Experian 2014 Annual Report Download - page 148

Download and view the complete annual report

Please find page 148 of the 2014 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial statements • Notes to the Group financial statements

Notes to the Group financial statements

for the year ended 31 March 2014 continued

144

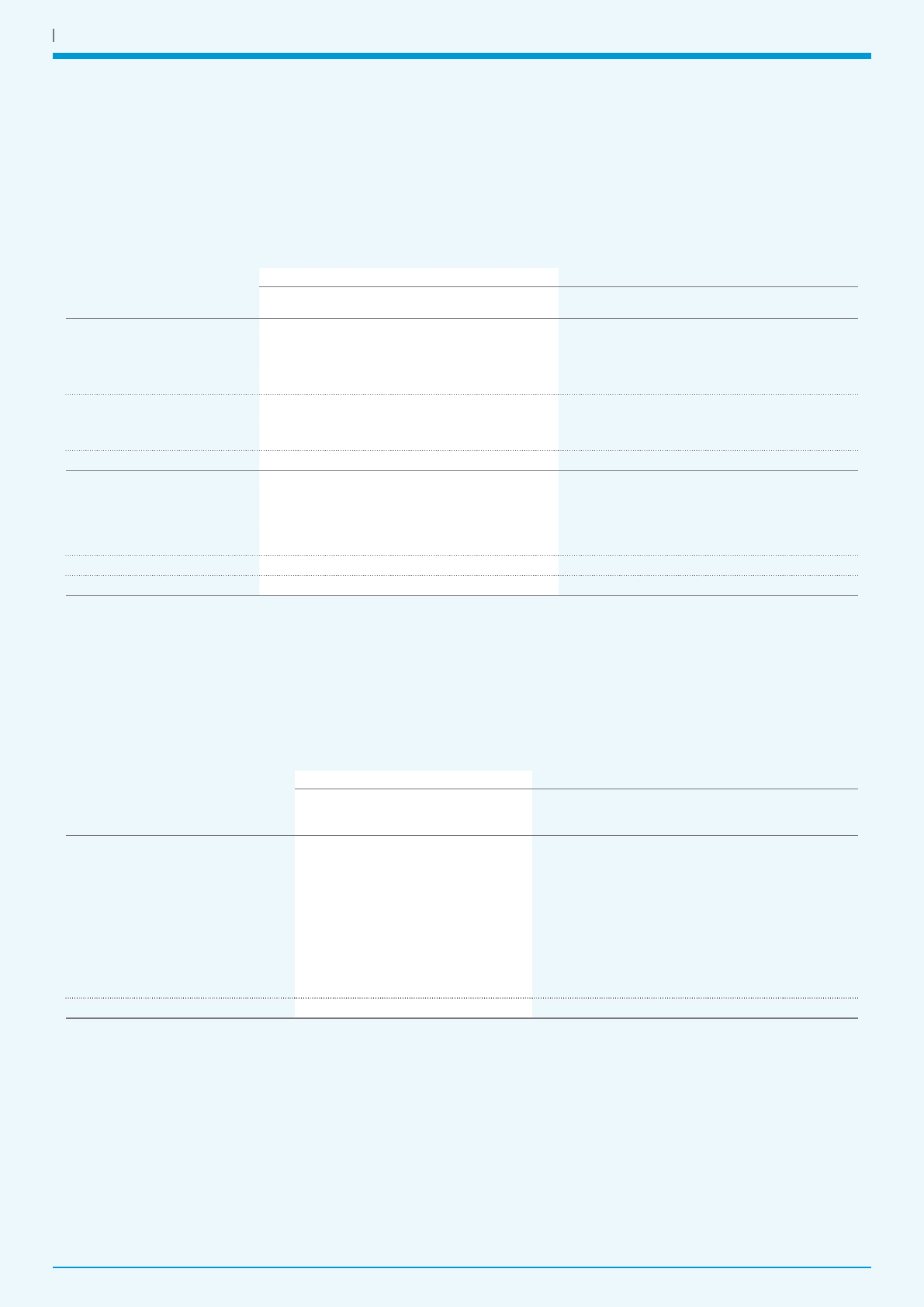

30. Fair values of financial assets and liabilities

(a) Analysis by valuation method for items measured at fair value

2014 2013

Level 1

US$m

Level 2

US$m

Level 3

US$m

Total

US$m

Level 1

US$m

Level 2

US$m

Level 3

US$m

Total

US$m

Financial assets:

Derivatives used for hedging – 143 – 143 – 92 – 92

Assets at fair value

through profit and loss – 22 – 22 – 12 – 12

Amounts reported as other

financial assets (note 29) – 165 – 165 – 104 – 104

Available-for-sale (note 28) 43 – 3 46 38 – 3 41

43 165 3 211 38 104 3 145

Financial liabilities:

Derivatives used for hedging – (1) – (1) – – – –

Liabilities at fair value

through profit and loss – (25) (44) (69) – (45) (55) (100)

– (26) (44) (70) – (45) (55) (100)

Net financial assets/(liabilities) 43 139 (41) 141 38 59 (52) 45

The analysis by level is a requirement of IFRS 13 ‘Fair value measurement’; the levels are defined therein and summarised here

for completeness. Assets and liabilities whose valuations are based on unadjusted quoted prices in active markets for identical

assets and liabilities are classified as Level 1. Assets and liabilities which are not traded in an active market and whose valuations

are derived from available market data that is observable for the asset or liability are classified as Level 2. Assets and liabilities

whose valuations are derived from inputs not based on observable market data are classified as Level 3. For Experian, Level 3 items

principally comprise put and call options associated with corporate transactions with no material effect on the amounts stated from

any reasonably possible change in Level 3 inputs at 31 March 2014.

(b) Analysis of movements in Level 3 assets and liabilities

Year ended 31 March 2014 Year ended 31 March 2013

Available-for-

sale

US$m

Other

US$m

Total

US$m

Available-for-

sale

US$m

Serasa put

option

US$m

Other

US$m

Total

US$m

At 1 April 3 (55) (52) – (1,092) (26) (1,118)

Additions and reclassifications – – – 3 – (24) (21)

Valuation losses recognised in

Group income statement – 13 13 – (558) (5) (563)

Currency translation gains

recognised directly in other

comprehensive income – (2) (2) – 163 – 163

De-recognition of put option

liability directly in equity – – – – 1,487 – 1,487

At 31 March 3 (44) (41) 3 – (55) (52)