Wells Fargo 2007 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2007 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

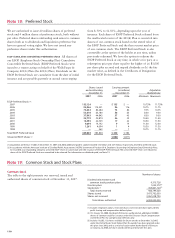

120

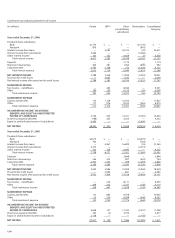

(in millions) Translation Net Net Defined Cumulative

adjustments unrealized unrealized benefit other

gains gains on pension compre-

(losses) on derivatives plans hensive

securities and income

available hedging

for sale activities

and other

interests

held

Balance, December 31, 2004 $24 $ 891 $ 35 $ — $ 950

Net change 5 (298) 8 — (285)

Balance, December 31, 2005 29 593 43 — 665

Net change — (31) 70 (402)(1) (363)

Balance, December 31, 2006 29 562 113 (402) 302

Net change 23 (164) 322 242 423

Balance, December 31, 2007 $52 $ 398 $435 $(160) $ 725

(1) Adoption of FAS 158.

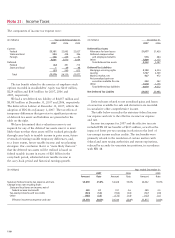

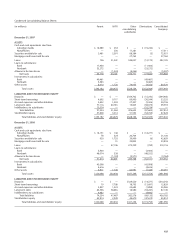

(in millions) Year ended December 31,

2007 2006 2005

Before Tax Net of Before Tax Net of Before Tax Net of

tax effect tax tax effect tax tax effect tax

Translation adjustments $ 36 $ 13 $ 23 $ — $ — $ — $ 8 $ 3 $ 5

Securities available for sale

and other interests held:

Net unrealized gains (losses)

arising during the year 86 36 50 264 93 171 (401) (143) (258)

Reclassification of gains

included in net income (345) (131) (214) (326) (124) (202) (64) (24) (40)

Net unrealized losses arising

during the year (259) (95) (164) (62) (31) (31) (465) (167) (298)

Derivatives and

hedging activities:

Net unrealized gains

arising during the year 645 246 399 46 16 30 349 134 215

Reclassification of net losses

(gains) on cash flow hedges

included in net income (124) (47) (77) 64 24 40 (335) (128) (207)

Net unrealized gains arising

during the year 521 199 322 110 40 70 14 6 8

Defined benefit pension plans:

Amortization of net actuarial

loss and prior service cost

included in net income 391 149 242 — — — — — —

Other comprehensive income $ 689 $ 266 $ 423 $ 48 $ 9 $ 39 $(443) $(158) $(285)

Note 23: Other Comprehensive Income

The components of other comprehensive income and the related tax effects were:

Cumulative other comprehensive income balances were: