Experian 2014 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2014 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

13

Strategic report • Our strategy

• Continue to deploy our existing products and platforms into high-growth markets.

• Evaluate opportunities in new countries with favourable characteristics, such as a

growing middle class and a transparent legal system.

• Extend our research teams into new countries, to partner with more clients and

deliver products with the best insights.

• Continue to support our long-term credit bureau builds in Australia and India.

Our vision is for our people, data and technology to become

a necessary part of every major consumer economy.

Please see the Chief Executive’s

statement for how we have executed

our strategy this year.

Our measures Our priorities for 2015 and beyond

• Continue to invest in industry experts, skills and propositions across new customer

segments, to open new markets and increase the number of products we sell into

existing segments.

• Focus on big opportunities in healthcare payments, automotive, public sector and

telecommunications. For example, in US healthcare payments we are completing the

integration of Passport Health Communications into Experian Healthcare and focusing

on opportunities to cross-sell or up-sell our full product suite. And in telecommunications

a rapidly changing industry means our clients need help to better manage their customer

lifecycles and reduce costs, fraud and customer churn.

• Further improve employee engagement by focusing on development plans,

training and local engagement programmes.

• Continue to strengthen and empower our sales teams, so they can consistently

deliver high-quality client service and realise cross-sell opportunities.

• Complete the global roll-out of the single customer relationship management

project, to align our sales processes across the regions.

• Continue to assess the best allocation of our resources within countries and

across regions, to keep improving our day-to-day operations.

Operate efficiently and

minimise our impact on

the environment

Protect and manage data

in a robust and safe way

Harness the talent and skills

of our employees

• Add unique data assets, to further improve the depth and quality of our databases.

• Continue to draw on our research teams’ scientific expertise, to solve clients’

strategic problems by developing innovative products.

• Further invest in our products, to transform them into global products we can

deploy quickly, at lower cost, and adapt locally, allowing clients to choose the

products best suited to solving their problems.

• Develop a specialised fraud prevention and identity management product, to

help both clients and consumers with this growing problem.

Exposure to legislation or regulatory

reforms addressing consumer privacy

Data ownership

and access

Interruptions in business

processes or systems

Loss or inappropriate

use of data

3. For further information see Our people section.

4. These are discussed in depth in the Protecting our business section.

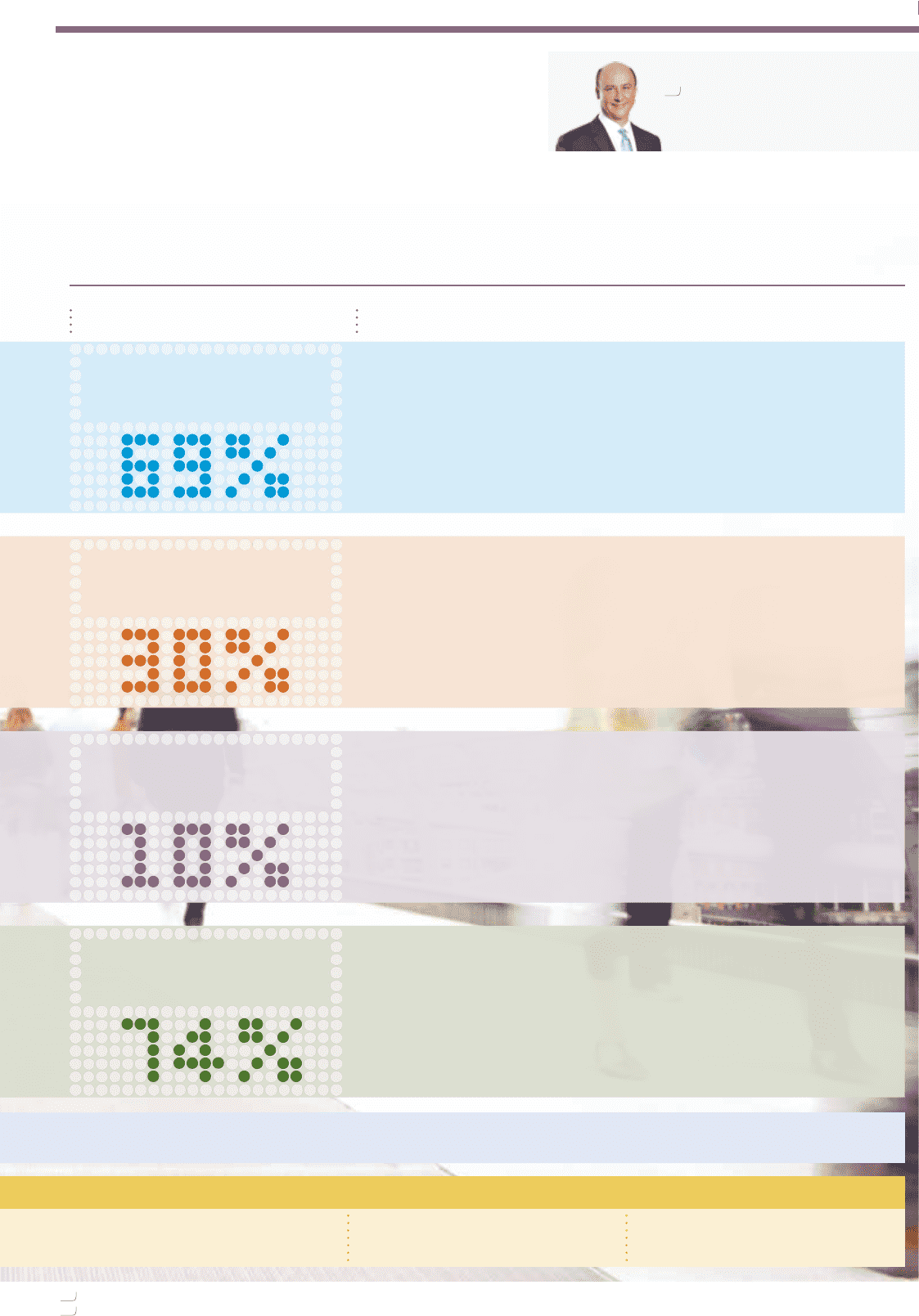

69%² of our revenue is now generated

from customer segments outside

financial services.

30%² of our revenue now comes

from Latin America and EMEA/

Asia Pacific.

We aim for more than 10% of our

revenue to come from products

developed in the past five years.

Our latest global people survey showed

74%3 employee engagement.

P20

P14

P28