Experian 2014 Annual Report Download

Download and view the complete annual report

Please find the complete 2014 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual Report

Year ended 31 March 2014

Table of contents

-

Page 1

Annual Report Year ended 31 March 2014 -

Page 2

... a difference to the communities we live and work in around the world." Don Robert Chief Executive Officer Telecoms Automotive US healthcare payments Learn how our data, analytics and services help people and businesses in their everyday lives Business information Fraud and identity management -

Page 3

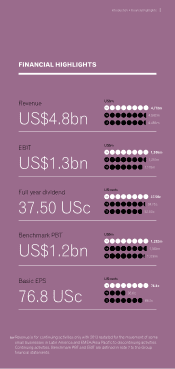

... 1,189m 1,128m 76.8c 36.6c 66.2c 76.8 USc P118 Revenue is for continuing activities only with 2013 restated for the movement of some small businesses in Latin America and EMEA/Asia Pacific to discontinuing activities. Continuing activities, Benchmark PBT and EBIT are defined in note 7 to the... -

Page 4

... in the UK and Ireland, 4% in North America and 2% in EMEA/Asia Pacific. We grew across all four of our global business lines, with organic revenue growth of 10% in Decision Analytics, 5% in Credit Services, 5% in Consumer Services and 1% in Marketing Services. We made significant strategic progress... -

Page 5

... our business Chief Executive's statement North America Latin America UK and Ireland EMEA/Asia Pacific Financial review Our corporate responsibilities GOVERNANCE 60 62 64 78 96 Chairman's introduction Board of directors Corporate governance report Report on directors' remuneration Directors' report... -

Page 6

...have laid important foundations for future development and expansion. I am pleased to report that this year saw further financial and strategic progress. Since demerger from GUS plc in 2006, Experian has delivered total returns more than two times the FTSE 100 average. We have again raised our full... -

Page 7

... an outstanding Chief Executive Officer in Brian Cassin, and a highly experienced Board. I know that Don and Brian share a passion for the power of information, Experian and its people, and will serve Experian and its shareholders tremendously well. 2014 marks a new chapter in Experian's history and... -

Page 8

... report • The role we play The role we play We help people, businesses and organisations connect in a trusted way, enabling them and the economies in which they operate to flourish. responsible fairer easier efficient Data on current and previous credit commitments helps give an insight... -

Page 9

...need help to extract value from all the data they are capturing. We help to bridge that gap, creating an environment in which information, held securely and managed properly, when coupled with analytics, helps provide better insights and outcomes benefiting people, businesses, organisations and the... -

Page 10

... our clients' data. Within a strict data security and Our competitive advantages Our unmatched global reach enables us to attract, support and service local and global clients. It enables our people to share best practice and innovation across our regions and business lines. Our scale allows us... -

Page 11

... value for the long term. Experts Client and customer interactions Experts Our technical and industry experts work collaboratively with our clients. They combine data and analytical expertise with sector experience, to support and empower our clients to solve strategic problems and turn insights... -

Page 12

..., retailers, insurance companies, telecommunications companies, US healthcare providers, and the public sector. Competitive environment We face competition in every market in which we operate. Our largest competitors are Equifax, TransUnion and Dun & Bradstreet. We hold the number one or number two... -

Page 13

Strategic report • Section Title Strategic report • Our business lines 09 09 Business lines: Decision Analytics Our analytics help to release the value of data, by providing insights to help clients solve problems and make valuable business decisions. 12% contribution to Group revenue Our ... -

Page 14

10 Strategic report • Our business lines Business lines: Marketing Services We provide data, data quality, analytics and cross-channel campaign management, to help our clients better interact with people and increase their customer revenue and loyalty. 19% contribution to Group revenue We help... -

Page 15

...real-time web and social network monitoring, to help prevent identity fraud before it happens. Revenue by region North America 78% UK and Ireland 22% Competitive environment We are the clear market leader in both the US and UK. In the US, competition is provided by Equifax, TransUnion, Fair Isaac... -

Page 16

... and services that generate value to society and the business Help consumers to make informed and responsible decisions Work in partnership with our communities to support social and economic development P18 1. We typically aim for our investments to generate a post-tax double-digit rate of return... -

Page 17

... cost, and adapt locally, allowing clients to choose the products best suited to solving their problems. • Develop a specialised fraud prevention and identity management product, to help both clients and consumers with this growing problem. Our latest global people survey showed 74%3 employee... -

Page 18

... the world support this shift, by working with local management to try to make the Heart of Experian real in every office. We are convinced that the Heart of Experian will deliver long-term benefits for our business performance and for clients and consumers. Our 2013 global people survey showed... -

Page 19

Strategic report • Our People 15 Global cost profile Labour 54% IT 8% Data 13% Marketing 12% Other 11% Central Activities 2% Experian employs people in North America: Latin America: UK and Ireland: EMEA/Asia Pacific: 6,400 3,000 3,800 3,100 Diversity profile of the senior leadership team ... -

Page 20

... set and location. It will then inform the need for talent acquisition and development programmes. Succession planning is also integral to our talent strategy, ensuring we have the leadership resources to achieve our strategic objectives. The executive leadership and the Board's Nomination • Si... -

Page 21

...brands they like. A banner ad from your current provider reminding you it's probably time to upgrade your old phone takes you to its website, where you browse the latest models. The next day, you head to your provider's store and pick out a new phone. The sales assistant couldn't be more helpful and... -

Page 22

... see the Group cash flow statement. P118 ROCE measures the return generated on the capital we have invested in the business and reflects our ability to add shareholder value over the long term. We have updated our ROCE measure in the year to reflect a more commonly used definition of return. This... -

Page 23

... small businesses in Latin America and EMEA/Asia Pacific to discontinuing activities. We use an all-employee global people survey every 18 months to measure employee engagement and gather feedback on how we can create a better workplace. We analyse this in depth and develop action plans to deliver... -

Page 24

...people, assets, capital and reputation. Experian is an innovation-driven, global business. Risk management is central to how we operate, enabling us to create value and deliver substantial returns to shareholders. It operates at all levels throughout our organisation, across regions, business lines... -

Page 25

... trends, investor relations analysis and detailed business trading summaries Regional-level detailed performance reviews Regional and executive risk management committee and Audit Committee risk reporting on the status of principal/emerging risks, the progress of strategic projects/acquisitions... -

Page 26

... risk 2014 update To the best of our knowledge, we comply with data protection requirements in every jurisdiction we operate in. The UK Financial Conduct Authority ('FCA') has been formed with rule-making, investigative and enforcement powers over some activities of our Credit Services businesses... -

Page 27

...aim for over 10% of our revenues to come from products developed during the past five years. In addition, 21% of our global costs are in information technology and data. Change from 2013 Stable 2014 update While we experienced limited disruptions during the financial year, isolated events including... -

Page 28

... security, technical controls and contractual precautions. Change from 2013 Increasing risk 2014 update The persistent threat of cyber-attacks in both the public and private sectors means that organisations will have to continuously adapt and strategically invest, to protect their data and systems... -

Page 29

... ventures are providing our consumer credit bureaux with data and regional expertise needed for their ongoing success. We invested in four businesses that diversify our product offerings, such as in fraud management and the US healthcare payments market; our risk profile was unchanged due to our... -

Page 30

... to benefit from a diversified portfolio of clients, in many countries. For 2014, businesses in North America accounted for 50% of global revenue, Latin America 19%, the UK and Ireland 20% and the remaining countries, comprising the EMEA/Asia Pacific regions, 11%. • Regional reviews EXPOSURE... -

Page 31

... in red. How Experian helps Our vehicle history service, AutoCheck in the US and VehicleCheck in the UK, helps you understand the history of a used car, including if it has been written off, whether it has mileage discrepancy, if it may have outstanding finance or has been reported as stolen. Our... -

Page 32

... of good growth, underscoring the strength of our portfolio, and we made further strategic progress as we concentrated investment in key growth areas. Organic revenue growth of 5% from continuing activities. Full year dividend of 37.50 US cents per share, up 8%. Don Robert Chief Executive Officer -

Page 33

... 7% in Latin America, 7% in the UK and Ireland, 4% in North America and 2% in EMEA/Asia Pacific. We also grew across all four global business lines, with organic revenue growth of 10% in Decision Analytics, 5% in Credit Services, 5% in Consumer Services and 1% in Marketing Services. Cash generation... -

Page 34

... areas. Our strategy is focused on a number of key elements, including: • • building on our leading position in the affinity channel; building on Experian's market-leading position in business-to-business data breach services; positioning the Experian.com brand as the trusted brand for consumers... -

Page 35

... your hospital stay. Two weeks before your due date, the hospital calls you. It's a patient counsellor, who wants to welcome you as a new patient and discuss some administrative details. She checks your name and insurance number, and confirms that you plan to stay in the postnatal wing for two days... -

Page 36

... as Chief Operating Officer by Kerry Williams, who will take up his new position and join the Board as an executive director following Chris's retirement at the Annual General Meeting. Kerry joined Experian North America in 2003 and was subsequently promoted to lead our Credit Services operations... -

Page 37

Strategic report • Chief Executive's statement 33 Revenue and EBIT by geography Revenue EBIT Growth2 % 2014 US$m 20131 US$m Growth2 % 2014 US$m 20131 US$m Year ended 31 March North America Latin America UK and Ireland EMEA/Asia Pacific Sub-total Central Activities - central corporate costs ... -

Page 38

... further progress in our strategic vertical markets, including the US public sector and automotive. We significantly increased our scale in the healthcare payments market with the acquisition of Passport, where the integration is going well." Victor Nichols Chief Executive Officer, North America -

Page 39

... for digital services for targeted marketing and in our data quality operations. This offset further declines in our more traditional data and database activities. Revenue by business line Credit Services 40% Decision Analytics 7% Marketing Services 18% Consumer Services 35% Consumer Services... -

Page 40

..., as we continued to expand in these markets. By introducing new products and services, we've helped more clients across more customer segments, working with them to improve their operational effectiveness and their understanding of their customers' needs." Kerry Williams President, Latin America -

Page 41

...on-demand software. We have also further enhanced our analytics offering and have been building-out our identity management and fraud prevention services, both in Brazil and across the wider Latin America region. Revenue by business line Credit Services 91% Decision Analytics 6% Marketing Services... -

Page 42

... in the UK and Ireland, with an exceptional performance from our Consumer Services business. Our membership base has grown as more people look to access and understand their credit history, and we're retaining members for longer as we continue to enhance our products. Credit Services benefitted from... -

Page 43

... in updating core systems. We secured a number of major client wins for credit risk management software, including our first major deal in the UK and Ireland for PowerCurve originations. We also saw further traction in identity management and fraud prevention services. More recently, we have added... -

Page 44

... of 2%. The difference relates principally to the acquisition of 41st Parameter. We divested of Sinotrust Market Research Services in May 2013 and other Marketing Services operations as part of actions to realign and refocus the business in Asia Pacific. 11% contribution to Group revenue " We're... -

Page 45

...of the year. our Asia Pacific operations, to focus on our most significant opportunities, and we were pleased to secure a number of new PowerCurve and fraud prevention deployments towards the end of the year. Revenue by business line Credit Services 38% Marketing Services Total revenue growth at... -

Page 46

... the financial highlights for the year, addressed earlier in the Strategic report. The Group financial statements provide further detail, to meet our obligations in this area. We also use this review to draw out the key elements of our accounting and risk management policies and to explain why we... -

Page 47

... further details. The gain on disposal of businesses in the year relating to a number of small disposals. Tax The Benchmark tax rate was 26.7% (2013: 25.3%). The increase reflects higher profits in the US, which has a corporate tax rate P129 above the main UK rate. Note 16 to the Group financial... -

Page 48

... reported results of our Latin America region. P157 Group cash flow commentary Cash flow summary We generated very strong cash flow in the year with operating cash flow of US$1,321m (2013: US$1,175m) and a cash flow conversion of 101% (2013: 94%). We manage working capital and capital expenditure... -

Page 49

... in working capital (Profit)/loss retained in associates Charge for share incentive plans Operating cash flow Net interest paid Tax paid - continuing operations Dividends paid to non-controlling interests Free cash flow Cash outflow for exceptional restructuring costs Acquisitions Purchase of... -

Page 50

...further information by operating P122 segment in note 9(a)(ii) to the Group financial statements. Capital employed includes post-employment benefit assets of US$13m (2013: US$24m) and net derivative financial assets of US$138m (2013: US$59m) where the balance sheet values depend on market conditions... -

Page 51

... report • Financial review 47 Share price and market capitalisation Experian's share price ranged from £10.20 to £12.90 during the year. On 31 March 2014, the mid-market price was £10.81, giving a market capitalisation of US$18.5bn at that date. 2014 NET FUNDING BY INTEREST RATE 2013... -

Page 52

...going concern in order to provide returns for shareholders and benefits for other stakeholders; and to maintain an optimal capital structure and cost of capital. Going concern The Board formed a judgment, at the time of approving the Group and the parent company financial statements, that there was... -

Page 53

... Revenue Labour costs Data and information technology costs Amortisation, depreciation and impairment charges Marketing and customer acquisition costs Other operating charges Total operating expenses Operating profit/(loss) Share of profit of associates EBIT from continuing operations Non-benchmark... -

Page 54

50 Strategic report • Financial review Financial review continued Revenue, EBIT and EBIT margin by business segment 2014 20131 Growth Total at constant rates % Organic at constant rates % Year ended 31 March US$m US$m Revenue Credit Services Decision Analytics Marketing Services Consumer ... -

Page 55

...new district. No one is supplying similar products there and having checked the size of the market and identified ideal target companies, you think there'll be good demand. You have managed your business's finances well so when the bank reviews your credit history they quickly agree a loan for a new... -

Page 56

... Page Title Our corporate responsibilities Our role in society is much more than simply managing the social, economic and environmental impact of our own operations. While this is a fundamental part of our corporate responsibilities, it is through our products, services and people that... -

Page 57

... have bank accounts and many people are unable to access the most basic financial services or government assistance because they have no official identity. This leads to poor access to credit, very high costs of credit delivery and the risks associated with informal lending. To start addressing this... -

Page 58

... and services that generate value to society and the business Supporting consumers to make informed and responsible decisions Working in partnership with our communities to support social and economic development Fundamentals ...which in turn relies on us ensuring that... We protect and manage data... -

Page 59

... up more achievable repayment terms. The portal puts millions of consumers back in control, allowing them to deal directly with lenders in a private and secure environment. Approximately 70% of users successfully negotiate debt settlements. Our goal is for five million consumers to be registered on... -

Page 60

...social housing tenants improve their credit reports and access mainstream lending. Community investment 2014 US$'000s 2013 US$'000s Funds from Experian plc Financial donations and investments from Experian subsidiaries Employee time volunteered Gifts in kind Management costs Total from Experian As... -

Page 61

... annual memberships to freecreditscore.com - Experian's credit profile checking service - in support of the National Foundation for Credit Counseling ('NFCC') Sharpen Your Financial Focus programme. These memberships have started to be redeemed and are offered to consumers who seek financial advice... -

Page 62

58 58 Strategic report • Our corporate responsibilities Case study Manage Your Future Now, Turkey Our Heart of Experian Social Responsibility programme aims to foster financial inclusion, promote financial education and support small business entrepreneurs. The Manage Your Future Now project in... -

Page 63

... in our Global Code of Conduct and policies on our website. Our Global Code of Conduct sets expectations for employee conduct and helps us make the right business decisions for our clients, shareholders and the global consumers we serve each day. The Group also has HR policies, a global Health and... -

Page 64

... of your Board's thinking was ensuring the continuity of the leadership team and maximising the likelihood of preserving Experian's unique and successful culture." • We are also announcing the appointment of Kerry Williams as Chief Operating Officer and as an executive director, to succeed... -

Page 65

... 2014. Kerry most recently assumed the post of Deputy Chief Operating Officer for Experian, and has immense experience and deep knowledge of Experian's businesses across the world, which will be of significant benefit to the Group in the future. UK Corporate Governance Code It is the Board's view... -

Page 66

... of Experian's business, due to his role in its inception and his time as Group Chief Executive Officer of GUS plc Don Robert Chief Executive Officer (54) Appointed: 6 July 2006 Other current roles: Non-executive director - Compass Group PLC. Director and trustee - National Education and Employer... -

Page 67

... roles: Group Chief Operating Officer, Group Chief Information Officer - HSBC Holdings plc. Non-executive director - MacDonald Dettwiler Key skills and experience: Information technology, global resourcing and an operational background that are invaluable at a large global business like Experian... -

Page 68

... company for approval. Remuneration Committee See Remuneration Committee report. Risk management committees (executive, regional and global operations) The Executive Risk Management Committee ('ERMC') comprises senior Group executives, including the executive directors and the Company Secretary... -

Page 69

.... The budget discussions in March ensure that Experian has the right resources to deliver the agreed strategy, and include detailed focus on both regional and global business line budgets. The Board also monitors management and financial performance against the Group's goals. To enable it to do this... -

Page 70

...' share dealings and external appointments. Operational and financial performance, including monitoring • Received operational and financial updates from the Chief Executive Officer and Chief Financial Officer respectively, at each scheduled Board meeting. • Reviewed monthly finance reports... -

Page 71

... development for individual non-executive directors as well as for the whole Board. This year the Board will continue their programme of key regional market visits, and this will provide them with deeper insights into local issues, risk, culture, talent and related matters. Progress report on Board... -

Page 72

... Officer and other executive management, and ensuring that members of the Board develop an understanding of the views of the Company's major investors. Chief Executive Officer's responsibilities include: Running the Group's business, and developing the Group's strategy and overall commercial... -

Page 73

...and the Chief Executive Officer is available on the Company's website, www.experianplc.com, and an extract appears on the previous page. Board training - Dallas The Board visited Dallas, Texas, in September 2013 and spent time at the Group's National Consumer Assistance Centre and other operational... -

Page 74

...those risks relating to social, ethical and environmental matters. This process has been in place for the financial year and up to the date of approval of this annual report. Full details of the Experian risk management and internal control systems can be found in the Protecting our business section... -

Page 75

...one ad hoc meeting. The Board considers nine current members of the Committee, including the Committee Chairman, to be independent non-executive directors, in accordance with provision B.2.1 of the UK Corporate Governance Code. The Group Human Resources Director and the Global Talent Director attend... -

Page 76

... executive search services in respect of other roles around the Group. During the year, the Committee also approved the process for the 2014/15 Board evaluation; received an AGM briefing from the Company Secretary, including voting results and shareholder feedback; reviewed the Committee's terms... -

Page 77

...Reviewed the Chairman's fee and the salaries of the Chief Executive Officer, the Chief Financial Officer, the Chief Operating Officer, the Company Secretary and a number of senior executives, taking account of remuneration arrangements throughout Experian and relevant market data. Received an update... -

Page 78

... without management present. In terms of recent and relevant financial experience, the Committee includes Deirdre Mahlan, the current Chief Financial Officer of Diageo plc, and George Rose, former Group Finance Director of BAE Systems plc and chairman of the audit committee of Genel Energy plc and... -

Page 79

..., operational, compliance and risk management. Reviewing and approving the Group's treasury policy. Approving the Committee's annual meeting schedule and reviewing the Committee's terms of reference. Some changes to ensure alignment with the UK Corporate Governance Code were recommended to the Board... -

Page 80

...best placed to carry out such work. This may include, but is not restricted to, shareholder and other circulars, regulatory reports and work in connection with acquisitions and divestments. Tax services: where the external auditors' knowledge of the Group's affairs may provide significant advantages... -

Page 81

...The information in your wallet included your full name, date of birth and postal address. You decide to call your local consumer credit bureau and explain what's happened. They suggest that you put a ï¬,ag on your credit report, so that if someone tries to obtain credit under your name, extra checks... -

Page 82

... deferred element, and clawback provisions are in place. As a result of the Board changes detailed in the Corporate governance report, the Committee has devoted considerable time to determining appropriate remuneration packages for the directors. Details of these are set out in the Annual report on... -

Page 83

... and works closely with the Human Resources team to ensure a consistent approach. When setting the remuneration policy for the executive directors, the Committee takes into account the pay, employment conditions and remuneration trends across the Group, especially when determining annual salary... -

Page 84

...range of market-competitive benefits that includes, but is not limited to, healthcare, death in service provision, company car or allowance, financial and tax advice and membership fees. In the US, eligible executive directors may participate in a deferred compensation plan, which is standard market... -

Page 85

... Report on directors' remuneration 81 Element and link to strategy Operation Maximum potential value and payment at target Performance metrics, weightings, relevant time period and clawback Annual bonus Motivates and rewards the achievement of specific financial objectives, linked to Experian... -

Page 86

.... The Group provides the Chairman with a limited range of benefits which includes a company car or allowance, healthcare and tax advice. The NEDs are paid a basic fee plus additional fees for chairing a Board Committee and for the role of Deputy Chairman / Senior Independent Director. NED fees are... -

Page 87

... covers the maximum annual bonus, the maximum face value of a matching award under the CIP and the normal maximum face value of an award under the PSP. As detailed in the policy table in the Directors' remuneration policy report, the rules of the incentive plans provide for award limits as set out... -

Page 88

...new hires is that service contracts will generally be limited to 12 months' notice of termination of employment and will follow the UK Corporate Governance Code guidelines. The Committee believes this policy is in line with best practice, remains market competitive and allows Experian to recruit key... -

Page 89

... Chief Executive Officer. These agreements are terminable by 12 months' notice from Experian Limited or six months' notice from Brian. The agreement provides for payment in lieu of notice (base salary only). Other than as described above, the service contract of each of the executive directors... -

Page 90

... of remuneration. For the share awards that will vest in June 2014, the value is calculated using the average share price from 1 January 2014 to 31 March 2014. This was £10.83, representing a 38% increase from the date of grant. As a result, US$3.2m of the single total figure for Don Robert and... -

Page 91

... of the Committee, the return on capital employed ('ROCE') performance over the period has been satisfactory. As these awards had not vested at the date this report was finalised, the value of the awards is based on the average share price of the last three months of the financial year, which... -

Page 92

...Four former directors of Experian Finance plc (formerly GUS plc) receive unfunded pensions from the Group. Three of the former directors are now paid under the Secured Unfunded Retirement Benefit Scheme, which provides security for the unfunded pensions of executives affected by the UK HMRC earnings... -

Page 93

... face value of Brian Cassin's award is in pounds sterling. In line with the rules of the Experian Co-investment Plan, invested shares for Brian Cassin were purchased with his bonus net of tax. In line with the rules of the Experian North America Co-investment Plan, invested shares for Don Robert and... -

Page 94

... the Chief Executive Officer should hold the equivalent of three times his base salary in Experian shares and other executive directors should hold two times their base salary (including invested shares held under the CIP). Until the shareholding guideline is met an executive director is expected... -

Page 95

... in June 2014 and this will be used to purchase further shares, if necessary, at that time. (6) (7) (8) Executive directors' non-executive directorships Don Robert served as a non-executive director of Compass Group plc during the period under review, for which he received a fee of £81,000 (2013... -

Page 96

...period of those awards was 49%. Percentage change in CEO's remuneration (not audited) The table below shows the percentage change in the CEO's salary, benefits and annual bonus between 2013 and 2014 and how this compares to the average percentage change for our UK and Ireland employees. The figures... -

Page 97

... towards UKlisted companies whereas the market for Don Robert was orientated more towards US and global companies. In September 2013, the Board reviewed the fees of the non-executive directors, as it normally does every two years. Based on supporting market data, the following fee increases were... -

Page 98

... report on remuneration continued Awards under this plan will not be made to Don Robert and Chris Callero, as a result of their change in role and forthcoming retirement as a director of the Company, respectively. Don Robert's outstanding share awards Upon Don Robert's retirement as Chief Executive... -

Page 99

...' remuneration policy report. Consideration by the directors of matters relating to directors' remuneration In making its decisions, the Committee consults with the Chairman, the Chief Executive Officer and the Group HR Director. Other members of the Global Reward team are also invited to attend... -

Page 100

...represents one Experian plc ordinary share. Further details are given in the Shareholder information section. P04 Results and dividends The Group income statement shows a profit for the financial year ended P67 31 March 2014 of US$754m (2013: US$401m, as re-presented). The directors have announced... -

Page 101

... at the date of approval of this annual report, the Company holds 38,536,619 (2013: 20,000,000) of its own shares as treasury shares. On 24 February 2014, 7,545,454 ordinary shares in the Company were transferred from RBC cees Trustee Limited, the trustee of the Experian plc Employee Share Trust, to... -

Page 102

... Our people section of the Strategic report. Experian supports employee share ownership by providing Sharesave and other employee share plan arrangements, which are intended to align the interests of employees with those of shareholders. Articles of association The Company's articles of association... -

Page 103

...Strategic report contains a fair review of the development and performance of the business and the position of the Company and the Group taken as a whole, together with a description of the principal risks and uncertainties that they face. In addition, each of the directors considers that the annual... -

Page 104

... statements Independent auditors' report to the members of Experian plc Report on the Group financial statements Our opinion In our opinion the Group financial statements, defined below give a true and fair view of the state of the Group's affairs as at 31 March 2014 and of the Group's profit and... -

Page 105

...audit The Group is structured into five geographical regions, being North America, Latin America, UK and Ireland, Europe, Middle East and Africa ('EMEA') and Asia Pacific ('APAC'). Each region comprises a number of reporting units. The Group financial statements comprise the financial information of... -

Page 106

... auditors' report: Group financial statements Independent auditors' report to the members of Experian plc continued Area of focus Tax - uncertain tax positions and tax planning The Group is subject to several tax regimes owing to the geographical diversity of its businesses. The directors are... -

Page 107

... non-standard contract terms. (Refer also to note 5(p) to the financial statements.) Risk of management override of internal controls ISAs (UK & Ireland) require that we consider this. How the scope of our audit addressed the area of focus We evaluated the relevant systems and tested the internal... -

Page 108

... the members of Experian plc continued As required by the Code Provision C.1.1, the directors have stated that they consider the annual report taken as a whole to be fair, balanced and understandable and provides the information necessary for members to assess the Group's performance, business model... -

Page 109

... Labour costs Data and information technology costs Amortisation, depreciation and impairment charges Marketing and customer acquisition costs Other operating charges Total operating expenses Operating profit Interest income Finance expense Net finance costs Share of post-tax profit of associates... -

Page 110

... income Group statement of comprehensive income for the year ended 31 March 2014 Notes 2014 2013 (Re-presented) (Note 3) US$m US$m Profit for the financial year Other comprehensive income Items that will not be reclassified to profit or loss: Remeasurement of post-employment benefit assets... -

Page 111

...payables Borrowings Deferred tax liabilities Post-employment benefit obligations Provisions Other financial liabilities Net assets Equity Called up share capital Share premium account Retained earnings Other reserves Attributable to owners of Experian plc Non-controlling interests Total equity 37 37... -

Page 112

... plans: - value of employee services - shares issued on vesting - other exercises of share awards and options - related tax credit - purchase of own shares by employee trusts - other payments Liability for put option over non-controlling interests Non-controlling interests arising on business... -

Page 113

... on vesting of share awards and exercise of share options - purchase of own shares by employee trusts - other payments Purchase of own shares held as treasury shares Payments to acquire non-controlling interests New borrowings Repayment of borrowings Capital element of finance lease rental payments... -

Page 114

..., Jersey JE4 8PX. The Company's ordinary shares are traded on the London Stock Exchange's Regulated Market (Premium Listing). Experian is the leading global information services group. There has been no change in this information since the annual report for the year ended 31 March 2013. 2. Basis of... -

Page 115

... impact on the Group. We routinely review such developments and adapt our financial reporting systems as appropriate. The following accounting standards, amendments and interpretations are effective for the first time for the Group's accounting periods beginning on or after 1 April 2014 IFRS 10... -

Page 116

... on management's expected retention of trade names within the business. Other intangibles Other intangibles are capitalised at cost, in accordance with IAS 38. Capitalisation and amortisation policies are Databases - capitalised databases, which comprise the data purchase and data capture costs of... -

Page 117

... social security obligations on employee share incentive plans, other than amounts of a financing nature, are charged or credited within labour costs. Other costs and changes in the fair value of such derivatives are charged or credited within financing fair value remeasurements in the Group income... -

Page 118

... date. The defined benefit obligation is calculated annually by independent qualified actuaries using the projected unit credit method. Under this method, and in view of the fact that the principal Experian funded plan is closed to new entrants, the current service cost increases as members approach... -

Page 119

.... (q) Operating charges Operating charges are reported by nature in the Group income statement, reflecting the Group's cost-management control structure. Details of charges in respect of share incentive plans within labour costs are set out in note (t) below. Those for post-employment benefits are... -

Page 120

... results of groups of service lines. Experian's four business segments, details of which are given in the separate Strategic report section of this annual report, are Credit Services; Decision Analytics; Marketing Services; and Consumer Services. The North America and the UK and Ireland operating... -

Page 121

... year are summarised below. Commentary on share incentive plans and pension benefits, which was included in the annual report for the year ended 31 March 2013, no longer features as management no longer considers these to be areas of critical accounting estimates or judgment. Revenue recognition is... -

Page 122

...goodwill, acquisition expenses, adjustments to contingent consideration, exceptional items, financing fair value remeasurements, tax and discontinued operations. It includes the Group's share of continuing associates' pre-tax results. An explanation of the basis on which Experian reports exceptional... -

Page 123

... (and the fair value of derivatives hedging borrowings) excluding accrued interest, less cash and cash equivalents reported in the Group balance sheet and other highly liquid bank deposits with original maturities greater than three months. (p) Capital employed Capital employed is defined as... -

Page 124

..., the Group monitors capital employed by operating segment. The Group's objectives in managing capital are to safeguard its ability to continue as a going concern in order to provide returns for shareholders and benefits for other stakeholders and to maintain an optimal capital structure and cost of... -

Page 125

... the year ended 31 March 2013 has been increased by US$2m and the net interest expense has been increased by US$4m. 3. Additional information by operating segment, including that on total and organic growth at constant exchange rates, is provided in the Strategic report section of the annual report. -

Page 126

...(160) (3,241) (263) (3,664) 125 (2,938) 429 (2,384) Capital employed 2014 US$m 2013 US$m North America Latin America UK and Ireland EMEA/Asia Pacific Total operating segments Central Activities Non-controlling interests Total capital employed attributable to owners 3,677 1,690 905 495 6,767 176... -

Page 127

... 123 (iii) Capital expenditure, amortisation and depreciation Capital expenditure 2014 US$m 2013 US$m Amortisation 2014 US$m 2013 US$m Depreciation 2014 US$m 2013 US$m North America Latin America UK and Ireland EMEA/Asia Pacific Total operating segments Central Activities Total Group 158 103 57... -

Page 128

... Group financial statements for the year ended 31 March 2014 continued 9. Segment information continued (b) Information on business segments (including non-GAAP disclosures) Credit Services Decision Analytics US$m Continuing operations1 Marketing Consumer Total Services Services business segments... -

Page 129

... (a) Labour costs - continuing operations 2014 2013 (Re-presented) (Note 3) US$m US$m Wages and salaries Social security costs Share incentive plans (note 32) Pension costs - defined benefit plans (note 34) Pension costs - defined contribution plans Employee benefit costs Other labour costs 1,338... -

Page 130

... such fees are included within other operating charges. 12. Average monthly number of employees (including executive directors) - continuing operations 2014 Full time Part time Full time equivalent Full time 2013 Part time Full time equivalent North America Latin America UK and Ireland EMEA/Asia... -

Page 131

... operations Note 2014 US$m 2013 US$m Amortisation and impairment of acquisition intangibles: Amortisation Impairment Amortisation and impairment of acquisition intangibles Impairment of goodwill Acquisition expenses Adjustment to the fair value of contingent consideration Financing fair value... -

Page 132

... Group financial statements for the year ended 31 March 2014 continued 15. Net finance costs (a) Net finance costs included in Profit before tax 2014 2013 (Re-presented) (Note 3) US$m US$m Interest income: Bank deposits, short-term investments and loan notes Interest on opening retirement benefit... -

Page 133

... net debt: Due to fair value gains on interest rate swaps offset by higher interest on floating rate borrowings (1) (3) 2 2 (1) (3) (11) 4 2014 US$m 2013 US$m 16. Tax charge in the Group income statement (a) Analysis of Group tax charge 2014 2013 (Re-presented) (Note 3) US$m US$m Current... -

Page 134

...of the Group tax charge 2014 2013 (Re-presented) (Note 3) US$m US$m Profit before tax Profit before tax multiplied by the main rate of UK corporation tax of 23% (2013: 24%) Effects of: Adjustments in respect of prior years Exceptional items Other income not taxable Increase in fair value of Serasa... -

Page 135

... in October 2012 and the results and cash flows of these businesses are classified as discontinued. (a) Results 2014 US$m 2013 US$m Revenue Labour costs Data and information technology costs Marketing and customer acquisition costs Other operating charges Total operating expenses Loss before tax... -

Page 136

...) 754 888 118 (605) 401 (e) Weighted average number of ordinary shares used 2014 million 2013 million Weighted average number of ordinary shares Add: dilutive effect of share incentive awards, options and share purchases Diluted weighted average number of ordinary shares 980 13 993 988 21 1,009 -

Page 137

... 26.00 US cents per ordinary share will be paid on 25 July 2014 to shareholders on the register at the close of business on 27 June 2014 and is not included as a liability in these financial statements. Further details are given in the separate Shareholder information section. This dividend and the... -

Page 138

... weighted average cost of capital from 12.6% to 14.6%. The decreases in both the long-term growth rate and EBIT margin that would be required to result in an impairment are not considered to be reasonably possible. In the case of the Asia Pacific CGU, the annual impairment review as at 31 March 2014... -

Page 139

... assets Acquisition intangibles Customer and other relationships US$m Acquired software development US$m Marketingrelated assets US$m Databases Internal use software Internally generated software US$m Total US$m US$m US$m Cost At 1 April 2013 Differences on exchange Additions through business... -

Page 140

... to the Group financial statements for the year ended 31 March 2014 continued 22. Property, plant and equipment Freehold properties US$m Short leasehold properties US$m Plant and equipment US$m Total US$m Cost At 1 April 2013 Differences on exchange Additions through business combinations (note... -

Page 141

... in Brazil, 19% (2013: 28%) in the UK and 20% (2013: 21%) in the USA. Together these represent 20% (2013: 22%) of trade receivables with other balances spread across a number of sectors and geographies. (b) Analysis of total trade and other receivables by nature 2014 US$m 2013 US$m Financial... -

Page 142

... 37 434 471 In the cases of trade receivables reported as not considered impaired, there is no evidence of impairment and no amounts have been renegotiated in either year. (e) Analysis of trade receivables considered partially impaired 2014 US$m 2013 US$m Up to three months past due Three to six... -

Page 143

... between the fair value of trade and other payables and the book value stated above. (b) Analysis of total trade and other payables by nature 2014 US$m 2013 US$m Financial instruments Items not regarded as financial instruments: VAT and other equivalent taxes payable Social security costs Amounts... -

Page 144

... the financing of acquisitions and the re-financing of other borrowings. (e) Covenants and gearing ratio There is one financial covenant in connection with the borrowing facilities. EBIT must exceed three times net interest expense before financing fair value remeasurements. The Group monitors this... -

Page 145

... US$m Net debt US$m US$m US$m US$m At 1 April 2013 Cash outflow Borrowings cash flow Net interest paid Movement on accrued interest Net cash inflow/(outflow) Net share purchases Fair value gains and losses Exchange and other movements At 31 March 2014 229 (314) 767 (74) - 379 (371) - (25) 212... -

Page 146

... in the UK to secure certain unfunded pension arrangements (note 34) and investments held overseas of US$3m (2013: US$3m). During the year ended 31 March 2014, there was a gain of US$5m (2013: US$3m) recognised in the Group statement of comprehensive income on the change in value of available-for... -

Page 147

... liabilities Assets 2014 US$m 2013 US$m Liabilities 2014 US$m 2013 US$m Amounts reported in the Group balance sheet Related amounts not offset in the Group balance sheet Net amount 165 (21) 144 104 (39) 65 26 (21) 5 45 (39) 6 There are no amounts offset within the values reported for assets... -

Page 148

... and liabilities whose valuations are derived from inputs not based on observable market data are classified as Level 3. For Experian, Level 3 items principally comprise put and call options associated with corporate transactions with no material effect on the amounts stated from any reasonably... -

Page 149

...; and The fair values of long-term borrowings are based on quoted market prices in the case of that portion of fixed rate borrowings not carried at fair value and are considered to approximate to the carrying amount in the case of floating rate bank loans and finance lease obligations. Of the Group... -

Page 150

... 2014 US$m 2013 US$m Share awards Share options Expense recognised Cost of associated social security obligations Total expense recognised in Group income statement 66 4 70 6 76 73 5 78 - 78 The Group has a number of equity-settled, share-based employee incentive plans and further information... -

Page 151

... are included in the fair value measurement on grant date and are not revised for actual performance. Awards granted in the year ended 31 March 2014 had a weighted average fair value per share of £12.02 (2013: £8.91). (iii) Share awards outstanding 2014 million 2013 million At 1 April Grants... -

Page 152

... over an independently managed portfolio of marketable securities owned by the Group and reported as available-for-sale financial assets (note 28). (c) Post-retirement medical benefits The Group operates plans which provide post-retirement medical benefits to certain retired employees and their... -

Page 153

...) 2014 US$m 2013 US$m Retirement benefit assets/(obligations) - funded plans: Fair value of funded plans' assets Present value of funded plans' obligations Assets in the balance sheet for funded defined pension benefits Obligations in the balance sheet for unfunded post-employment benefits: Present... -

Page 154

.... Post-employment benefit assets and obligations continued (b) Movements in net post-employment benefit assets recognised in the balance sheet Fair value of plan assets Present value of obligations Defined pension benefits - funded US$m Defined pension benefits - unfunded US$m Postemployment medical... -

Page 155

... constant. (i) Principal financial actuarial assumptions 2014 % 2013 % Discount rate Inflation rate - based on the UK Retail Prices Index ('RPI') Inflation rate - based on the UK Consumer Prices Index ('CPI') Increase in salaries Increase for pensions in payment - element based on RPI (where cap is... -

Page 156

... 31 March 2014 continued 34. Post-employment benefit assets and obligations continued (d) Assets of the Group's defined benefit plans at fair value 2014 Listed US$m Unlisted US$m Total US$m % Listed US$m 2013 Unlisted US$m Total US$m % Equities Fixed interest securities Investment funds Other 514... -

Page 157

... and liabilities Accelerated depreciation Intangibles Share incentive plans US$m Tax losses Other temporary differences US$m Total Assets At 1 April 2013 Differences on exchange Tax (charge)/credit in the Group income statement - continuing operations Business combinations Tax recognised within... -

Page 158

...(41) 8 Current tax recognised directly in equity on transactions with owners relates to employee share incentive plans. 36. Provisions 2014 Restructuring costs US$m Other liabilities US$m Total US$m Restructuring costs US$m 2013 Other liabilities US$m Total US$m At 1 April Differences on exchange... -

Page 159

... Notes to the Group financial statements 155 37. Called up share capital and share premium account At 31 March 2014, there were 1,031.6m shares in issue (2013: 1,030.1m) and 1.5m (2013: 1.1m) shares were issued in the year then ended. Further information relating to share capital is contained in... -

Page 160

... post-tax profit of associates Net finance costs Operating profit Loss on disposals of fixed assets (Gain)/loss on disposal of businesses Depreciation and amortisation Impairment of acquisition intangibles Impairment of goodwill Charge in respect of share incentive plans Increase in working capital... -

Page 161

... - for employee share incentive plans Purchase of own shares held as treasury shares Cash outflow in respect of net share purchases (non-GAAP measure) (13) 55 126 203 371 (9) (61) 250 - 180 (g) Payments to acquire non-controlling interests 2014 US$m 2013 US$m Payment to shareholders in Serasa... -

Page 162

...'s existing activities in fraud detection and online authentication. the acquisition on 21 November 2013 of the whole of the issued share capital of Passport Health Communications, Inc., a leading provider of data, analytics and software in the US healthcare payment market, for a consideration of... -

Page 163

... their accounting policies and period end dates did not accord with those of the Group prior to their acquisition. (ii) For current and prior year acquisitions There have been no material gains, losses, error corrections or other adjustments recognised in the year ended 31 March 2014 that relate to... -

Page 164

...one year Between one and five years In more than five years 69 163 68 300 73 149 51 273 The Group leases offices, vehicles and technology under non-cancellable operating lease agreements with varying terms, escalation clauses and renewal rights and the charge for the year was US$72m (2013: US$71m). -

Page 165

... no related party transactions are reported with such entities. (b) Remuneration of key management personnel 2014 US$m 2013 US$m Salaries and short-term employee benefits Retirement benefits Share incentive plans 7 1 12 20 9 1 15 25 Key management personnel comprises the Board of directors and... -

Page 166

... Independent auditors' report to the members of Experian plc Report on the parent company financial statements Our opinion In our opinion the parent company financial statements, defined below: • • give a true and fair view of the state of the parent company's affairs as at 31 March 2014 and of... -

Page 167

... and fair view. Our responsibility is to audit and express an opinion on the parent company financial statements in accordance with applicable law and ISAs (UK & Ireland). Those standards require us to comply with the Auditing Practices Board's Ethical Standards for Auditors. This report, including... -

Page 168

... Creditors - amounts falling due within one year Net current assets Net assets Capital and reserves Called up share capital Share premium account Profit and loss account Total shareholders' funds K L L M 79.2 1,163.2 6,144.9 7,387.3 79.0 1,150.5 6,484.7 7,714.2 J (77.8) 1,490.8 7,387.3 (81... -

Page 169

... from total shareholders' funds at cost. The Group has a number of equity-settled, share-based employee incentive plans and, in connection with these plans, shares in the Company are held by The Experian plc Employee Share Trust and the Experian UK Approved All-Employee Share Plan. The assets... -

Page 170

...to the Company's auditor and its associates for the audit of the Group financial statements. D. Staff costs 2014 US$m 2013 US$m Directors' fees Wages and salaries Social security costs Other pension costs 2.6 1.0 0.1 0.1 3.8 2.5 1.1 0.3 0.1 4.0 Executive directors of the Company are employed by... -

Page 171

... issued share capital of the following undertakings. Company Experian Investment Holdings Limited Experian Finance Holdings Limited Experian Group Services Limited Experian Holdings Ireland Limited Experian Ireland Investments Limited Principal activity Holding company Finance company Administrative... -

Page 172

... year Purchase of own shares held as treasury shares Purchase of own shares by employee trusts Shares issued under share incentive plans Credit in respect of share incentive plans Net decrease in total shareholders' funds Opening total shareholders' funds Closing total shareholders' funds (10... -

Page 173

... UK defined benefit pension plan. The Company has also issued a small number of other guarantees in connection with the performance of operational business contracts by Group undertakings. O. Principal subsidiary undertakings at 31 March 2014 Company Experian Finance plc Experian Holdings Limited... -

Page 174

... Registrars (Jersey) Limited, via the Company website at www.experianplc.com/shares. The service enables shareholders to access a comprehensive range of shareholder services online, including dividend payment information, the ability to check shareholdings, amend address or bank details and submit... -

Page 175

...171 Capital Gains Tax ('CGT') base cost for UK shareholders On 10 October 2006, GUS plc separated its Experian business from its Home Retail Group business by way of demerger. Following the demerger, GUS plc shareholders at 4.30pm on 6 October 2006 were entitled to receive one share in Experian plc... -

Page 176

...Contact information Corporate headquarters Newenham House Northern Cross Malahide Road Dublin 17 Ireland T +353 (0) 1 846 9100 F +353 (0) 1 846 9150 Registered office 22 Grenville Street St Helier Jersey JE4 8PX The registered number of Experian plc is 93905. Registrars Experian Shareholder Services... -

Page 177

... in the printing factory. ISO 14001 - A pattern of control for an environmental management system against which an organisation can be credited by a third party. Carbon Balancing by the World Land Trust tackles climate change through projects that both offset carbon dioxide (CO2) emissions and... -

Page 178

Corporate headquarters Experian plc Newenham House Northern Cross Malahide Road Dublin 17 Ireland Corporate office Experian Cardinal Place 80 Victoria Street London SW1E 5JL United Kingdom Operational headquarters Experian Landmark House Experian Way NG2 Business Park Nottingham NG80 1ZZ United ...