Experian 2014 Annual Report Download - page 155

Download and view the complete annual report

Please find page 155 of the 2014 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial statements • Notes to the Group financial statements 151

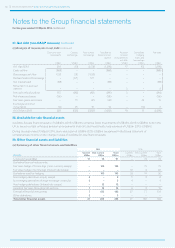

(c) Actuarial assumptions and sensitivities

The accounting valuations at 31 March 2014 have been based on the most recent actuarial valuations, updated by Towers Watson

Limited to take account of the requirements of IAS 19 (revised). The assumptions for discount rate, salary increases and mortality,

used to calculate the present value of the defined benefit obligations, all have a significant effect on the accounting valuation.

Changes to these assumptions in the light of prevailing conditions may have a significant impact on future valuations. Indications

of the sensitivity of the amounts reported at 31 March 2014 to changes in the discount rate, life expectancy and medical costs are

included below. The methods and types of assumptions used are consistent with those used in the year ended 31 March 2013 and

the absolute sensitivity numbers are stated on a basis consistent with the methodology used in determining the accounting valuation

at 31 March 2014. The methodology evaluates the effect of a change in each assumption on the relevant obligations whilst holding all

other assumptions constant.

(i) Principal financial actuarial assumptions

2014

%

2013

%

Discount rate 4.3 4.5

Inflation rate – based on the UK Retail Prices Index (‘RPI’) 3.3 3.4

Inflation rate – based on the UK Consumer Prices Index (‘CPI’) 2.3 2.4

Increase in salaries 3.8 4.4

Increase for pensions in payment – element based on RPI (where cap is 5%) 3.0 3.1

Increase for pensions in payment – element based on CPI (where cap is 5%) 1.7 2.4

Increase for pensions in payment – element based on CPI (where cap is 3%) 1.9 2.0

Increase for pensions in deferment 2.3 2.4

Inflation in medical costs 6.8 6.9

The principal financial assumption is the real discount rate, being the excess of the discount rate over the rate of inflation. The

discount rate is based on the market yields on high-quality corporate bonds of appropriate currency and term to the defined benefit

obligations. In the case of the Experian Pension Scheme, the obligations are primarily in sterling and have a maturity of some 18

years. If the discount rate increased/decreased by 0.1%, the defined benefit obligations at 31 March 2014 would decrease/increase by

approximately US$18m and the annual current service cost would remain unchanged.

The rates of increase for pensions in payment reflect the separate arrangements applying to different groups of Experian’s pensioners.

(ii) Mortality assumptions – average life expectation on retirement at age 65 in normal health

2014

years

2013

years

For a male currently aged 65 23.2 22.5

For a female currently aged 65 25.0 23.7

For a male currently aged 50 24.6 23.6

For a female currently aged 50 26.9 24.8

The valuation assumes that mortality will be in line with standard tables adjusted to reflect the expected experience of the

Experian Pension Scheme membership based on analysis carried out for the 31 March 2013 funding valuation. A specific

allowance for anticipated future improvements in life expectancy is also incorporated. An increase in assumed life expectancy

of 0.1 years would increase the defined benefit obligations at 31 March 2014 by approximately US$4m.

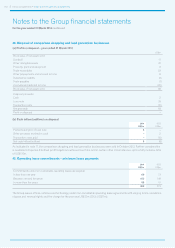

(iii) Post-retirement healthcare

The valuation in respect of post-retirement healthcare benefits assumes a rate of increase for medical costs. If this rate

increased/decreased by 1.0% per annum, the obligation would increase/decrease by US$1m and the finance expense would

remain unchanged.