Wells Fargo 2007 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2007 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.111

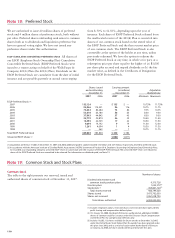

Dividend Reinvestment and Common Stock Purchase Plans

Participants in our dividend reinvestment and common stock

direct purchase plans may purchase shares of our common

stock at fair market value by reinvesting dividends and/or

making optional cash payments, under the plan’s terms.

Employee Stock Plans

We offer the stock-based employee compensation plans

described below. Effective January 1, 2006, we adopted

FAS 123(R), Share-Based Payment, using the “modified

prospective” transition method. FAS 123(R) requires that

we measure the cost of employee services received in

exchange for an award of equity instruments, such as stock

options or restricted share rights (RSRs), based on the fair

value of the award on the grant date. The cost is normally

recognized in our income statement over the vesting period

of the award; awards with graded vesting are expensed on a

straight-line method. Awards to retirement-eligible employees

are subject to immediate expensing upon grant. Total stock

option compensation expense was $129 million in 2007 and

$134 million in 2006, with a related recognized tax benefit

of $49 million and $50 million for the same years, respectively.

Stock option expense is based on the fair value of the awards

at the date of grant. Prior to January 1, 2006, we did not

record any compensation expense for stock options.

LONG-TERM INCENTIVE COMPENSATION PLAN Our Long-Term

Incentive Compensation Plan provides for awards of incentive

and nonqualified stock options, stock appreciation rights,

restricted shares, RSRs, performance awards and stock

awards without restrictions. Options must have an exercise

price at or above fair market value (as defined in the plan)

of the stock at the date of grant (except for substitute or

replacement options granted in connection with mergers or

other acquisitions) and a term of no more than 10 years.

Except for options granted in 2004 and 2005, which generally

vested in full upon grant, options generally become exercisable

over three years beginning on the first anniversary of the

date of grant. Except as otherwise permitted under the plan,

if employment is ended for reasons other than retirement,

permanent disability or death, the option period is reduced

or the options are canceled.

Options granted prior to 2004 may include the right to

acquire a “reload” stock option. If an option contains the

reload feature and if a participant pays all or part of the

exercise price of the option with shares of stock purchased in

the market or held by the participant for at least six months

and, in either case, not used in a similar transaction in the

last six months, upon exercise of the option, the participant

is granted a new option to purchase, at the fair market value

of the stock as of the date of the reload, the number of

shares of stock equal to the sum of the number of shares

used in payment of the exercise price and a number of shares

with respect to related statutory minimum withholding

taxes. Reload grants are fully vested upon grant and are

expensed immediately under FAS 123(R) beginning in 2006.

The total number of shares of common stock available

for grant under the plan at December 31, 2007, was

145,278,124.

Holders of RSRs are entitled to the related shares of

common stock at no cost generally over three to five years

after the RSRs were granted. Holders of RSRs granted prior

to July 2007 may be entitled to receive cash payments equal

to the cash dividends that would have been paid had the

RSRs been issued and outstanding shares of common stock.

Except in limited circumstances, RSRs are canceled when

employment ends.

The compensation expense for RSRs equals the quoted

market price of the related stock at the date of grant and is

accrued over the vesting period. Total compensation expense

for RSRs was not significant in 2007 or 2006.

For various acquisitions and mergers, we converted

employee and director stock options of acquired or merged

companies into stock options to purchase our common stock

based on the terms of the original stock option plan and the

agreed-upon exchange ratio.

PARTNERSHARES PLAN In 1996, we adopted the PartnerShares®

Stock Option Plan, a broad-based employee stock option

plan. It covers full- and part-time employees who generally

were not included in the long-term incentive compensation

plan described above. The total number of shares of

common stock authorized for issuance under the plan since

inception through December 31, 2007, was 108,000,000,

including 10,285,112 shares available for grant at

December 31, 2007. No options have been granted under

the plan since 2002, and as a result of action taken by the

Board of Directors on January 22, 2008, no future awards

will be granted under the plan. The exercise date of options

granted under the PartnerShares Plan is the earlier of (1) five

years after the date of grant or (2) when the quoted market

price of the stock reaches a predetermined price. These

options generally expire 10 years after the date of grant.

Because the exercise price of each PartnerShares Plan grant

has been equal to or higher than the quoted market price of

our common stock at the date of grant, we did not recognize

any compensation expense in 2005 and prior years. In

2006, under FAS 123(R), we began to recognize expense

related to these grants, based on the remaining vesting

period. All of our PartnerShares Plan grants were fully

vested as of December 31, 2007.

Director Plan

We provide a stock award to non-employee directors as

part of their annual retainer under our Directors Stock

Compensation and Deferred Plan. We also provide annual

grants of options to purchase common stock to each non-

employee director elected or re-elected at the annual meeting

of stockholders. The options can be exercised after six

months and through the tenth anniversary of the grant date.