Experian 2014 Annual Report Download - page 150

Download and view the complete annual report

Please find page 150 of the 2014 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial statements • Notes to the Group financial statements

Notes to the Group financial statements

for the year ended 31 March 2014 continued

146

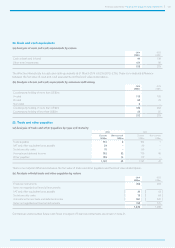

32. Share incentive plans

(a) Cost of share-based compensation

2014

US$m

2013

US$m

Share awards 66 73

Share options 45

Expense recognised 70 78

Cost of associated social security obligations 6 –

Total expense recognised in Group income statement 76 78

The Group has a number of equity-settled, share-based employee incentive plans and further information on share award

arrangements is given in note (b) below. The only share options granted in the current and prior year have been in respect of

Experian Sharesave Plans. Although there have been no grants of options under the Experian Share Option Plan and equivalent

legacy plans in the current and prior year, options remain outstanding under such plans. As the amounts involved for all the share

option plans and the related charge to the Group income statement are not significant, no further disclosures are included within

these financial statements.

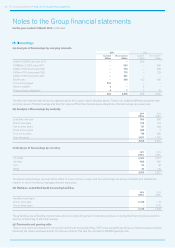

(b) Share awards

(i) Summary of arrangements and performance conditions

There are three plans under which share awards are currently granted – the two Experian Co-Investment Plans (the ‘Experian CIPs’)

and the Experian Performance Share Plan (the ‘Experian PSP’). Awards take the form of a grant of shares and vest over a service

period of three years with a maximum term of the same length. The method of settlement for the awards is by share distribution. The

assumption at grant date for employee departures prior to vesting is between 5% and 10% for conditional awards and 20% for certain

unconditional awards which are only made under the Experian PSP. Other details in respect of conditional awards are given below.

Performance conditions for vesting Assumed outcome at grant date

Experian CIPs 50% – Benchmark profit performance of Group

assessed against specified targets

Benchmark profit – 66% to 100%

50% – Cumulative operating cash flow of Group Cumulative operating cash flow – 100%

Experian PSP 75% – Benchmark profit performance of Group

assessed against specified targets

Benchmark profit – 66% to 100%

25% – Distribution percentage determined by ranking

Total Shareholder Return (‘TSR’) relative to a comparator group

TSR – Range from 45% to 52%

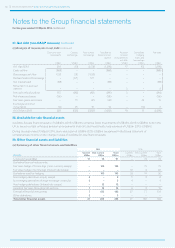

Experian CIPs

The grant date for these plans is the start of the financial year in which performance is assessed. This is before the number of shares

to be awarded is determined but the underlying value of the award is known, subject to the outcome of the performance condition.

The value of awarded shares reflects the performance outcome assumed at the date of their issue to participants and is recognised

over a four-year period.

The range of performance conditions for awards under this plan is set out below. The Benchmark profit performance condition

(the ‘profit condition’) requires Benchmark PBT growth at the stated percentages over a three-year period. The cumulative

operating cash flow performance condition (the ‘cash flow condition’) is based on cumulative operating cash flow over a three-

year period. The period of assessment commences at the beginning of the financial year of grant. These are not market-based

performance conditions as defined by IFRS 2.

Year of award

Profit condition Cash flow condition

Target Maximum Target Maximum

Year ended 31 March 2014 7% per annum 14% per annum US$3.8bn US$4.2bn

Year ended 31 March 2013 7% per annum 14% per annum US$3.7bn US$4.1bn

Year ended 31 March 2012 7% per annum 14% per annum US$3.0bn US$3.4bn