Wells Fargo 2007 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2007 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

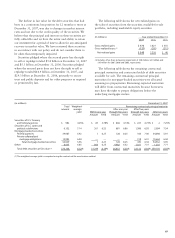

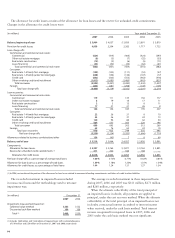

86

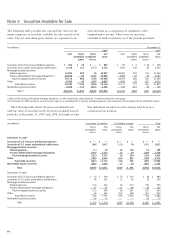

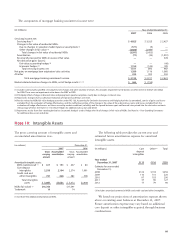

The following table shows the gross unrealized losses

and fair value of securities in the securities available-for-sale

portfolio at December 31, 2007 and 2006, by length of time

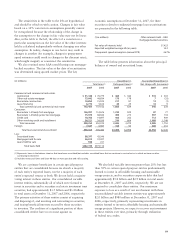

The following table provides the cost and fair value for the

major categories of securities available for sale carried at fair

value. The net unrealized gains (losses) are reported on an

Note 5: Securities Available for Sale

after-tax basis as a component of cumulative other

comprehensive income. There were no securities

classified as held to maturity as of the periods presented.

that individual securities in each category had been in a

continuous loss position.

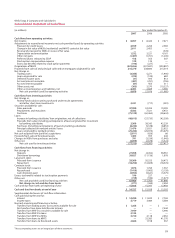

(in millions) December 31,

2007 2006

Cost Gross Gross Fair Cost Gross Gross Fair

unrealized unrealized value unrealized unrealized value

gains losses gains losses

Securities of U.S. Treasury and federal agencies $ 962 $ 20 $ — $ 982 $ 774 $ 2 $ (8) $ 768

Securities of U.S. states and political subdivisions 6,128 135 (111) 6,152 3,387 148 (5) 3,530

Mortgage-backed securities:

Federal agencies 34,092 898 (3) 34,987 26,981 497 (15) 27,463

Private collateralized mortgage obligations (1) 20,026 82 (126) 19,982 3,989 63 (6) 4,046

Total mortgage-backed securities 54,118 980 (129) 54,969 30,970 560 (21) 31,509

Other 8,185 45 (165) 8,065 5,980 67 (21) 6,026

Total debt securities 69,393 1,180 (405) 70,168 41,111 777 (55) 41,833

Marketable equity securities 2,878 172 (267) 2,783 592 210 (6) 796

Total (2) $72,271 $1,352 $(672) $72,951 $41,703 $987 $(61) $42,629

(1) Most of the private collateralized mortgage obligations are AAA-rated bonds collateralized by 1-4 family residential first mortgages.

(2) At December 31, 2007, we held no securities of any single issuer (excluding the U.S. Treasury and federal agencies) with a book value that exceeded 10% of stockholders’ equity.

(in millions) Less than 12 months 12 months or more Total

Gross Fair Gross Fair Gross Fair

unrealized value unrealized value unrealized value

losses losses losses

December 31, 2007

Securities of U.S. Treasury and federal agencies $ — $ — $ — $ — $ — $ —

Securities of U.S. states and political subdivisions (98) 1,957 (13) 70 (111) 2,027

Mortgage-backed securities:

Federal agencies (1) 39 (2) 150 (3) 189

Private collateralized mortgage obligations (124) 7,722 (2) 54 (126) 7,776

Total mortgage-backed securities (125) 7,761 (4) 204 (129) 7,965

Other (140) 2,425 (25) 491 (165) 2,916

Total debt securities (363) 12,143 (42) 765 (405) 12,908

Marketable equity securities (266) 1,688 (1) 36 (267) 1,724

Total $(629) $13,831 $(43) $ 801 $(672) $14,632

December 31, 2006

Securities of U.S. Treasury and federal agencies $ (1) $ 164 $ (7) $ 316 $ (8) $ 480

Securities of U.S. states and political subdivisions (4) 203 (1) 90 (5) 293

Mortgage-backed securities:

Federal agencies (10) 342 (5) 213 (15) 555

Private collateralized mortgage obligations (5) 67 (1) 68 (6) 135

Total mortgage-backed securities (15) 409 (6) 281 (21) 690

Other (6) 365 (15) 558 (21) 923

Total debt securities (26) 1,141 (29) 1,245 (55) 2,386

Marketable equity securities (6) 75 — — (6) 75

Total $ (32) $ 1,216 $(29) $1,245 $ (61) $ 2,461