Experian 2014 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2014 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Strategic report • UK and Ireland

Credit Services

Total and organic revenue growth at

constant exchange rates was 3%. During

the year, Credit Services benefitted from

gradually improving volumes and the

introduction of new products. We saw

strength across consumer information,

where we have benefitted from increased

credit origination activity amongst

traditional lenders, engagements with

new entrants in the banking market and

growth across non-financial customers.

Business information had a more mixed

year, which we are addressing through

a number of initiatives, including the

introduction of new products and

expansion of the small and medium

enterprise channel.

Decision Analytics

Total and organic revenue growth at

constant exchange rates was 4% and

3% respectively. In Decision Analytics,

momentum improved as the year

progressed as large organisations started

to invest more in updating core systems.

We secured a number of major client

wins for credit risk management software,

including our first major deal in the UK

and Ireland for PowerCurve originations.

We also saw further traction in identity

management and fraud prevention

services. More recently, we have added

device identification from 41st Parameter

to our product range, and we were

pleased to secure a major client win in the

insurance sector after the year end.

Marketing Services

Total and organic revenue growth was

1% at constant exchange rates. During

the year we focused on developing a

more integrated approach to Marketing

Services in the UK and Ireland, bundling

our services in order to create a more

comprehensive offer for our clients

across channels. This has delivered

demonstrable benefits, as we have

secured new client wins, with a good

pipeline of similar future prospects.

Consumer Services

Consumer Services performed strongly,

with total and organic revenue growth

of 23% at constant exchange rates.

Growth reflected new member growth

and improved member retention as

we continue to build our brand in the

UK, where we have benefitted from a

significant uplift in consumer recognition,

and as we add new features and

enhancements to increase the attraction

of the membership service and to

encourage loyalty.

EBIT and EBIT margin

For the UK and Ireland, EBIT from

continuing activities was US$284m, up

14% at constant exchange rates. EBIT

margin increased by 190 basis points to

30.1%, reflecting operating leverage due

to revenue growth as well as cost savings,

net of reinvestments.

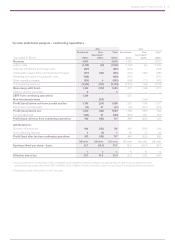

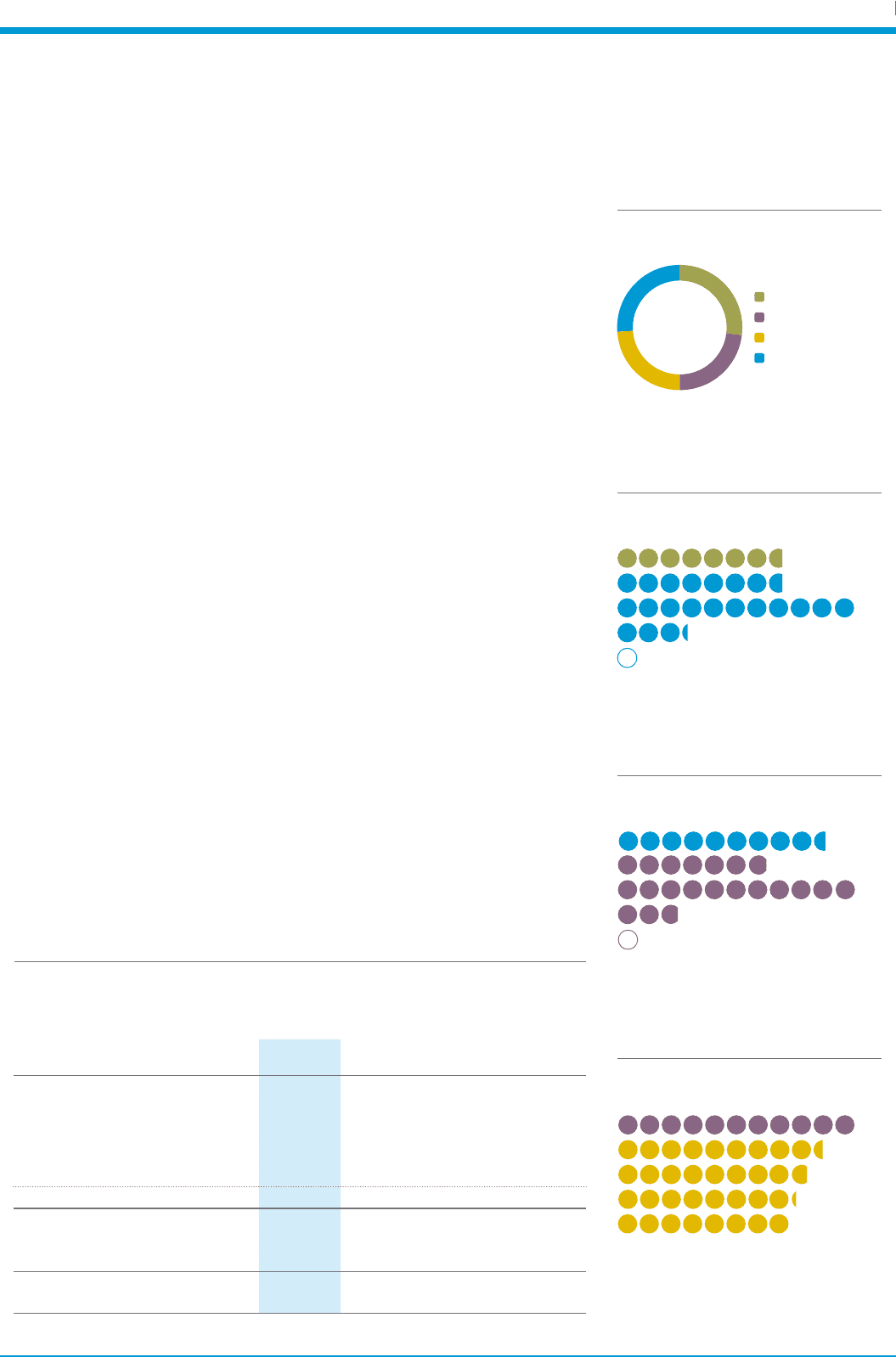

27%

Credit Services 27%

Decision Analytics 23%

Marketing Services 24%

Consumer Services 26%

Highest % of revenue

from Credit Services

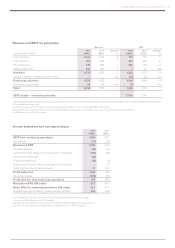

Year ended 31 March

2014

US$m

2013

US$m

Total grow th1

%

Organic growth

1

%

Revenue

Credit Services 257 248 3 3

Decision Analytics 217 206 4 3

Marketing Services 230 226 1 1

Consumer Services 240 193 23 23

Total UK and Ireland 944 873 7 7

EBIT

Total UK and Ireland 284 246 14

EBIT margin 30.1% 28.2%

1. At constant exchange rates.

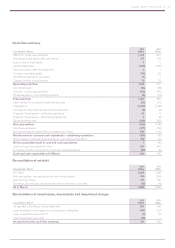

284m 30.1% 2014

7% 2014

7% 2014

(1)%

7%

3%

10%

7%

10

12

11

13

14

246m 28.2%

27.5%

29.3%

28.1%

227m

205m

214m

284m 30.1%

10

12

11

13

14

(1)%

2%

8%

5%

7%

10

12

11

13

14

39

EBIT (US$m) and EBIT margin (%)

Revenue by business line

Total revenue growth

Organic revenue growth