Experian 2014 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2014 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

89

Plan interests awarded during the year

On 6 June 2013 awards were granted to the executive directors under the CIP and the PSP. The face value of awards to Don Robert

and Chris Callero are given in US dollars, using the average exchange rate for the three days prior to grant of £1:US$1.53, and the

face value of Brian Cassin’s award is in pounds sterling.

In line with the rules of the Experian Co-investment Plan, invested shares for Brian Cassin were purchased with his bonus net of

tax. In line with the rules of the Experian North America Co-investment Plan, invested shares for Don Robert and Chris Callero were

calculated with reference to their gross bonus. The matching awards are based on the gross value of the bonus deferred.

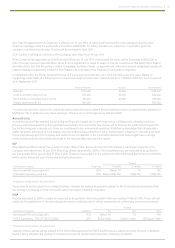

The details are set out in the following table.

Scheme

Type of interest in

shares Basis of award

Face value

‘000

Number of

shares

Vesting

at threshold

performance

Vesting

date

Don Robert

CIP invested shares Deferred shares 100% of gross bonus US$2,325 125,990 n/a 6 June 2016

CIP matching shares* Conditional shares 200% of value of gross bonus deferral US$4,650 251,980 1:1 match 6 June 2016

PSP* Conditional shares 200% of salary US $ 3,190 172,864 25% 6 June 2016

Chris Callero

CIP invested shares Deferred shares 100% of gross bonus US$1,485 80,471 n/a 6 June 2016

CIP matching shares* Conditional shares 200% of value of gross bonus deferral US$2,970 160,942 1:1 match 6 June 2016

PSP* Conditional shares 200% of salary US$2,030 110.004 25% 6 June 2016

Brian Cassin

CIP invested shares Purchased shares 100% of net bonus £358 29,947 n/a 6 June 2016

CIP matching shares** Nil-cost options 200% of value of gross bonus deferral £1,350 113,0 0 8 1:1 match 6 June 2016

PSP* Conditional shares 200% of salary £925 76,827 25% 6 June 2016

* Awards under the CIP and PSP were based on the average share price for the three days prior to grant, which was £12.04. Except as described below this figure was

used to determine the number of shares awarded.

** The award granted to Brian Cassin under the CIP was based on the share price at which invested shares were purchased in the market. This price was £11.95 and

was used to determine the number of shares awarded.

Dividend equivalents will be paid on any shares vesting at the end of the relevant performance period.

Performance conditions for 2013 awards

The performance conditions applying to awards granted during the year are set out in the following tables.

CIP awards

Performance measure Weighting

Vesting*

No match 1:1 match 2:1 match

Benchmark PBT (annual growth) 50% Below 7% 7% 14%

Cumulative operating cash flow 50% Below US$3.8bn US$3.8bn US$4.2bn

*Straight-line vesting between the points shown.

PSP awards

Performance measure Weighting

Vesting*

0% 25% 100%

Benchmark PBT (annual growth) 75% Below 7% 7% 14%

TSR of Experian vs. TSR of FTSE 100 Index 25% Below Index

Equal to

Index

25% above

Index

*Straight-line vesting between the points shown.

PSP awards will also only vest where, in the judgment of the Committee, the ROCE performance over the period has been satisfactory.

All outstanding share awards have a clawback feature whereby the vesting of awards is subject to the Committee being satisfied that

the vesting is not based on financial results which have been materially misstated.

In addition, the Committee has the discretion to vary the level of vesting, if it considers that the level of vesting determined by

measuring performance is inconsistent with the Group’s actual underlying financial and operational performance.

Governance • Report on directors’ remuneration