%

US dollar 57%

Brazilian real 26%

Sterling 10%

Other 7%

2013 NET FUNDING BY INTEREST RATE

2013 NET FUNDING BY CURRENCY

2013 EBIT BY CURRENCY

P111

P110

P117

P20