Wells Fargo 2007 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2007 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

89

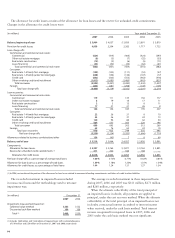

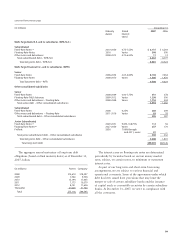

The total of our unfunded loan commitments, net of all

funds lent and all standby and commercial letters of credit

issued under the terms of these commitments, is summarized

by loan category in the following table:

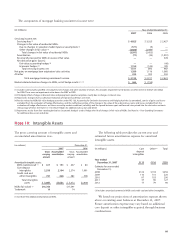

(in millions) December 31,

2007 2006

Commercial and commercial real estate:

Commercial $ 89,480 $ 79,879

Other real estate mortgage 2,911 2,612

Real estate construction 9,986 9,600

Total commercial and

commercial real estate 102,377 92,091

Consumer:

Real estate 1-4 family first mortgage 11,861 9,708

Real estate 1-4 family junior lien mortgage 47,763 44,179

Credit card 62,680 55,010

Other revolving credit and installment 16,220 14,679

Total consumer 138,524 123,576

Foreign 980 824

Total unfunded loan commitments $241,881 $216,491

We have an established process to determine the adequacy

of the allowance for credit losses that assesses the risks and

losses inherent in our portfolio. We combine estimates of the

allowances needed for loans analyzed on a pooled basis and

loans analyzed individually (including impaired loans) to

determine the adequacy of the total allowance.

A significant portion of the allowance is estimated at

a pooled level for consumer loans and some segments of

commercial small business loans. We use forecasting models

to measure the losses inherent in these portfolios. We validate

and update these models periodically to capture recent

behavioral characteristics of the portfolios, such as updated

credit bureau information, actual changes in underlying

economic or market conditions and changes in our loss

mitigation strategies. The increase in provision for 2007

was a significant credit event where home equity credit

losses emerged in excess of previous estimates and the

allowance was increased primarily to reflect this increase

in inherent losses.

The remaining portion of the allowance is for commercial

loans, commercial real estate loans and lease financing. We

initially estimate this portion of the allowance by applying

historical loss factors statistically derived from tracking losses

associated with actual portfolio movements over a specified

period of time, using a standardized loan grading process.

Based on this process, we assign loss factors to each pool

of graded loans and a loan equivalent amount for unfunded

loan commitments and letters of credit. These estimates

are then adjusted or supplemented where necessary from

additional analysis of long-term average loss experience,

external loss data, or other risks identified from current

conditions and trends in selected portfolios, including

management’s judgment for imprecision and uncertainty.

We assess and account for as impaired certain nonaccrual

commercial and commercial real estate loans that are over

$3 million and certain consumer, commercial and commercial

real estate loans whose terms have been modified in a

troubled debt restructuring. We include the impairment on

these nonperforming loans in the allowance unless it has

already been recognized as a loss.

The potential risk from unfunded loan commitments and

letters of credit for wholesale loan portfolios is considered

along with the loss analysis of loans outstanding. Unfunded

commercial loan commitments and letters of credit are

converted to a loan equivalent factor as part of the analysis.

The reserve for unfunded credit commitments was

$211 million at December 31, 2007, and $200 million

at December 31, 2006.

Reflected in the two portions of the allowance previously

described is an amount for imprecision or uncertainty that

incorporates the range of probable outcomes inherent in

estimates used for the allowance, which may change from

period to period. This amount is the result of our judgment

of risks inherent in the portfolios, economic uncertainties,

historical loss experience and other subjective factors,

including industry trends, calculated to better reflect our

view of risk in each loan portfolio.

Like all national banks, our subsidiary national banks

continue to be subject to examination by their primary

regulator, the OCC, and some have OCC examiners in

residence. The OCC examinations occur throughout the

year and target various activities of our subsidiary national

banks, including both the loan grading system and specific

segments of the loan portfolio (for example, commercial

real estate and shared national credits). The Parent and

our nonbank subsidiaries are examined by the Federal

Reserve Board.

We consider the allowance for credit losses of $5.52 billion

adequate to cover credit losses inherent in the loan portfolio,

including unfunded credit commitments, at December 31, 2007.

Nonaccrual loans were $2,679 million and $1,666 million

at December 31, 2007 and 2006, respectively. Loans past due

90 days or more as to interest or principal and still accruing

interest were $6,393 million at December 31, 2007, and

$5,073 million at December 31, 2006. The 2007 and 2006

balances included $4,834 million and $3,913 million,

respectively, in advances pursuant to our servicing agreements

to the Government National Mortgage Association (GNMA)

mortgage pools whose repayments are insured by the Federal

Housing Administration or guaranteed by the Department of

Veterans Affairs.