Experian 2014 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2014 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

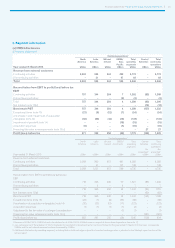

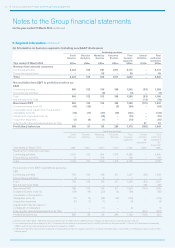

Financial statements • Notes to the Group financial statements 127

13. Exceptional items – continuing operations

2014

US$m

2013

US$m

Restructuring costs:

Redundancy costs 61 41

Asset write-offs 7 13

Restructuring costs 68 54

(Gain)/loss on disposal of businesses (14) 12

Total exceptional items 54 66

By income statement caption:

Labour costs 61 41

Amortisation, depreciation and impairment charges 7 13

Other operating charges (14) 12

Total exceptional items 54 66

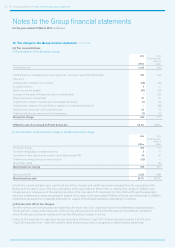

The Group conducted a strategic review of its cost base during the year ended 31 March 2013 and recognised a charge of US$54m in

connection with this significant programme in that year and a further charge of US$68m in the year ended 31 March 2014. The cash

outflow from the restructuring programme in the year ended 31 March 2014 was US$65m (2013: US$27m) and a reconciliation of the

charge to the cash outflow is given in note 39(c).

The gain on disposal of businesses in the year ended 31 March 2014 related to a number of small disposals with a related cash inflow

of US$25m. The loss in the prior year of US$12m also related to small disposals and there was a cash inflow of US$5m in that year.

14. Other adjustments made to derive Benchmark PBT – continuing operations

Note 2014

US$m

2013

US$m

Amortisation and impairment of acquisition intangibles:

Amortisation 122 123

Impairment 9 –

Amortisation and impairment of acquisition intangibles 21 131 123

Impairment of goodwill 20 15 –

Acquisition expenses 10 4

Adjustment to the fair value of contingent consideration – 1

Financing fair value remeasurements 15(c) (27) 561

Other adjustments made to derive Benchmark PBT 129 689

By income statement caption:

Amortisation, depreciation and impairment charges 146 123

Other operating charges 10 5

Within operating profit 156 128

Finance expense 15(c) (27) 561

Other adjustments made to derive Benchmark PBT 129 689

During the year ended 31 March 2014, the Group recorded impairment charges of US$24m, comprising US$9m on acquisition

intangibles (primarily customer relationships and other contractual relationships) and US$15m on goodwill, on a business in the Asia

Pacific segment that was sold during the year. There were no such charges in the year ended 31 March 2013. Further information on

the nature of the items within the above table is given in note 7(a).