Experian 2014 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2014 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Strategic report • North America 35

Credit Services

Total revenue growth was 10% and

organic revenue growth was 5%. The

core credit bureau, excluding mortgage,

performed well as clients engaged in

more credit prospecting and origination

activity. Mortgage detracted from growth

however, due to a sharp contraction

in refinancing activity during the

year. Across the verticals, our legacy

healthcare services operations performed

well, as we secured new business

bookings and extended our presence

within the existing base of hospital clients

and physician practices. Automotive

performed strongly, reflecting volume

growth in automotive checks and good

appetite among our dealer and lender

clients for vehicle sales information.

Decision Analytics

Total revenue growth was 23% and

organic revenue growth was 12%. Growth

in Decision Analytics was robust, picking-

up as the year progressed. Our credit

risk management software platform,

PowerCurve, has been well received by

clients and we secured a number of new

wins during the year. In addition, identity

verification volumes were exceptionally

strong, driven by growth across major

federal public sector agencies, as US

citizens enrolled for affordable healthcare

and social security benefits.

Marketing Services

Total revenue growth was 4% and

organic revenue growth was 3%.

Progress in Marketing Services was

encouraging as we secured more client

conversions for our new cross-channel

marketing platform, and as we have built

a strong pipeline of future prospects.

Overall, this led to higher cross-channel

marketing volumes and first-time

contributions from new business wins.

We also saw good demand for digital

services for targeted marketing and in

our data quality operations. This offset

further declines in our more traditional

data and database activities.

Consumer Services

Total and organic revenue growth was

1%. We delivered growth across the

Experian.com brand, affinity and data

breach, which offset a decline in revenue

across the ‘free’ brands. This supports

our strategy to focus the majority of our

investment on building the Experian

brand, developing the affinity channel

and expanding in data breach services.

Over the year, we secured key client wins

in the affinity channel, for which we have

commenced the implementation process.

EBIT and EBIT margin

For continuing activities, North

America EBIT was US$757m, up 5%.

EBIT margin was 31.5% (2013: 31.8%).

There was good margin progress in

Credit Services, Decision Analytics and

Marketing Services, reflecting revenue

growth and cost efficiency actions.

Margins in Consumer Services declined

as we increased marketing expenditure in

support of the Experian brand. There was

also some dilution attributable

to acquisitions.

EBIT (US$m) and EBIT margin (%)

40%

Revenue by business line

Credit Services 40%

Decision Analytics 7%

Marketing Services 18%

Consumer Services 35%

Total revenue growth

Organic revenue growth

Highest % of revenue

from Credit Services

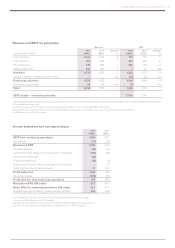

Year ended 31 March

2014

US$m

2013

US$m

Total grow th1

%

Organic growth

1

%

Revenue

Credit Services 961 873 10 5

Decision Analytics 179 146 23 12

Marketing Services 433 417 4 3

Consumer Services 831 822 1 1

Total North America 2,404 2,258 6 4

EBIT

Total North America 757 718 5

EBIT margin 31.5% 31.8%

1. At constant exchange rates.

757m 31.5% 2014

6% 2014

4% 2014

718m 31.8%

31.5%

29.2%

27.8%

658m

572m

556m

757m 31.5%

10

12

11

13

14

4%

7%

7%

0%

6%

10

12

11

13

14

6%

8%

10%

9%

0%

10

12

11

13

14