Wells Fargo 2007 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2007 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

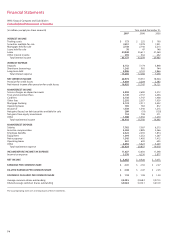

75

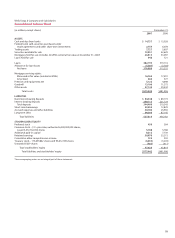

Wells Fargo & Company and Subsidiaries

Consolidated Balance Sheet

(in millions, except shares) December 31,

2007 2006

ASSETS

Cash and due from banks $ 14,757 $ 15,028

Federal funds sold, securities purchased under

resale agreements and other short-term investments 2,754 6,078

Trading assets 7,727 5,607

Securities available for sale 72,951 42,629

Mortgages held for sale (includes $24,998 carried at fair value at December 31, 2007) 26,815 33,097

Loans held for sale 948 721

Loans 382,195 319,116

Allowance for loan losses (5,307) (3,764)

Net loans 376,888 315,352

Mortgage servicing rights:

Measured at fair value (residential MSRs) 16,763 17,591

Amortized 466 377

Premises and equipment, net 5,122 4,698

Goodwill 13,106 11,275

Other assets 37,145 29,543

Total assets $575,442 $481,996

LIABILITIES

Noninterest-bearing deposits $ 84,348 $ 89,119

Interest-bearing deposits 260,112 221,124

Total deposits 344,460 310,243

Short-term borrowings 53,255 12,829

Accrued expenses and other liabilities 30,706 25,965

Long-term debt 99,393 87,145

Total liabilities 527,814 436,182

STOCKHOLDERS’ EQUITY

Preferred stock 450 384

Common stock – $12/3par value, authorized 6,000,000,000 shares;

issued 3,472,762,050 shares 5,788 5,788

Additional paid-in capital 8,212 7,739

Retained earnings 38,970 35,215

Cumulative other comprehensive income 725 302

Treasury stock – 175,659,842 shares and 95,612,189 shares (6,035) (3,203)

Unearned ESOP shares (482) (411)

Total stockholders’ equity 47,628 45,814

Total liabilities and stockholders’ equity $575,442 $481,996

The accompanying notes are an integral part of these statements.