Experian 2014 Annual Report Download - page 162

Download and view the complete annual report

Please find page 162 of the 2014 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial statements • Notes to the Group financial statements

Notes to the Group financial statements

for the year ended 31 March 2014 continued

158

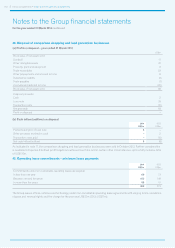

39. Notes to the Group cash flow statement continued

(i) Reconciliation of Cash generated from operations to Operating cash flow (non-GAAP measure)

2014

US$m

2013

US$m

Cash generated from operations (note 39(a)) 1,641 1,602

Acquisition expenses paid 8 4

Purchase of other intangible assets (319) (345)

Purchase of property, plant and equipment (83) (115)

Sale of property, plant and equipment 8 1

Dividends received from associates 1 1

Cash outflow in respect of restructuring programme (note 39(c)) 65 27

Operating cash flow 1,321 1,175

40. Acquisitions

(a) Acquisitions in the year

The Group made four acquisitions during the year, in connection with which provisional goodwill of US$831m was recognised based

on the fair value of the net assets acquired of US$418m.

These transactions included:

• the acquisition on 1 October 2013 of the whole of the issued share capital of The 41st Parameter, Inc, a leading provider of fraud

detection services based in the US, for an aggregate purchase consideration of US$324m of which US$14m is subject to limited,

two-year revenue based earn-out provisions. This acquisition increases Experian’s presence in the fraud prevention market, and

complements Experian’s existing activities in fraud detection and online authentication.

• the acquisition on 21 November 2013 of the whole of the issued share capital of Passport Health Communications, Inc., a

leading provider of data, analytics and software in the US healthcare payment market, for a consideration of US$850m. This

acquisition further increases Experian’s presence in this market.

• two other acquisitions, neither of which is individually material.

(b) Net assets acquired, goodwill and acquisition consideration

Passport Health

Communications,

Inc.

US$m

The 41st

Parameter, Inc

US$m

Other

US$m

Total

US$m

Intangible assets:

Customer and other relationships 398 72 16 486

Software development 45 15 12 72

Intangible assets 443 87 28 558

Property, plant and equipment 11 2 – 13

Trade and other receivables 32 3 3 38

Cash and cash equivalents 4 4 5 13

Trade and other payables (20) (9) (1) (30)

Loans and borrowings – (4) –(4)

Deferred tax liabilities (145) (17) (8) (170)

Total identifiable net assets 325 66 27 418

Goodwill 529 258 44 831

Total 854 324 71 1,249

Satisfied by:

Cash 854 310 71 1,235

Deferred and contingent consideration – 14 – 14

Total 854 324 71 1,249