Experian 2014 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2014 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

43

Strategic report • Financial review

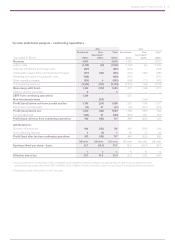

Exceptional items –

continuing operations

As shown in the table below, there was

an exceptional charge of US$54m in the

year (2013: US$66m). The charge for the

year includes:

• Restructuring costs which are the

costs we incurred following the

strategic review of our cost base

during the year ended 31 March

2013. Note 13 to the Group financial

statements gives further details.

• The gain on disposal of businesses

in the year relating to a number of

small disposals.

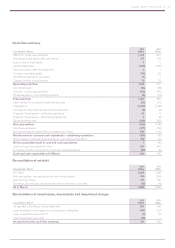

Net interest expense

The net interest expense for the year

was US$74m (2013: US$62m). The key

driver of the increase was the full-year

effect of the additional funding for the

acquisition of the further 29.6% stake

in Serasa in November 2012, and the

effect of the US$1.2bn we spent on the

Passport Health Communications and

41st Parameter acquisitions in the US

in the second half of the year ended

31 March 2014.

Experian remains strongly cash

generative and both our interest cost

and the amount paid have continued to

benefit from low interest rates globally.

Ta x

The Benchmark tax rate was 26.7% (2013:

25.3%). The increase reflects higher profits

in the US, which has a corporate tax rate

above the main UK rate. Note 16 to the

Group financial statements includes a

reconciliation of the Benchmark tax charge.

The tax charge for the year was US$302m

and the effective tax rate was 28.8%. This

is higher than the Benchmark tax rate,

primarily reflecting the reduction in the

main rate of UK corporation tax from

23% to 20% and the associated reduction

in deferred tax assets we recognise in

respect of tax losses. The blended tax

rate on exceptional items and other

adjustments made to derive Benchmark

PBT was 27.3%.

The tax charge for the year ended

31 March 2013 was US$151m and the

effective tax rate was 34.8%. This was

higher than the Benchmark tax rate,

primarily because our statutory profit

before tax included the charge for the

Serasa put option, on which there was

no tax relief, while there was a one-off

tax benefit on a corporate transaction

in respect of our Colombia business.

Earnings and dividends per share

Basic earnings per share were 76.8

US cents (2013: 36.6 US cents). Basic

earnings per share included 0.7 US

cents (2013: 11.9 US cents) in respect of

discontinued operations (see note 17).

Benchmark EPS increased to 91.7 US

cents, from 85.2 US cents last year.

The second interim dividend is 26.00 US

cents per share (2013: 24.00 US cents)

giving a total dividend for the year of

37.50 US cents (2013: 34.75 US cents),

an increase of 8%. This is covered 2.4

times by Benchmark EPS.

Group income

statement commentary

Revenue and profit performance –

continuing operations

Revenue increased from US$4,730m

in the prior year to US$4,840m in the

year ended 31 March 2014. At constant

exchange rates, we delivered organic

revenue growth of 5% and grew total

EBIT by 7% to US$1,306m.

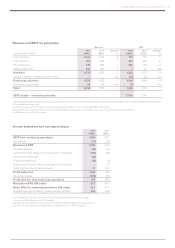

Group profit performance by geography

is discussed earlier in the Strategic

report. This Financial review includes

tables giving an additional analysis of

the income statement and summarising

performance by business segment.

Profit before tax from continuing

operations increased by US$615m,

from US$434m to US$1,049m. In the

year ended 31 March 2013, we incurred

a charge of US$558m due to the

movement in the fair value of the Serasa

put option prior to our purchase of the

non-controlling interest. There was no

such charge in the year ended 31 March

2014 and any similar exposures we face

in respect of other transactions are now

comparatively minor. Benchmark PBT

rose by US$43m to US$1,232m (2013:

US$1,189m).

Seasonality

In recent years, our margin progression

has tended to be weighted towards

the second half of the year, reflecting

revenue seasonality and the phasing of

our investment expenditure.

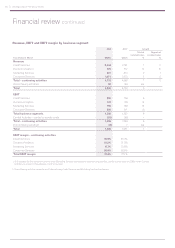

Key financials

Year ended 31 March 2014 2013

Revenue US$4,840m US$4,730m

EBIT margin – continuing activities 27.4% 27.1%

Benchmark PBT US$1,232m US$1,189m

Benchmark tax rate 26.7% 25.3%

Benchmark EPS USc 91.7 USc 85.2

Operating cash flow US$1,321m US$1,175m

Net debt US$3,809m US$2,938m

Exceptional items – continuing operations

The table below gives a summary of exceptional items.

Year ended 31 March

2014

US$m

2013

US$m

Restructuring costs 68 54

(Gain)/loss on disposal of businesses (14) 12

Total exceptional charge 54 66

P129

P127

P132