Wells Fargo 2007 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2007 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

95

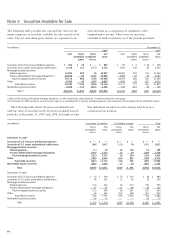

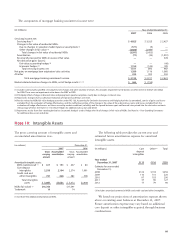

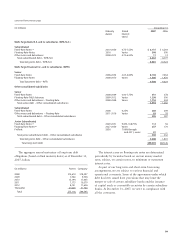

(in millions) Year ended December 31,

2007 2006 2005

Servicing income, net:

Servicing fees (1) $ 4,025 $ 3,525 $ 2,457

Changes in fair value of residential MSRs:

Due to changes in valuation model inputs or assumptions (2) (571) (9) —

Other changes in fair value (3) (3,026) (2,444) —

Total changes in fair value of residential MSRs (3,597) (2,453) —

Amortization (71) (34) (1,991)

Reversal of provision for MSRs in excess of fair value —— 378

Net derivative gains (losses):

Fair value accounting hedges (4) —— (46)

Economic hedges (5) 1,154 (145) 189

Total servicing income, net 1,511 893 987

Net gains on mortgage loan origination/sales activities 1,289 1,116 1,085

All other 333 302 350

Total mortgage banking noninterest income $ 3,133 $ 2,311 $ 2,422

Market-related valuation changes to MSRs, net of hedge results (2) + (5) $ 583 $ (154)

(1) Includes contractually specified servicing fees, late charges and other ancillary revenues. Also includes impairment write-downs on other interests held of $26 million

for 2006. There were no impairment write-downs for 2007 or 2005.

(2) Principally reflects changes in discount rates and prepayment speed assumptions, mostly due to changes in interest rates.

(3) Represents changes due to collection/realization of expected cash flows over time.

(4) Results related to MSRs fair value hedging activities under FAS 133, Accounting for Derivative Instruments and Hedging Activities (as amended), consist of gains and losses

excluded from the evaluation of hedge effectiveness and the ineffective portion of the change in the value of these derivatives. Gains and losses excluded from the

evaluation of hedge effectiveness are those caused by market conditions (volatility) and the spread between spot and forward rates priced into the derivative contracts

(the passage of time). See Note 16 – Fair Value Hedges for additional discussion and detail.

(5) Represents results from free-standing derivatives (economic hedges) used to hedge the risk of changes in fair value of MSRs. See Note 16 – Free-Standing Derivatives

for additional discussion and detail.

The components of mortgage banking noninterest income were:

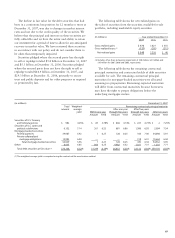

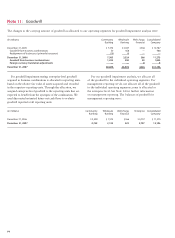

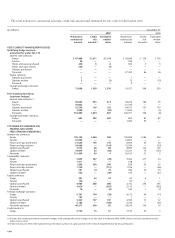

The gross carrying amount of intangible assets and

accumulated amortization was:

Note 10: Intangible Assets

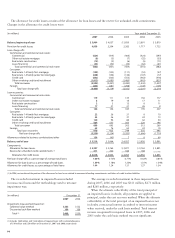

We based our projections of amortization expense shown

above on existing asset balances at December 31, 2007.

Future amortization expense may vary based on additional

core deposit or other intangibles acquired through business

combinations.

(in millions) December 31,

2007 2006

Gross Accumulated Gross Accumulated

carrying amortization carrying amortization

amount amount

Amortized intangible assets:

MSRs (commercial) (1) $ 617 $ 151 $ 457 $ 80

Core deposit

intangibles 2,539 2,104 2,374 1,991

Credit card and

other intangibles 731 426 581 378

Total intangible

assets $ 3,887 $2,681 $ 3,412 $2,449

MSRs (fair value) (1) $16,763 $17,591

Trademark 14 14

(1) See Note 9 for additional information on MSRs.

(in millions) Core Other(1) Total

deposit

intangibles

Year ended

December 31, 2007 $113 $116 $229

Estimate for year ended

December 31,

2008 $122 $134 $256

2009 110 116 226

2010 97 103 200

2011 37 90 127

2012 17 79 96

(1) Includes amortized commercial MSRs and credit card and other intangibles.

The following table provides the current year and

estimated future amortization expense for amortized

intangible assets.