Experian 2014 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2014 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Strategic report • Latin America

Credit Services

At constant exchange rates, total

and organic revenue growth in Credit

Services was 7%. Credit Services in

Brazil performed well, with growth

across both consumer and business

information, partially offset by a decline

in digital certificates (authentication).

Within business information, we are

benefiting from the introduction of new

product features, which create a richer

offering for small and medium enterprise

customers, while in consumer information

we delivered good growth in higher value-

added services and across a wide range

of industry verticals, which compensated

for lower growth in credit bureau volumes.

Growth in our other Latin American

bureau markets was very strong. We

have extended our market position in

Colombia with a series of new client wins

and further expansion of the small and

medium enterprise channel.

Decision Analytics

We delivered strong growth across the

region, with total and organic revenue

growth of 37% at constant exchange

rates. We have invested significantly

in Decision Analytics, as we have

leveraged expertise and best practices

from across Experian. Growth was

in part attributable to the roll-out of

our credit risk management suite,

including PowerCurve originations and

PowerCurve on-demand software. We

have also further enhanced our analytics

offering and have been building-out

our identity management and fraud

prevention services, both in Brazil and

across the wider Latin America region.

Marketing Services

Total and organic revenue at constant

exchange rates declined 10%. Marketing

Services was affected by the weak

trading environment in Brazil, particularly

for retailers who cut back on customer

prospecting activity during the year.

Notwithstanding these challenges, we are

investing in our product range, in order

to provide more sophisticated targeted

marketing services and to enhance our

digital offerings.

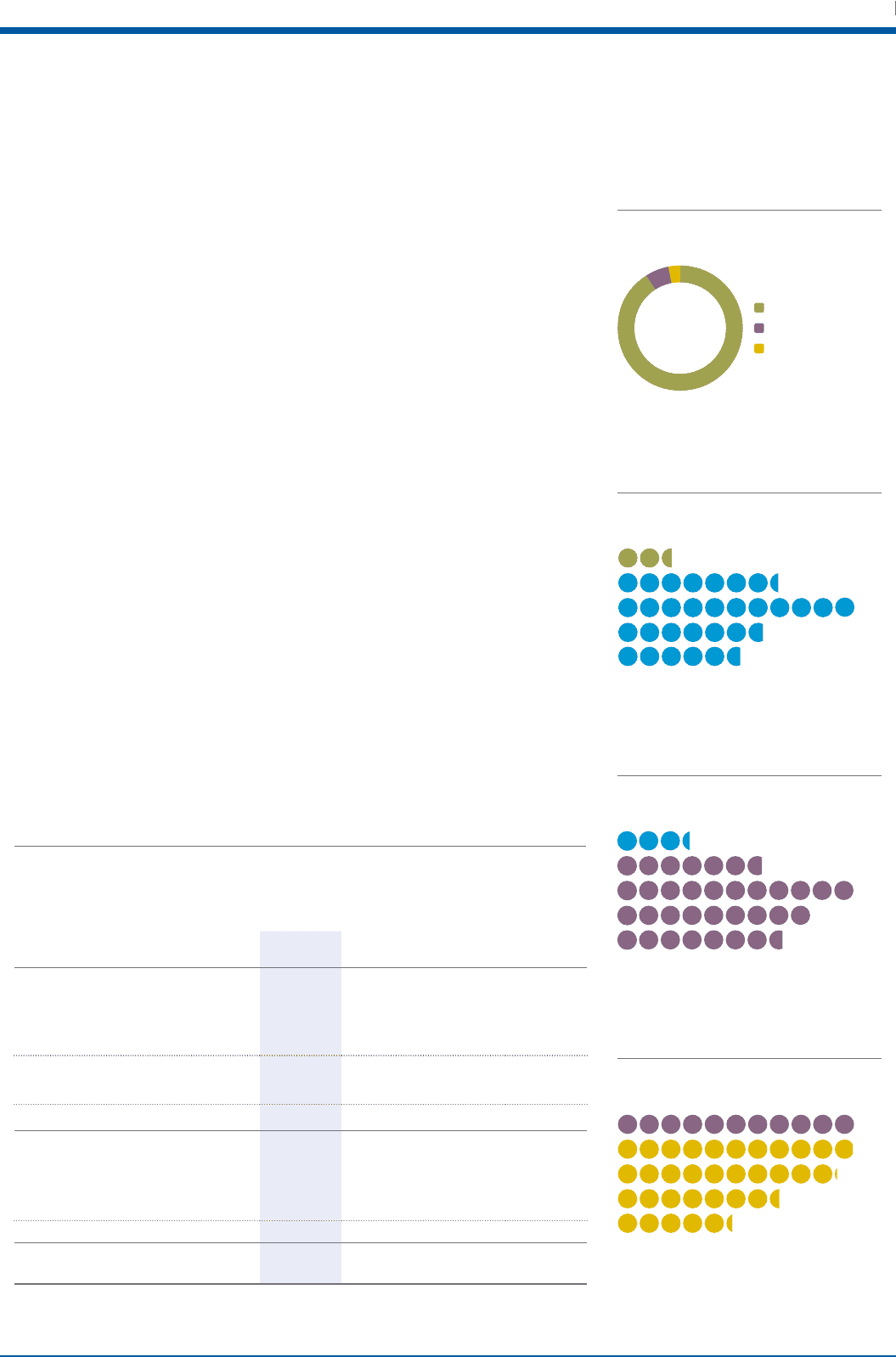

EBIT and EBIT margin

For Latin America, EBIT grew 12% at

constant exchange rates to US$344m.

The EBIT margin increased by 150 basis

points to 37.2%, reflecting operating

leverage due to revenue growth and cost

savings, net of reinvestment for growth.

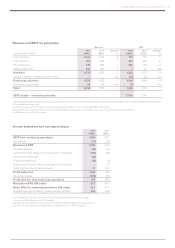

Credit Services 91%

Decision Analytics 6%

Marketing Services 3%

91%Highest % of revenue

from Credit Services

Year ended 31 March

2014

US$m

20131

US$m

Total grow th2

%

Organic growth

2

%

Revenue

Credit Services 839 874 7 7

Decision Analytics 53 44 37 37

Marketing Services 33 42 (10) (10)

Total continuing activities 925 960 7 7

Discontinuing activities 21 41

Total Latin America 946 1,001

EBIT

Continuing activities 344 343 12

Discontinuing activities –3

Total Latin America 344 346

EBIT margin337.2% 35.7%

1. 2013 restated for the movement of some businesses to discontinuing activities.

2. At constant exchange rates.

3. EBIT margin is for continuing activities only.

344m 37.2% 2014

7% 2014

7% 2014

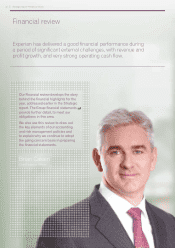

31%

16%

21%

19%

7%

10

12

11

13

14

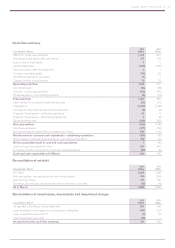

16%

19%

23%

14%

7%

10

12

11

13

14

343m 35.7%

33.3%

32.5%

29.7%

320m

166m

235m

344m 37.2%

10

12

11

13

14

37

EBIT (US$m) and EBIT margin (%)

Revenue by business line

Total revenue growth

Organic revenue growth