Experian 2014 Annual Report Download - page 149

Download and view the complete annual report

Please find page 149 of the 2014 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial statements • Notes to the Group financial statements 145

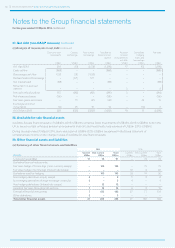

(c) Other financial assets and liabilities

There are no material differences between the carrying value of the Group’s other financial assets and liabilities and their estimated

fair values. The following assumptions and methods are used to estimate the fair values of financial assets and liabilities not

measured at fair value:

• The fair value of receivables, payables and cash and cash equivalents is considered to approximate to the carrying amounts;

• The fair values of short-term borrowings are considered to approximate to the carrying amounts due to the short maturity terms

of such instruments; and

• The fair values of long-term borrowings are based on quoted market prices in the case of that portion of fixed rate borrowings

not carried at fair value and are considered to approximate to the carrying amount in the case of floating rate bank loans and

finance lease obligations.

Of the Group’s financial assets and liabilities not carried at fair value, bonds and notes are based on quoted market prices falling

within Level 1 of the IFRS 13 fair value hierarchy. Other financial assets and liabilities are calculated based on a discounted cash flow

analysis and are within Level 2 of that hierarchy.

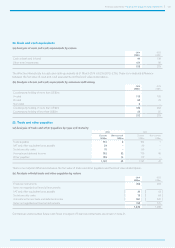

31. Contractual undiscounted future cash flows for financial liabilities

At 31 March 2014

Less than

one year

US$m

One to two

years

US$m

Two to three

years

US$m

Three to four

years

US$m

Four to five

years

US$m

Over five

years

US$m

Total

US$m

Borrowings 778 106 820 695 751 1,452 4,602

Net settled derivative financial

instruments – interest rate swaps 12 1 (4) (8) (9) (37) (45)

Gross settled derivative financial instruments:

Outflows for foreign exchange contracts 287 – – – – – 287

Inflows for foreign exchange contracts (285) – – – – – (285)

Gross settled derivative financial instruments 2 – – – – – 2

Options in respect of non-controlling interests – 24 37 – – – 61

Trade and other payables (note 25(b)) 417 21 6 5 1 2 452

Cash outflows 1,209 152 859 692 743 1,417 5,072

At 31 March 2013

Less than

one year

US$m

One to two

years

US$m

Two to three

years

US$m

Three to four

years

US$m

Four to five

years

US$m

Over five

years

US$m

Total

US$m

Borrowings 716 177 567 77 669 1,339 3,545

Net settled derivative financial

instruments – interest rate swaps 20 16 12 8 3 1 60

Gross settled derivative financial instruments:

Outflows for foreign exchange contracts 234 – – – – – 234

Inflows for foreign exchange contracts (231) – – – – – (231)

Gross settled derivative financial instruments 3 – – – – – 3

Options in respect of non-controlling interests 17 – 15 – 41 – 73

Trade and other payables (note 25(b)) 448 3 2 2 2 6 463

Cash outflows 1,204 196 596 87 715 1,346 4,14 4

The table above analyses financial liabilities into maturity groupings based on the period from the balance sheet date to the

contractual maturity date. As the amounts disclosed are the contractual undiscounted cash flows, they differ from the carrying

values and fair values. As indicated in the table, there are contractual undiscounted cash flows for derivative financial liabilities

which in total amount to US$43m (2013: US$63m).