Experian 2014 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2014 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

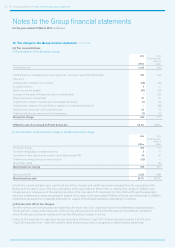

Financial statements • Notes to the Group financial statements

Notes to the Group financial statements

for the year ended 31 March 2014 continued

124

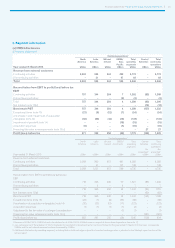

9. Segment information continued

(b) Information on business segments (including non-GAAP disclosures)

Year ended 31 March 2014

Continuing operations1

Credit

Services

US$m

Decision

Analytics

US$m

Marketing

Services

US$m

Consumer

Services

US$m

Total

business

segments

US$m

Central

Activities

US$m

Total

continuing

operations

US$m

Revenue from external customers

Continuing activities 2,244 576 881 1,071 4,772 – 4,772

Discontinuing activities – – 68 – 68 – 68

Tot al 2,244 576 949 1,071 4,840 – 4,840

Reconciliation from EBIT to profit/(loss) before tax

EBIT

Continuing activities 806 122 156 308 1,392 (83) 1,309

Discontinuing activities – – (3) – (3) – (3)

Total 806 122 153 308 1,389 (83) 1,306

Net interest (note 15(b)) – – – – – (74) (74)

Benchmark PBT 806 122 153 308 1,389 (157) 1,232

Exceptional items (note 13) (41) (10) – (3) (54) – (54)

Amortisation and impairment of acquisition

intangibles (note 14) (74) (11) (27) (19) (131) – (131)

Impairment of goodwill (note 14) – – (15) – (15) – (15)

Acquisition expenses (5) (4) (1) – (10) – (10)

Financing fair value remeasurements (note 15(c)) – – – – – 27 27

Profit/(loss) before tax 686 97 110 286 1,179 (130) 1,049

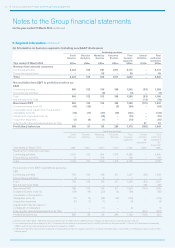

Year ended 31 March 2013

Continuing operations1

Credit

Services

US$m

Decision

Analytics

US$m

Marketing

Services

US$m

Consumer

Services

US$m

Total

business

segments

US$m

Central

Activities

Re-

presented2

US$m

Total

continuing

operations

Re-

presented2

US$m

Revenue from external customers

Continuing activities 2,181 512 874 1,015 4,582 – 4,582

Discontinuing activities 13 – 135 – 148 – 148

Total 2,194 512 1,009 1,015 4,730 – 4,730

Reconciliation from EBIT to profit/(loss) before tax

EBIT

Continuing activities 769 109 138 311 1,327 (83) 1,244

Discontinuing activities (1) – 8 – 7 – 7

Total 768 109 146 311 1,334 (83) 1,251

Net interest (note 15(b)) – – – – – (62) (62)

Benchmark PBT 768 109 146 311 1,334 (145) 1,189

Exceptional items (note 13) (29) (14) (20) (3) (66) – (66)

Amortisation of acquisition

intangibles (note 14) (71) (5) (28) (19) (123) – (123)

Acquisition expenses (2) (1) (1) – (4) – (4)

Adjustment to the fair value of

contingent consideration – – (1) – (1) – (1)

Financing fair value remeasurements (note 15(c)) – – – – – (561) (561)

Profit/(loss) before tax 666 89 96 289 1,140 (706) 434

1. Revenue of US$nil (2013: US$147m) and a loss before tax of US$nil (2013: US$5m) arose in respect of discontinued operations (see note 17).

2. As a consequence of the adoption of IAS 19 (revised), the loss before interest and tax for Central Activities for the year ended 31 March 2013 has been increased by

US$2m and the net interest expense has been increased by US$4m.

3. Additional information by business segment, including that on total and organic growth at constant exchange rates, is provided in the Strategic report section of the

annual report.