Experian 2014 Annual Report Download - page 146

Download and view the complete annual report

Please find page 146 of the 2014 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial statements • Notes to the Group financial statements

Notes to the Group financial statements

for the year ended 31 March 2014 continued

142

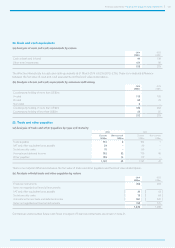

27. Net debt (non-GAAP measure) continued

(c) Analysis of movements in net debt continued

Cash and cash

equivalents

US$m

Current

borrowings

US$m

Non-current

borrowings

US$m

Net debt by

balance sheet

caption

US$m

Accrued

interest

excluded from

net debt

US$m

Derivatives

hedging

loans and

borrowings

US$m

Net debt

US$m

At 1 April 2012 254 (13) (2,179) (1,938) 17 103 (1,818)

Cash outflow (888) – – (888) – – (888)

Borrowings cash flow 1,123 (91) (1,032) – – – –

Reclassification of borrowings – (571) 571 – – – –

Net interest paid (68) – – (68) – – (68)

Movement on accrued

interest – – – – 2 – 2

Net cash inflow/(outflow) 167 (662) (461) (956) 2 – (954)

Net share purchases (180) – – (180) – – (180)

Fair value gains and losses – 15 (47) (32) – 44 12

Exchange and other

movements (12) 25 61 74 – (72) 2

At 31 March 2013 229 (635) (2,626) (3,032) 19 75 (2,938)

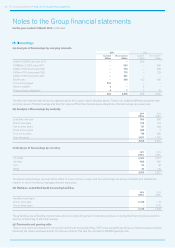

28. Available-for-sale financial assets

Available-for-sale financial assets of US$46m (2013: US$41m) comprise listed investments of US$43m (2013: US$38m) held in the

UK to secure certain unfunded pension arrangements (note 34) and investments held overseas of US$3m (2013: US$3m).

During the year ended 31 March 2014, there was a gain of US$5m (2013: US$3m) recognised in the Group statement of

comprehensive income on the change in value of available-for-sale financial assets.

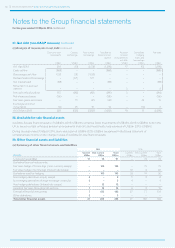

29. Other financial assets and liabilities

(a) Summary of other financial assets and liabilities

Assets

2014 2013

Current

US$m

Non-current

US$m

Total

US$m

Current

US$m

Non-current

US$m

Total

US$m

Loans and receivables 17 74 91 – 79 79

Derivative financial instruments:

Fair value hedge of borrowings (cross currency swaps) – 143 143 – 70 70

Fair value hedge of borrowings (interest rate swaps) – – – 18 4 22

Derivatives used for hedging – 143 143 18 74 92

Non-hedging derivatives (equity swaps) 2 – 2 5 3 8

Non-hedging derivatives (foreign exchange contracts) 5 – 5 4 – 4

Non-hedging derivatives (interest rate swaps) – 12 12 – – –

Assets at fair value through profit and loss 7 12 19 9 3 12

Derivative financial instruments 7 155 162 27 77 104

Other derivatives 3 – 3 – – –

Total other financial assets 27 229 256 27 156 183