Wells Fargo 2007 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2007 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

118

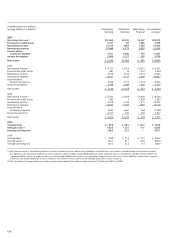

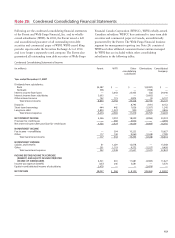

(in millions) December 31,

2007 2006

Deferred Tax Assets

Allowance for loan losses $1,977 $1,430

Deferred compensation

and employee benefits 576 484

Other 1,809 1,173

Total deferred tax assets 4,362 3,087

Deferred Tax Liabilities

Mortgage servicing rights 5,103 4,234

Leasing 1,737 2,349

Mark to market, net 427 972

Net unrealized gains on

securities available for sale 242 342

Other 1,510 1,175

Total deferred tax liabilities 9,019 9,072

Net Deferred Tax Liability $4,657 $5,985

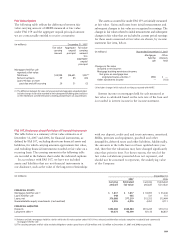

The components of income tax expense were:

The tax benefit related to the exercise of employee stock

options recorded in stockholders’ equity was $210 million,

$229 million and $143 million for 2007, 2006 and

2005, respectively.

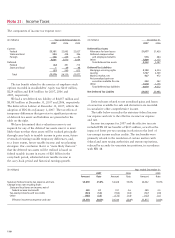

We had a net deferred tax liability of $4,657 million and

$5,985 million at December 31, 2007 and 2006, respectively.

The deferred tax balance at December 31, 2007, reflects the

adoption of FIN 48 on January 1, 2007. The tax effects of

temporary differences that gave rise to significant portions

of deferred tax assets and liabilities are presented in the

table on the right.

We have determined that a valuation reserve is not

required for any of the deferred tax assets since it is more

likely than not that these assets will be realized principally

through carry back to taxable income in prior years, future

reversals of existing taxable temporary differences, and,

to a lesser extent, future taxable income and tax planning

strategies. Our conclusion that it is “more likely than not”

that the deferred tax assets will be realized is based on

federal taxable income in excess of $20 billion in the

carry-back period, substantial state taxable income in

the carry-back period and historical earnings growth.

Note 21: Income Taxes

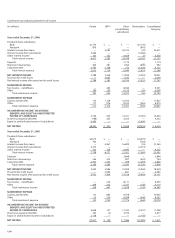

(in millions) Year ended December 31,

2007 2006 2005

Current:

Federal $3,181 $2,993 $2,627

State and local 284 438 346

Foreign 136 239 91

3,601 3,670 3,064

Deferred:

Federal (32) 491 715

State and local 1 69 98

(31) 560 813

Total $3,570 $4,230 $3,877

Deferred taxes related to net unrealized gains and losses

on securities available for sale and derivatives are recorded

in cumulative other comprehensive income.

The table below reconciles the statutory federal income

tax expense and rate to the effective income tax expense

and rate.

Income tax expense for 2007 and the effective tax rate

included FIN 48 tax benefits of $235 million, as well as the

impact of lower pre-tax earnings in relation to the level of

tax-exempt income and tax credits. The tax benefits were

primarily related to the resolution of certain matters with

federal and state taxing authorities and statute expirations,

reduced by accruals for uncertain tax positions, in accordance

with FIN 48.

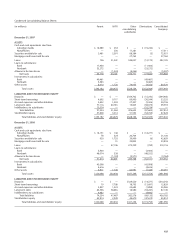

(in millions) Year ended December 31,

2007 2006 2005

Amount Rate Amount Rate Amount Rate

Statutory federal income tax expense and rate $4,070 35.0% $4,428 35.0% $4,042 35.0%

Change in tax rate resulting from:

State and local taxes on income, net of

federal income tax benefit 359 3.1 331 2.6 289 2.5

Tax-exempt income and tax credits (424) (3.6) (356) (2.8) (327) (2.8)

Other (435) (3.8) (173) (1.4) (127) (1.1)

Effective income tax expense and rate $3,570 30.7% $4,230 33.4% $3,877 33.6%