Experian 2014 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2014 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

18 Strategic report • Key performance indicators

Key performance indicators

We use our key performance indicators to measure our business.

They give us visibility of our financial, strategic, employee engagement

and environmental performance. Three of the financial metrics are

specifically linked to management remuneration.

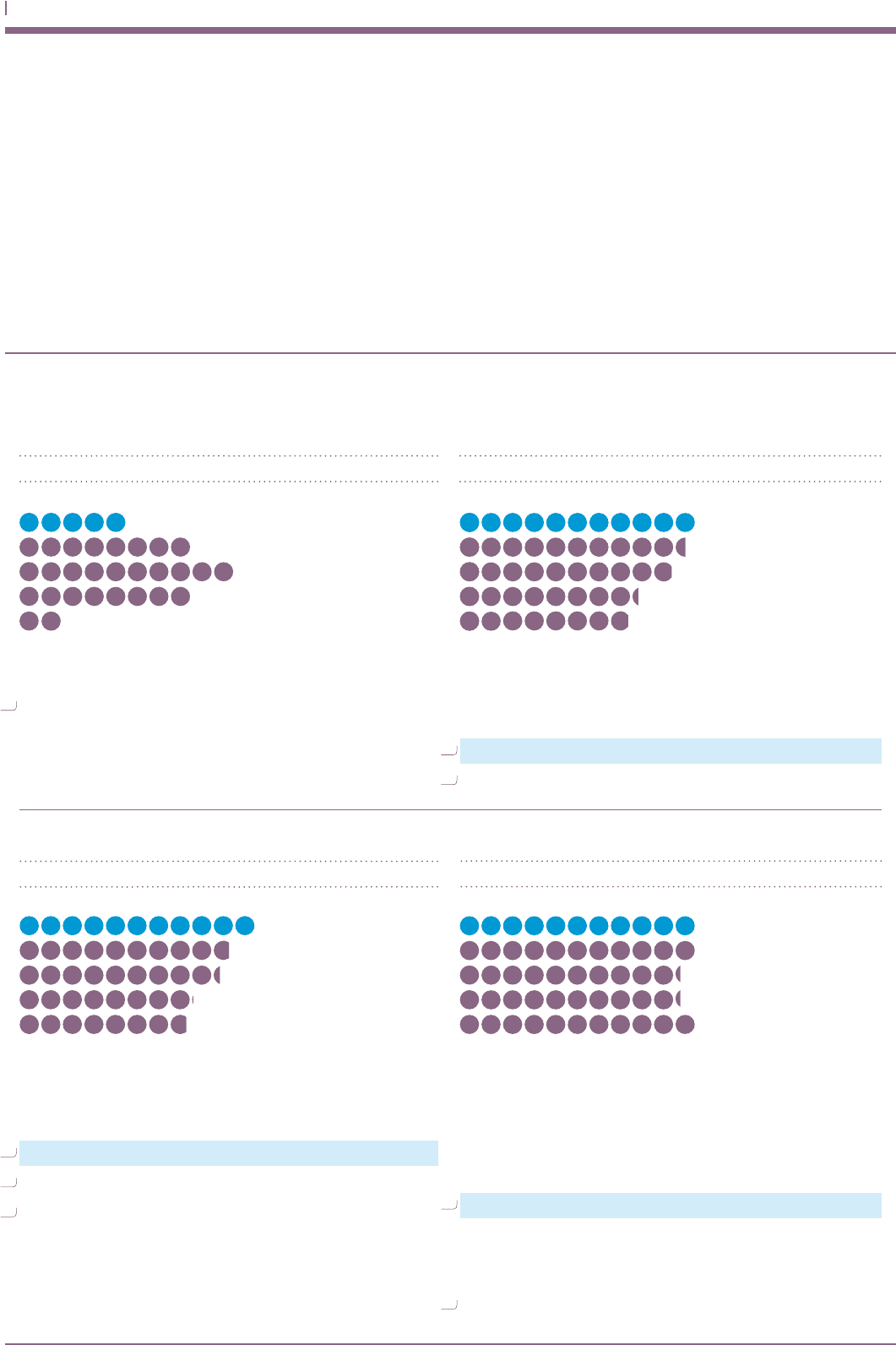

FINANCIAL

Organic revenue increased by 5% this year, with

growth coming from all regions and business lines.

See note 7 to the Group financial statements for definition of organic

revenue growth.

Aim: To deliver mid-to-high single digit

organic revenue growth

Organic revenue growth

The nature of our business model means that we generate

strong operating cash flow as a proportion of EBIT. This year we

converted 101% of EBIT into operating cash flow, which itself

increased 12% to US$1,321m.

Cumulative operating cash flow is a directors’ remuneration measure.

See note 7 to the Group financial statements for definition of operating cash flow

and cash flow conversion.

For additional information on cash flow see the Group cash flow statement.

Aim: To convert at least 90% of EBIT into operating cash flow

Operating cash flow (US$m) and cash flow conversion (%)

2%

935 100%

98%

1,124

975

96%

1,175 94%

8%

10%

8%

5%

1,321 101%

This year total EBIT increased by 4% to US$1,306m, EBIT from

continuing activities increased 7% at constant exchange rates.

We improved our EBIT margin from continuing activities

30 basis points to 27.4%.

The directors’ remuneration measure of PBT derives from EBIT.

See note 7 to the Group financial statements for definition of EBIT.

Aim: To maintain or improve EBIT margin

EBIT (US$m) and EBIT margin (%)

935 24.5%

25.7%

1,175

991

26.2%

1,251 27.1%

1,306 27.4%

16%

15%

15%

16%

16%

Aim: To generate and preserve value for our shareholders

Return on capital employed (‘ROCE’)

ROCE measures the return generated on the capital we

have invested in the business and reflects our ability to add

shareholder value over the long term. We have updated our

ROCE measure in the year to reflect a more commonly used

definition of return. This year ROCE has not increased, primarily

reflecting recent acquisitions where return rates are typically

lower in the early years of ownership.

ROCE is a directors’ remuneration measure.

We now define ROCE as EBIT less tax at the Benchmark rate divided by a 3 point

average of capital employed over the period, adjusted for non-controlling interests.

All comparatives have been updated on a consistent basis. Under the old

methodology we’d have reported a ROCE of 15% (2013 15%, 2012 to 2010 14%).

See note 7 to the Group financial statements for definition of capital employed.

1010

1212

1111

1414

1313

10

12

11

14

13

10

12

11

14

13

P118

P87

P118

P118

P87

P118

P109

P87