Experian 2014 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2014 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

We hold and manage data

about people and businesses,

to help organisations manage

the risks associated with

extending credit and with

preventing fraud.

Business lines: Credit Services

Clients

Our clients are principally organisations

that extend or offer credit. Our

diverse client base includes financial

institutions, retailers, insurance

companies, telecommunications

companies, US healthcare providers,

and the public sector.

Competitive environment

We face competition in every market

in which we operate. Our largest

competitors are Equifax, TransUnion and

Dun & Bradstreet. We hold the number

one or number two position in most of

the markets in which we operate.

Financial characteristics

We sell credit reports on a transactional

basis, priced per report delivered.

Pricing typically varies according to

the volume of reports we deliver and

revenue recurs as our clients habitually

buy from us.

Lenders and other subscribing members provide us with credit application and

repayment history data on consumers and businesses, to which we add other

information, such as public records. We aggregate, cleanse and sort this data, to form

a credit report to depict a comprehensive view of how borrowers have managed their

current and past credit obligations.

Credit reports help lenders make faster and better-informed credit decisions, set

the credit terms for new accounts and manage existing customer and supplier

relationships more positively and effectively. The reports vary by country, but typically

include data on identity, transactions, past and present credit obligations, court

judgments, bankruptcy, suspected fraudulent applications, collections and previous

addresses. For businesses, the report also covers company registration and ownership.

The laws governing data hosting and access vary by country. To check the credit history

of a person or business and to store data with us, a company must have a legitimate

reason for doing so and must usually notify the applicant of its intention.

We do not make lending decisions or offer any comment or advice on particular

applications. Instead, we provide factual information to lenders, to help them decide

whether or not to lend. They often use our data alongside other information, such as

that included in an application form.

We maintain a comprehensive security programme to protect data through its entire

lifecycle, from collection, transformation and use, to storage and then destruction.

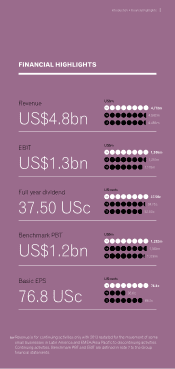

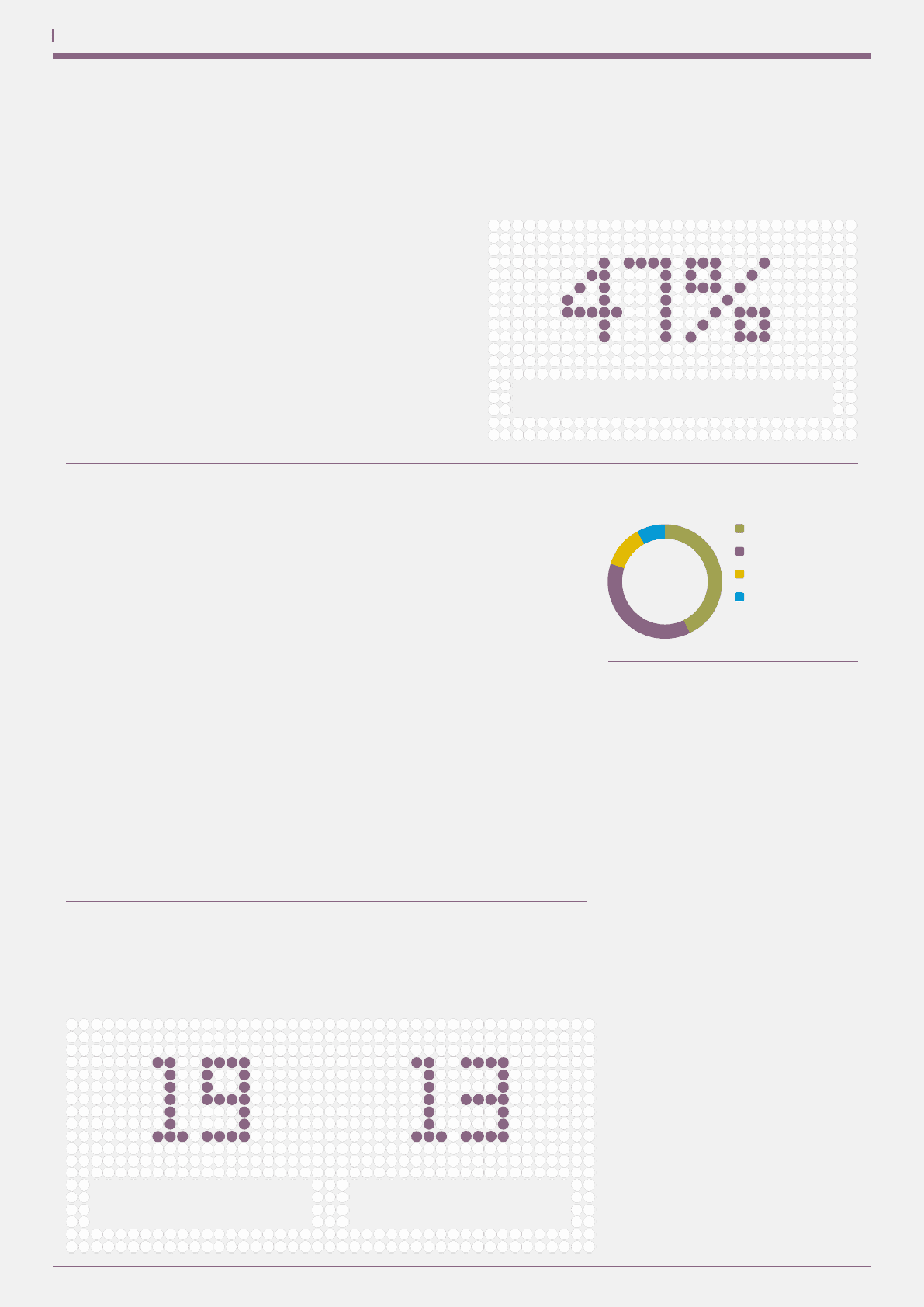

Revenue by region

North America 43%

Latin America 37%

UK and Ireland 12%

EMEA/Asia Pacific 8%

47% contribution to Group revenue

08 Strategic report • Our business lines

We provide consumer credit

information in 19 countries.

We provide business credit

information in 13 countries.