Wells Fargo 2007 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2007 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

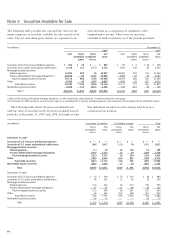

91

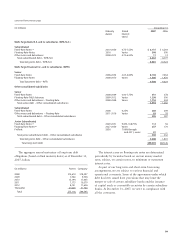

(in millions) Year ended December 31,

2007 2006 2005

Net gains from private equity

investments $598 $393 $351

Net gains from all other nonmarketable

equity investments 4 20 43

Net gains from nonmarketable

equity investments $602 $413 $394

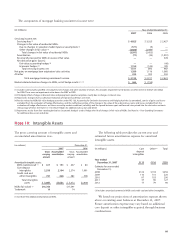

Note 7: Premises, Equipment, Lease Commitments and Other Assets

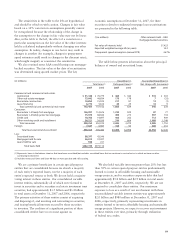

Operating lease rental expense (predominantly for premises),

net of rental income, was $673 million, $631 million and

$583 million in 2007, 2006 and 2005, respectively.

The components of other assets were:

Depreciation and amortization expense for premises and

equipment was $828 million, $737 million and $810 million

in 2007, 2006 and 2005, respectively.

Net gains on dispositions of premises and equipment,

included in noninterest expense, were $3 million, $13 million

and $56 million in 2007, 2006 and 2005, respectively.

We have obligations under a number of noncancelable

operating leases for premises and equipment. The terms

of these leases are predominantly up to 15 years, with the

longest up to 72 years, and many provide for periodic

adjustment of rentals based on changes in various economic

indicators. Some leases also include a renewal option. The

following table provides the future minimum payments under

capital leases and noncancelable operating leases, net of

sublease rentals, with terms greater than one year as of

December 31, 2007. Income related to nonmarketable equity investments was:

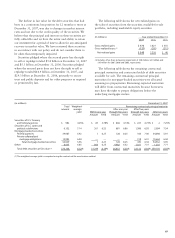

(in millions) December 31,

2007 2006

Land $ 707 $ 657

Buildings 4,088 3,891

Furniture and equipment 4,526 3,786

Leasehold improvements 1,258 1,117

Premises and equipment leased

under capital leases 67 60

Total premises and equipment 10,646 9,511

Less: Accumulated depreciation

and amortization 5,524 4,813

Net book value, premises and equipment $ 5,122 $4,698

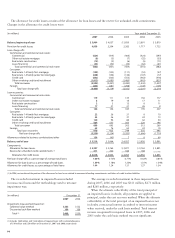

(in millions) Operating Capital

leases leases

Year ended December 31,

2008 $ 618 $ 4

2009 533 5

2010 443 5

2011 365 2

2012 316 1

Thereafter 1,408 14

Total minimum lease payments $3,683 31

Executory costs (2)

Amounts representing interest (9)

Present value of net minimum

lease payments $20

(in millions) December 31,

2007 2006

Nonmarketable equity investments:

Private equity investments $ 2,024 $ 1,671

Federal bank stock 1,925 1,326

All other 2,981 2,240

Total nonmarketable equity

investments (1) 6,930 5,237

Operating lease assets 2,218 3,091

Accounts receivable 10,913 7,522

Interest receivable 2,977 2,570

Core deposit intangibles 435 383

Foreclosed assets:

GNMA loans (2) 535 322

Other 649 423

Due from customers on acceptances 62 103

Other 12,426 9,892

Total other assets $37,145 $29,543

(1) At December 31, 2007 and 2006, $5.9 billion and $4.5 billion, respectively,

of nonmarketable equity investments, including all federal bank stock,

were accounted for at cost.

(2) Consistent with regulatory reporting requirements, foreclosed assets include

foreclosed real estate securing GNMA loans. Both principal and interest for

GNMA loans secured by the foreclosed real estate are collectible because

the GNMA loans are insured by the Federal Housing Administration or

guaranteed by the Department of Veterans Affairs.