Experian 2014 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2014 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

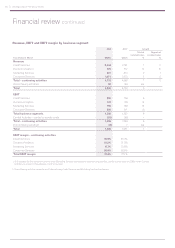

48 Strategic report • Financial review

Interest rate risk is managed by:

• using fixed and floating rate

borrowings and interest rate swaps

to adjust the balance between the

two; and

• mixing the duration of borrowings

and interest rate swaps to smooth the

impact of interest rate fluctuations.

Credit risk is managed by:

• dealing only with banks and

financial institutions with strong

credit ratings, within limits set for

each organisation; and

• closely controlling dealing activity

and regularly monitoring

counterparty positions.

Liquidity risk is managed by:

• the issue of long maturity bonds

and notes;

• entering into long-term committed

bank borrowing facilities to ensure we

have sufficient funds available for our

operations and planned growth; and

• monitoring rolling cash flow forecasts

to ensure we have adequate

borrowing facilities.

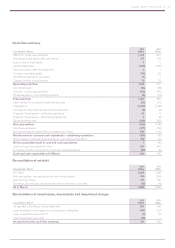

Capital risk management

Our definition and management of capital

focuses on capital employed. The Group’s

capital employed is analysed in the net

assets summary table.

Our objectives in managing capital are:

• to safeguard our ability to continue as

a going concern in order to provide

returns for shareholders and benefits

for other stakeholders; and

• to maintain an optimal capital

structure and cost of capital.

Our policy remains to have:

• a prudent but efficient balance

sheet; and

• a target gearing ratio of 1.75 to 2.00

times EBITDA, consistent with our

intention to retain strong investment-

grade credit ratings.

To maintain or adjust our capital

structure, we may:

• adjust the amount of dividends

we pay to shareholders;

• return capital to shareholders;

• issue or purchase ordinary shares; or

• sell assets to reduce net debt.

Going concern

The Board formed a judgment, at the time

of approving the Group and the parent

company financial statements, that there

was a reasonable expectation that the

Group and the Company had adequate

resources to continue in operational

existence for the foreseeable future. In

arriving at this conclusion, the Board took

account of:

• current and anticipated trading

performance which is the subject of

detailed comment elsewhere in the

Strategic report;

• current and anticipated levels of

borrowings and the availability of the

committed borrowing facilities; and

• exposures to and management of

financial risks, which are summarised

above and detailed in the notes to the

Group financial statements.

For this reason, we continue to adopt

the going concern basis in preparing

the Group and the parent company

financial statements.

Roundings

Certain financial data have been rounded

in this report. As a result, the totals of

data presented may vary slightly from the

actual arithmetic totals of the data.

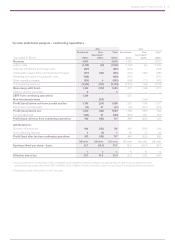

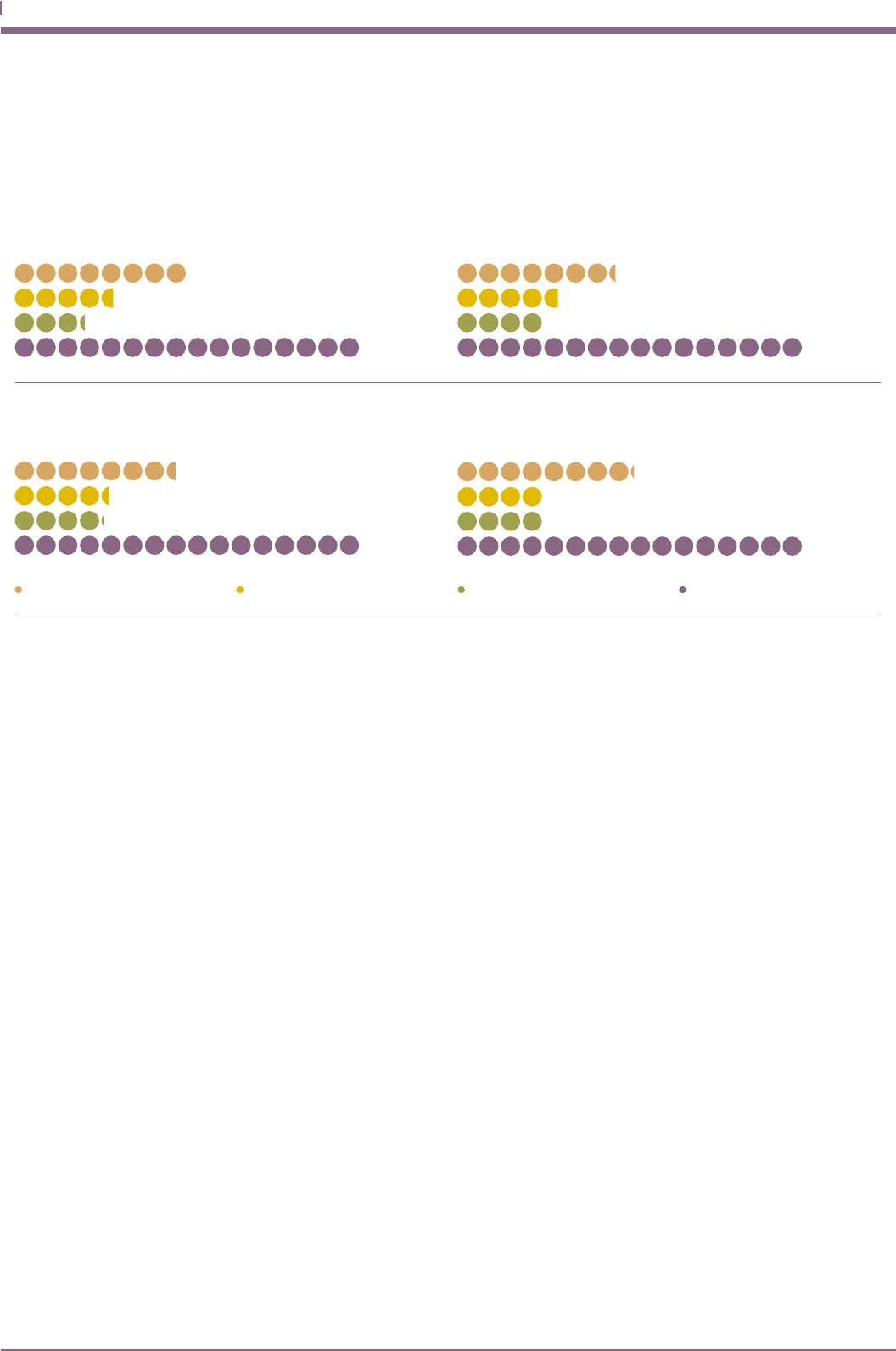

2013 CAPITAL EXPENDITURE (US$M)2014 CAPITAL EXPENDITURE (US$M)

2013 AMORTISATION/DEPRECIATION/(US$M)2014 AMORTISATION/DEPRECIATION (US$M)

Databases Software Property, plant and equipment Total

211

168

460

329

134

80

11583

402

116

203

173

102

96

371

81

Financial review continued