Experian 2014 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2014 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

46 Strategic report • Financial review

Group balance sheet commentary

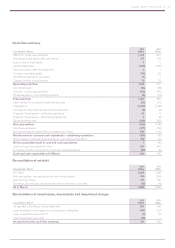

Net assets

The net assets summary table analyses

our net assets and capital employed. We

monitor capital employed by operating

segment as part of our internal reporting,

and give further information by operating

segment in note 9(a)(ii) to the Group

financial statements. Capital employed

includes post-employment benefit assets

of US$13m (2013: US$24m) and net

derivative financial assets of US$138m

(2013: US$59m) where the balance sheet

values depend on market conditions.

Total equit y

A reconciliation of the movement in

Group total equity is given in the summary

reconciliation of total equity table with

two items worthy of further comment:

• Currency translation losses of

US$188m (2013: US$39m) arise

mainly from the weakening of the

Brazilian real against the US dollar.

• The net movement from transactions

with non-controlling interests in

the year ended 31 March 2013

of US$427m, reported within

transactions with owners, principally

related to our recognition of a

deferred tax asset on the acquisition

of the further stake in Serasa.

Other items

The Group has continued to receive a

significant number of claims in Brazil

throughout the year, primarily in three

states, relating to the disclosure and use

of credit scores. The cases are mainly

individual small claims and also include

a small number of class actions. Similar

proceedings have been commenced

against other suppliers of credit scores

in Brazil. The Superior Tribunal of Justice

(‘STJ’), the highest court in Brazil for

such cases, has issued a stay on all

proceedings relating to these claims while

it determines the principal legal issues

involved. The Group does not believe the

claims have merit under Brazilian law and

will continue to vigorously defend them.

Net assets summary

At 31 March

2014

US$m

2013

US$m

Goodwill 4,807 4,057

Other intangible assets 1,869 1,474

Other segment assets 1,380 1,384

Total segment assets 8,056 6,915

Segment liabilities (1,289) (1,307)

Operating segments – net assets 6,767 5,608

Central Activities – net assets 176 125

Deduct: non-controlling interests (22) (40)

Capital employed 6,921 5,693

Net debt (3,809) (2,938)

Tax (30) 429

Add: non-controlling interests 22 40

Net assets 3,104 3,224

US$ US$

Net assets per share 3.18 3.26

Summary reconciliation of total equity

Year ended 31 March

2014

US$m

2013

US$m

Profit for the financial year 754 401

Remeasurement loss on post-employment benefits (10) (43)

Other – principally currency translation losses (185) (36)

Total comprehensive income for the financial year 559 322

Transactions with owners:

Net movement for employee share incentive plans and

treasury shares (296) (80)

Net movement from transactions with non-controlling

interests (28) 427

Dividends paid (355) (376)

(Decrease)/increase in total equity (120) 293

At 1 April 3,224 2,931

At 31 March 3,104 3,224

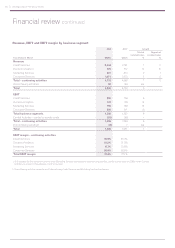

Foreign exchange – closing rates

The table below shows the principal exchange rates used to translate assets and

liabilities at the balance sheet dates.

At 31 March 2014 2013

US$ : Brazilian real 2.27 2.02

Sterling : US$ 1.66 1.52

Euro : US$ 1.38 1.28

Financial review continued

P122