Experian 2014 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2014 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial statements • Notes to the Group financial statements

Notes to the Group financial statements

for the year ended 31 March 2014 continued

120

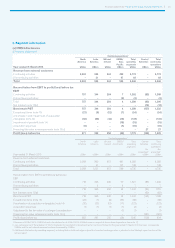

8. Financial risk management

(a) Financial risk factors

The Group’s activities expose it to a variety of financial risks. These are market risk, including foreign exchange risk and interest

rate risk, credit risk, and liquidity risk. These risks are unchanged from those reported in the annual report for the year ended

31 March 2013. The numeric disclosures in respect of financial risks are included within later notes to the financial statements,

to provide a more transparent link between financial risks and results.

Financial risks represent part of the Group’s risks in relation to its strategy and business objectives. There is a full discussion of all

such risks in the separate Protecting our business section of the annual report. The Group’s financial risk management focuses on

the unpredictability of financial markets and seeks to minimise potentially adverse effects on the Group’s financial performance.

The Group seeks to reduce its exposure to financial risks and uses derivative financial instruments to hedge certain risk exposures.

The Group also ensures surplus funds are prudently managed and controlled.

Market risk

Foreign exchange risk

The Group is exposed to foreign exchange risk from future commercial transactions, recognised assets and liabilities and

investments in, and loans between, undertakings with different functional currencies. The Group manages such risk, primarily

within undertakings whose functional currencies are US dollars, by borrowing in the relevant currencies and using forward foreign

exchange contracts. The principal transaction exposures are to sterling and the euro. An indication of the sensitivity to foreign

exchange risk is given in note 10.

Interest rate risk

The Group’s interest rate risk arises principally from its net debt and the amounts at variable rates.

The Group has a policy of normally maintaining between 50% and 100% of net funding at rates that are fixed for more than six

months. Net funding for this purpose is the total funding less freely available unrestricted cash. The Group manages its interest rate

exposure by using fixed and floating rate borrowings. Interest rate swaps and cross currency interest rate swaps are used to adjust

the balance of fixed and floating rate liabilities. The Group also mixes the duration of its borrowings to smooth the impact of interest

rate fluctuations. Further information in respect of the Group’s net finance costs for the year and an indication of the sensitivity to

interest rate risk is given in note 15.

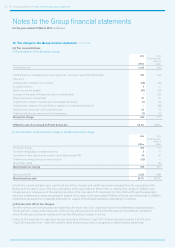

Credit risk

In the case of derivative financial instruments, deposits and trade receivables, the Group is exposed to credit risk from the non-

performance of contractual agreements by the contracted party.

The Group minimises its credit risk for derivative financial instruments and deposits by only entering into such contracts with banks and

financial institutions with strong credit ratings, within limits set for each organisation. Dealing and deposit activity is closely controlled

and counterparty positions are monitored regularly. The credit risk on derivative financial instruments utilised and deposits held by the

Group is therefore not considered to be significant. The Group does not anticipate that any losses will arise from non-performance by

these counterparties. Further information in respect of the Group’s derivative financial instruments at the balance sheet dates is given in

note 29 and that in respect of amounts recognised in the Group income statement is given in note 15. Further information in respect of

the Group’s deposits at the balance sheet dates is given in note 24.

To minimise credit risk for trade receivables, the Group has implemented policies that require appropriate credit checks on potential

clients before granting credit. The maximum credit risk in respect of such financial assets is their carrying value. Further information

in respect of the Group’s trade receivables is given in note 23.

Liquidity risk

The Group maintains long-term committed borrowing facilities to ensure it has sufficient funds available for operations and planned

growth. The Group monitors rolling cash flow forecasts to ensure that it will have adequate undrawn committed facilities available.

Details of such facilities are given in note 26. A maturity analysis of contractual undiscounted cash flows for financial liabilities is

given in note 31.

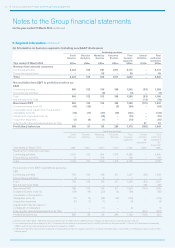

(b) Capital risk management

The Group’s definition and management of capital focuses on capital employed. The Group’s capital employed is reported in the

net assets summary table set out in the Financial review and analysed by segment in note 9(a)(ii). As part of its internal reporting

processes, the Group monitors capital employed by operating segment.

The Group’s objectives in managing capital are to safeguard its ability to continue as a going concern in order to provide

returns for shareholders and benefits for other stakeholders and to maintain an optimal capital structure and cost of capital.

To maintain or adjust its capital structure, the Group may adjust the amount of dividends paid to shareholders, return capital

to shareholders, issue or purchase shares or sell assets to reduce net debt.