Experian 2014 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2014 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

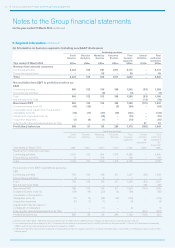

Financial statements • Notes to the Group financial statements

Notes to the Group financial statements

for the year ended 31 March 2014 continued

116

5. Significant accounting policies continued

(t) Share incentive plans (note 32)

The fair value of share incentives granted in connection with the Group’s equity-settled, share-based employee incentive plans is

recognised as an expense on a straight-line basis over the vesting period. Fair value is measured using whichever of the Black-

Scholes model, Monte Carlo model or closing market price is most appropriate. The Group takes into account the best estimate

of the number of awards and options expected to vest and such estimates are revised at each balance sheet date. Non-market

performance conditions are included in the vesting estimates. Market-based performance conditions are included in the fair value

measurement but are not revised for actual performance.

(u) Contingent consideration

Contingent consideration is recognised in accordance with EU-IFRS, including IFRS 3.

(v) Discontinued operations (note 17)

Discontinued operations are reported in accordance with EU-IFRS, including IFRS 5.

(w) Earnings per share (note 18)

Earnings per share are reported in accordance with EU-IFRS, including IAS 33.

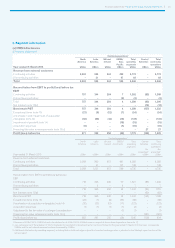

(x) Segment information policy and presentation principles (note 9)

Experian is organised into, and managed on a worldwide basis through, the following five operating segments, which are based on

geographic areas and supported by central functions:

• North America;

• Latin America;

• UK and Ireland;

• Europe, Middle East and Africa (‘EMEA’); and

• Asia Pacific.

The chief operating decision maker assesses the performance of these operating segments on the basis of EBIT, as defined in note 7.

The ‘All other segments’ category required to be disclosed has been captioned as EMEA/Asia Pacific in these financial statements.

This combines information in respect of the EMEA and Asia Pacific segments as neither of these operating segments is individually

reportable, on the basis of their share of the Group’s results and net assets.

Experian separately presents information equivalent to segment disclosures in respect of the costs of its central functions under

the caption of ‘Central Activities’, as management believes that this information is helpful to users of the financial statements. Costs

reported for Central Activities include costs arising from finance, treasury and other global functions.

Inter-segment transactions are entered into under the normal commercial terms and conditions that would be available to unrelated

third parties. Inter-segment transactions have no material impact on the Group’s results.

Segment assets exclude tax assets, cash and cash equivalents and derivatives designated as hedges of borrowings. Segment

liabilities exclude tax liabilities, borrowings and related hedging derivatives. Net assets reported for Central Activities comprise

corporate head office assets and liabilities, including certain post-employment benefit assets and obligations and derivative assets

and liabilities. Capital expenditure comprises additions to property, plant and equipment and intangible assets, other than additions

through business combinations.

Information required to be presented additionally includes analysis of the Group’s revenues over groups of service lines. This is

supplemented by voluntary disclosure of the profitability of those groups of service lines. For ease of reference, Experian continues

to use the term ‘business segments’ when discussing the results of groups of service lines. Experian’s four business segments,

details of which are given in the separate Strategic report section of this annual report, are:

• Credit Services;

• Decision Analytics;

• Marketing Services; and

• Consumer Services.

The North America and the UK and Ireland operating segments derive revenues from all of the Group’s business segments.

The EMEA and Asia Pacific segments currently do not derive revenue from the Consumer Services business segment and

such revenue generated in the Latin America segment is not yet sufficiently material to be disclosed separately.

Reportable segment information for the full year provided to the chief operating decision maker is set out in note 9(a).