Wells Fargo 2007 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2007 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

110

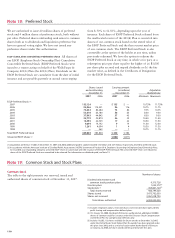

We are authorized to issue 20 million shares of preferred

stock and 4 million shares of preference stock, both without

par value. Preferred shares outstanding rank senior to common

shares both as to dividends and liquidation preference but

have no general voting rights. We have not issued any

preference shares under this authorization.

ESOP CUMULATIVE CONVERTIBLE PREFERRED STOCK All shares of

our ESOP (Employee Stock Ownership Plan) Cumulative

Convertible Preferred Stock (ESOP Preferred Stock) were

issued to a trustee acting on behalf of the Wells Fargo &

Company 401(k) Plan (the 401(k) Plan). Dividends on the

ESOP Preferred Stock are cumulative from the date of initial

issuance and are payable quarterly at annual rates ranging

Note 18: Preferred Stock

from 8.50% to 12.50%, depending upon the year of

issuance. Each share of ESOP Preferred Stock released from

the unallocated reserve of the 401(k) Plan is converted into

shares of our common stock based on the stated value of

the ESOP Preferred Stock and the then current market price

of our common stock. The ESOP Preferred Stock is also

convertible at the option of the holder at any time, unless

previously redeemed. We have the option to redeem the

ESOP Preferred Stock at any time, in whole or in part, at a

redemption price per share equal to the higher of (a) $1,000

per share plus accrued and unpaid dividends or (b) the fair

market value, as defined in the Certificates of Designation

for the ESOP Preferred Stock.

Shares issued Carrying amount

and outstanding (in millions) Adjustable

December 31, December 31, dividend rate

2007 2006 2007 2006 Minimum Maximum

ESOP Preferred Stock (1):

2007 135,124 —$ 135 $ — 10.75% 11.75%

2006 95,866 115,521 96 116 10.75 11.75

2005 73,434 84,284 73 84 9.75 10.75

2004 55,610 65,180 56 65 8.50 9.50

2003 37,043 44,843 37 45 8.50 9.50

2002 25,779 32,874 26 33 10.50 11.50

2001 16,593 22,303 17 22 10.50 11.50

2000 9,094 14,142 914 11.50 12.50

1999 1,261 4,094 14 10.30 11.30

1998 — 563 — 110.75 11.75

Total ESOP Preferred Stock 449,804 383,804 $ 450 $ 384

Unearned ESOP shares (2) $(482) $(411)

(1) Liquidation preference $1,000. At December 31, 2007 and 2006, additional paid-in capital included $32 million and $27 million, respectively, related to preferred stock.

(2) In accordance with the American Institute of Certified Public Accountants (AICPA) Statement of Position 93-6, Employers’ Accounting for Employee Stock Ownership Plans,

we recorded a corresponding charge to unearned ESOP shares in connection with the issuance of the ESOP Preferred Stock. The unearned ESOP shares are reduced as

shares of the ESOP Preferred Stock are committed to be released. For information on dividends paid, see Note 19.

Note 19: Common Stock and Stock Plans

Common Stock

The table to the right presents our reserved, issued and

authorized shares of common stock at December 31, 2007.

Number of shares

Dividend reinvestment and

common stock purchase plans 9,315,728

Director plans 1,022,372(2)

Stock plans (1) 455,861,120(3)

Total shares reserved 466,199,220

Shares issued 3,472,762,050

Shares not reserved 2,061,038,730

Total shares authorized 6,000,000,000

(1) Includes employee option, restricted shares and restricted share rights, 401(k),

profit sharing and compensation deferral plans.

(2) On January 22, 2008, the Board of Directors authorized an additional 100,000

shares of common stock for issuance under the Directors Stock Compensation

and Deferral Plan for compensation deferrals only.

(3) Includes 10,285,112 shares available for future awards at December 31, 2007,

under the PartnerShares Stock Option Plan. No awards have been granted under

this plan since 2002, and as a result of action taken by the Board of Directors

on January 22, 2008, no future awards will be granted under this plan.