Experian 2014 Annual Report Download - page 159

Download and view the complete annual report

Please find page 159 of the 2014 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial statements • Notes to the Group financial statements 155

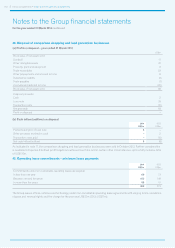

37. Called up share capital and share premium account

At 31 March 2014, there were 1,031.6m shares in issue (2013: 1,030.1m) and 1.5m (2013: 1.1m) shares were issued in the year then

ended. Further information relating to share capital is contained in note K to the parent company financial statements.

The difference between the amounts shown in the Group and parent company financial statements in respect of called up

share capital and the share premium account arose due to the translation of the sterling amounts into US dollars at the

different exchange rates on the different translation dates.

38. Retained earnings and other reserves

(a) Retained earnings

Retained earnings comprise net profits retained in the Group after the payment of equity dividends. There are no significant

statutory, contractual or exchange control restrictions on distributions by Group undertakings.

(b) Other reserves

(i) Movements in reserves

Merger

reserve

US$m

Hedging

reserve

US$m

Translation

reserve

US$m

Own

shares

reserve

US$m

Total

other

reserves

US$m

At 1 April 2013 (15,682) 11 (11) (565) (16,247)

Purchase of own shares by employee trusts – – – (126) (126)

Purchase of own shares held as treasury shares –––(203) (203)

Exercise of share awards and options – – – 85 85

Currency translation items recognised in other

comprehensive income – – (189) – (189)

At 31 March 2014 (15,682) 11 (200) (809) (16,680)

Merger

reserve

US$m

Hedging

reserve

US$m

Translation

reserve

US$m

Own

shares

reserve

US$m

Total

other

reserves

US$m

At 1 April 2012 (15,682) 11 12 (492) (16,151)

Purchase of own shares by employee trusts – – – (221) (221)

Exercise of share awards and options – – – 148 148

Currency translation items recognised in other

comprehensive income – – (23) – (23)

At 31 March 2013 (15,682) 11 (11) (565) (16,247)

(ii) Nature of reserves

The merger reserve arose on the demerger in October 2006 and is the difference between the share capital and share premium

of GUS plc and the nominal value of the share capital of the Company before the share offer in October 2006 and subsequent

share issues.

Movements on the hedging reserve and the position at the balance sheet date reflect hedging transactions which are not

charged or credited to the Group income statement, net of related tax.

Movements on the translation reserve and the position at the balance sheet date reflect foreign currency translations since

1 April 2004 which are not charged or credited to the Group income statement, net of related tax. The movement in the

year ended 31 March 2014 comprises currency translation losses of US$187m (2013: US$23m) recognised directly in other

comprehensive income, together with the reclassification of cumulative currency translation gains in respect of divestments

of US$2m (2013: US$nil).

The balance on the own shares reserve is the cost of ordinary shares in the Company and further details are given in note (iii)

below. The difference between the amounts shown in the Group and parent company financial statements in respect of the own

shares reserve arose due to the translation of the sterling amounts into US dollars at the different exchange rates on the different

translation dates.