Experian 2014 Annual Report Download - page 169

Download and view the complete annual report

Please find page 169 of the 2014 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

165

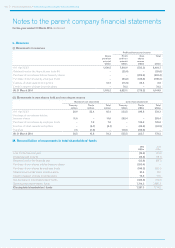

A. Basis of preparation

The separate financial statements of the Company are presented voluntarily and:

• prepared on a going concern basis and under the historical cost convention, and in accordance with UK accounting standards;

• presented in US dollars, the Company’s functional currency; and

• designed to include disclosures sufficient to comply with those parts of the UK Companies Act 2006 applicable to companies

reporting under UK accounting standards even though the Company is incorporated and registered in Jersey.

There has been no change in this information since the annual report for the year ended 31 March 2013.

B. Significant accounting policies

The significant accounting policies applied in the preparation of these financial statements are set out below. These policies have

been consistently applied to both years presented.

(i) Foreign currency

Transactions in foreign currencies are recorded at the rates prevailing at the transaction date. Monetary assets and liabilities

denominated in foreign currencies are retranslated at the rates prevailing at the balance sheet date. All differences are taken to the

profit and loss account in the year in which they arise.

(ii) Investments – shares in Group undertakings

Investments in Group undertakings are stated at cost less any provisions necessary for impairment.

The fair value of share incentives issued by the Company to employees of subsidiary undertakings is accounted for as a capital

contribution and recognised as an increase in the Company’s investment in Group undertakings with a corresponding increase in

total shareholders’ funds.

(iii) Debtors and creditors

Debtors are initially recognised at fair value and subsequently measured at this value. Where the time value of money is material, they

are then carried at amortised cost using the effective interest rate method. Creditors are initially recognised at fair value. Where the time

value of money is material, they are then carried at amortised cost using the effective interest rate method.

(iv) Deferred tax

Deferred tax is provided in respect of timing differences that have originated but not reversed at the balance sheet date and is

determined using the tax rates that are expected to apply when the timing differences reverse. Deferred tax assets are recognised

only to the extent that they are expected to be recoverable.

(v) Own shares

Shares in the Company purchased in connection with any share buyback programme, and held as treasury shares, are shown as a

deduction from total shareholders’ funds at cost.

The Group has a number of equity-settled, share-based employee incentive plans and, in connection with these plans, shares in the

Company are held by The Experian plc Employee Share Trust and the Experian UK Approved All-Employee Share Plan. The assets,

liabilities and expenses of these separately administered trusts are included in the Company’s financial statements as if they were the

Company’s own. The assets of the trusts mainly comprise Experian shares and such shares are also shown as a deduction from total

shareholders’ funds at cost.

Contractual obligations to purchase own shares are recognised at the net present value of expected future payments. Gains and

losses in connection with such obligations are recognised in the profit and loss account.

(vi) Profit and loss account format

Income and charges are reported by nature in the profit and loss account, as this reflects the composition of the Company’s income

and cost base. Income and costs are recognised on an accruals basis.

Financial statements • Notes to the parent company financial statements

Notes to the parent company financial statements

for the year ended 31 March 2014