Experian 2014 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2014 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

45

Strategic report • Financial review

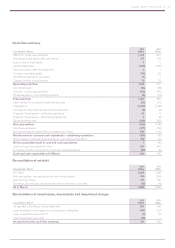

Cash flow summary

Year ended 31 March

2014

US$m

2013

US$m

EBIT from continuing operations 1,306 1,251

Amortisation and depreciation (see below) 371 329

Loss on sale of fixed assets 52

Capital expenditure (402) (460)

Sale of property, plant and equipment 81

Increase in working capital (36) (27)

(Profit)/loss retained in associates (1) 1

Charge for share incentive plans 70 78

Operating cash flow 1,321 1,175

Net interest paid (74) (68)

Tax paid – continuing operations (174) (162)

Dividends paid to non-controlling interests (6) (54)

Free cash flow 1,067 891

Cash outflow for exceptional restructuring costs (65) (27)

Acquisitions (1,250) (1,549)

Purchase of other financial assets and investments (3) (8)

Disposal of businesses – continuing operations 25 5

Disposal of businesses – discontinued operations 5(8)

Equity dividends paid (349) (322)

Net cash outflow (570) (1,018)

Net share purchases (371) (180)

New borrowings and other financing related cash flows 808 1,118

Net decrease in cash and cash equivalents – continuing operations (133) (80)

Net increase in cash and cash equivalents – discontinued operations 140 64

Net increase/(decrease) in cash and cash equivalents 7(16)

Cash and cash equivalents at 1 April 226 254

Exchange and other movements in cash and cash equivalents (25) (12)

Cash and cash equivalents at 31 March 208 226

Reconciliation of net debt

Year ended 31 March

2014

US$m

2013

US$m

At 1 April 2,938 1,818

Net cash outflow – as reported in the cash flow summary 570 1,018

Net share purchases 371 180

Exchange, discontinued operations and other movements in net debt (70) (78)

At 31 March 3,809 2,938

Reconciliation of amortisation, depreciation and impairment charges

Year ended 31 March

2014

US$m

2013

US$m

As reported in the Group income statement 524 465

Less: amortisation and impairment of acquisition intangibles (131) (123)

Less: exceptional asset write-off (7) (13)

Less: impairment of goodwill (15) –

As reported in the cash flow summary 371 329