Experian 2014 Annual Report Download - page 147

Download and view the complete annual report

Please find page 147 of the 2014 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

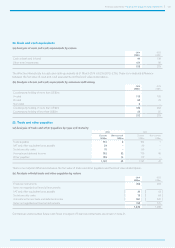

Financial statements • Notes to the Group financial statements 143

Liabilities

2014 2013

Current

US$m

Non-current

US$m

Total

US$m

Current

US$m

Non-current

US$m

Total

US$m

Derivative financial instruments:

Fair value hedge of borrowings (interest rate swaps) – 1 1 – – –

Derivatives used for hedging – 1 1 – – –

Non-hedging derivatives (equity swaps) – 1 1 – – –

Non-hedging derivatives (foreign exchange contracts) 2 – 2 3 – 3

Non-hedging derivatives (interest rate swaps) 3 19 22 2 40 42

Liabilities at fair value through profit and loss 5 20 25 5 40 45

Derivative financial instruments 5 21 26 5 40 45

Options in respect of non-controlling interests – 44 44 15 40 55

Total other financial liabilities 5 65 70 20 80 100

Amounts recognised in the Group income statement in connection with the Group’s hedging instruments are disclosed in note 15.

There is no material difference between the fair values and the book values stated above. Loans and receivables principally comprise

amounts due following the disposal of businesses.

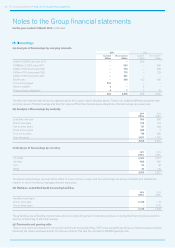

(b) Fair value and notional principal amounts of derivative financial instruments

2014 2013

Assets Liabilities Assets Liabilities

Fair value

US$m

Notional

US$m

Fair value

US$m

Notional

US$m

Fair value

US$m

Notional

US$m

Fair value

US$m

Notional

US$m

Cross currency swaps 143 1,347 – – 70 1,347 – –

Interest rate swaps 12 1,366 23 2,570 22 858 42 2,087

Equity swaps 2 8 1 10 8 17 – –

Foreign exchange contracts 5 410 2 286 4 203 3 171

162 3,131 26 2,866 104 2,425 45 2,258

(c) Offsetting derivative financial assets and financial liabilities

Assets Liabilities

2014

US$m

2013

US$m

2014

US$m

2013

US$m

Amounts reported in the Group balance sheet 165 104 26 45

Related amounts not offset in the Group balance sheet (21) (39) (21) (39)

Net amount 144 65 5 6

There are no amounts offset within the values reported for assets and liabilities in the Group balance sheet.