Experian 2014 Annual Report Download - page 163

Download and view the complete annual report

Please find page 163 of the 2014 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial statements • Notes to the Group financial statements 159

These provisional fair values contain amounts which will be finalised no later than one year after the dates of acquisition. Provisional

amounts have been included at 31 March 2014 as a consequence of the timing and complexity of the acquisitions. Goodwill

represents the synergies, assembled workforces and future growth potential of the businesses. None of the goodwill arising in the

year of US$831m is currently deductible for tax purposes.

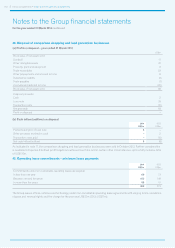

(c) Additional information

(i) For current year acquisitions

Passport Health

Communications,

Inc.

US$m

The 41st

Parameter Inc

US$m

Other

US$m

Total

US$m

Increase in book value from fair value adjustments:

Intangible assets 416 87 28 531

Other assets and liabilities (145) (17) (8) (170)

Increase in book value from fair value adjustments 271 70 20 361

Gross contractual amounts receivable in respect of trade

and other receivables 28 2 3 33

Revenue from 1 April 2013 to dates of acquisition 85 13 1 99

Revenue from dates of acquisition to 31 March 2014 45 14 11 70

Loss before tax from dates of acquisition to 31 March 2014 – (8) – (8)

At the dates of acquisition, the gross contractual amounts receivable in respect of trade and other receivables of US$33m were

expected to be collected in full.

It has been impracticable to estimate the impact on Group profit after tax had the acquired entities been owned from 1 April 2013, as

their accounting policies and period end dates did not accord with those of the Group prior to their acquisition.

(ii) For current and prior year acquisitions

There have been no material gains, losses, error corrections or other adjustments recognised in the year ended 31 March 2014 that

relate to acquisitions in the current or prior years.

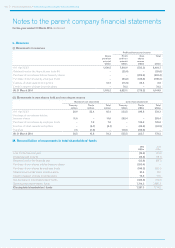

41. Acquisition of additional interest in Serasa – year ended 31 March 2013

In November 2012, the Group completed the acquisition of a further 29.6% interest in Serasa SA taking its holding to 99.6%. This

transaction was not a related party transaction under IFRS. The treatment of the changes in this ownership interest in the Group

statement of changes in total equity for the year ended 31 March 2013 is summarised below.

US$m

Increase in equity attributable to owners of Experian plc:

Payments to acquire additional interest in Serasa – charged to equity (1,500)

De-recognition of put option liability – credited to equity 1,487

Deferred tax asset recognised 462

Movement on de-recognition of non-controlling interest 85

Increase in equity attributable to owners of Experian plc 534

De-recognition of non-controlling interest (85)

Increase in total equity 449

The cash outflow of US$1,500m in respect of this transaction is further analysed in note 39(g).