Experian 2014 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2014 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178

|

|

Financial statements • Notes to the Group financial statements 137

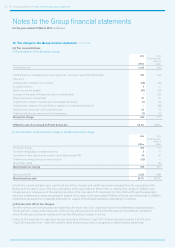

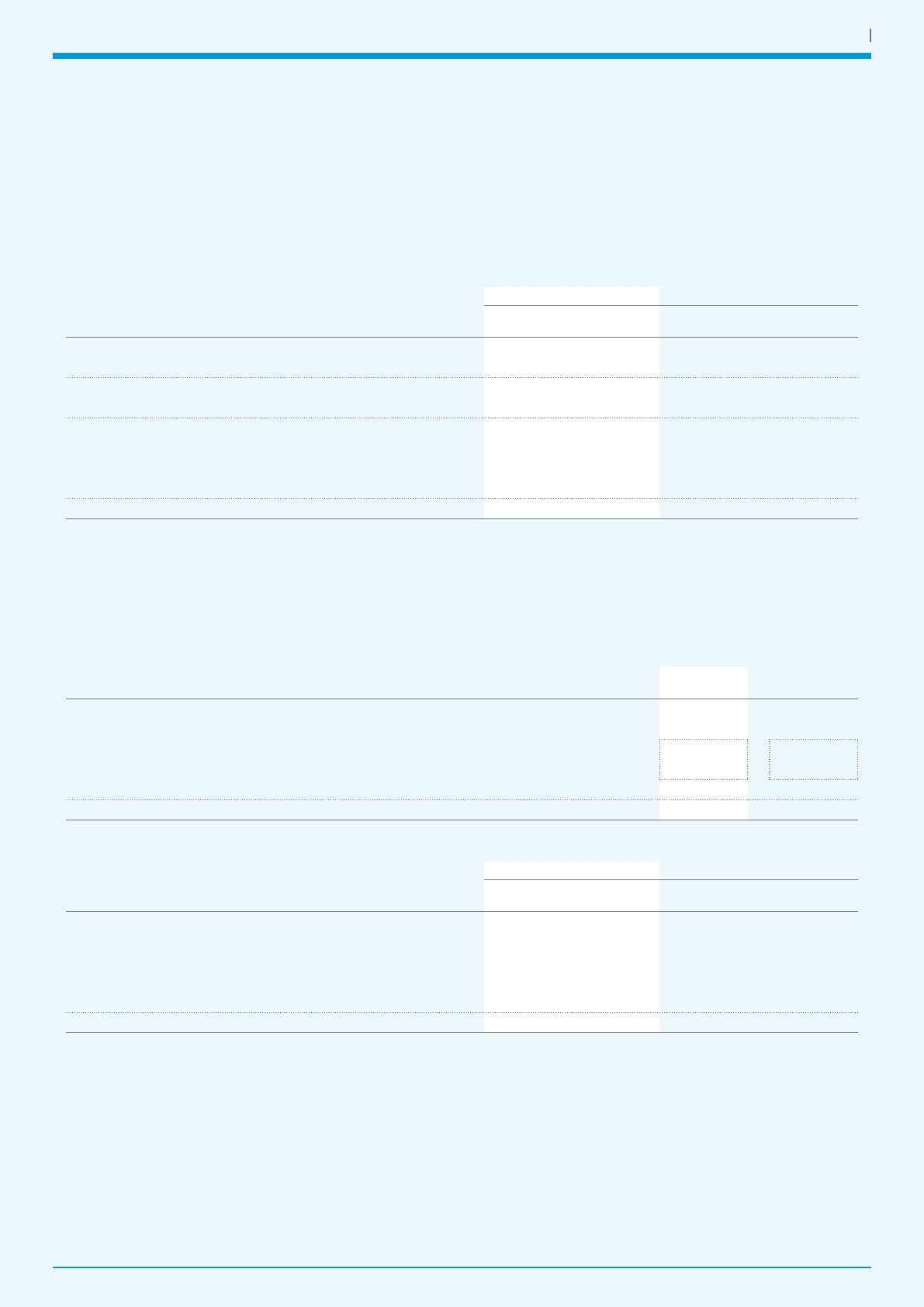

23. Trade and other receivables

(a) Analysis of trade and other receivables by type and maturity

2014 2013

Current

US$m

Non-current

US$m

Current

US$m

Non-current

US$m

Trade receivables 722 – 710 –

Credit note provision (15) – (16) –

Trade receivables – after credit note provision 707 – 694 –

Provision for impairment of trade receivables (36) – (40) –

Trade receivables – net 671 – 654 –

Amounts owed by associates 7 – 3 –

VAT recoverable 3 – 3 –

Other prepayments and accrued income 261 9 263 10

942 9 923 10

There is no material difference between the fair value of trade and other receivables and the book value stated above. The only

impaired assets are within trade receivables.

Trade receivables with financial institutions comprise 36% (2013: 33%) of such receivables in Brazil, 19% (2013: 28%) in the UK and

20% (2013: 21%) in the USA. Together these represent 20% (2013: 22%) of trade receivables with other balances spread across a

number of sectors and geographies.

(b) Analysis of total trade and other receivables by nature

2014

US$m

2013

US$m

Financial instruments 712 710

Items not regarded as financial instruments:

VAT recoverable 3 3

Amounts within other prepayments and accrued income 236 220

Items not regarded as financial instruments 239 223

951 933

(c) Analysis of trade and other receivables by denomination of currency

2014 2013

Current

US$m

Non-current

US$m

Current

US$m

Non-current

US$m

US dollar 407 3 338 6

Sterling 221 – 229 –

Brazilian real 141 3 155 2

Euro 75 1 79 –

Other 98 2 122 2

942 9 923 10