Wells Fargo 2007 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2007 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

115

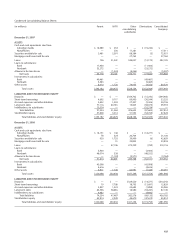

The net actuarial loss and net prior service credit for

the defined benefit pension plans that will be amortized

from accumulated other comprehensive income into net

periodic benefit cost in 2008 are $14 million and $5 million,

respectively. The net actuarial loss and net prior service

credit for the other postretirement plans that will be

amortized from accumulated other comprehensive income

into net periodic benefit cost in 2008 are $1 million and

$4 million, respectively.

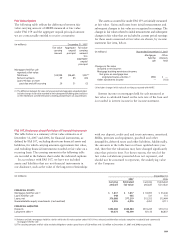

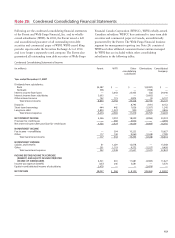

Amounts recognized in accumulated other comprehensive income (pre tax) for the year ended December 31, 2007 and 2006, consist of:

(in millions) December 31,

2007 2006

Pension benefits Pension benefits

Non- Other Non- Other

Qualified qualified benefits Qualified qualified benefits

Change in benefit obligation:

Benefit obligation at beginning of year $4,443 $ 301 $ 739 $4,045 $ 277 $ 709

Service cost 281 15 15 247 16 15

Interest cost 246 18 41 224 16 39

Plan participants’ contributions ——39 ——35

Amendments — (24) — 18 — (11)

Plan mergers (1) —64— ———

Actuarial loss (gain) (105) 16 (105) 225 31 26

Benefits paid (310) (24) (70) (317) (39) (74)

Foreign exchange impact 10 — 4 1 — —

Benefit obligation at end of year 4,565 366 663 4,443 301 739

Change in plan assets:

Fair value of plan assets at beginning of year 5,351 — 412 4,944 — 370

Actual return on plan assets 560 — 56 703 — 37

Employer contribution 72421 20 39 44

Plan participants’ contributions ——39 ——35

Benefits paid (310) (24) (70) (317) (39) (74)

Foreign exchange impact 9 — — 1 — —

Fair value of plan assets at end of year 5,617 — 458 5,351 — 412

Funded status at end of year $1,052 $(366) $(205) $ 908 $(301) $(327)

Amounts recognized in the balance sheet

at end of year:

Assets $1,061 $ — $ — $ 927 $ — $ —

Liabilities (9) (366) (205) (19) (301) (327)

$1,052 $(366) $(205) $ 908 $(301) $(327)

(1) Represents acquisition of Greater Bay Bancorp on October 1, 2007.

The changes in the projected benefit obligation of pension

benefits and the accumulated benefit obligation of other

benefits and the fair value of plan assets during 2007 and

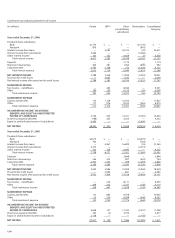

The weighted-average assumptions used to determine the

projected benefit obligation were:

Year ended December 31,

2007 2006

Pension Other Pension Other

benefits(1) benefits benefits(1) benefits

Discount rate 6.25% 6.25% 5.75% 5.75%

Rate of compensation

increase 4.0 — 4.0 —

(1) Includes both qualified and nonqualified pension benefits.

(in millions) December 31,

2007 2006

Pension benefits Pension benefits

Non- Other Non- Other

Qualified qualified benefits Qualified qualified benefits

Net actuarial loss $248 $ 79 $ 13 $494 $ 76 $144

Net prior service credit (7) (42) (42) (7) (21) (46)

Net transition obligation —— 3 —— 3

Translation adjustments 3 — 2 — — —

$244 $ 37 $(24) $487 $ 55 $101

2006, the funded status at December 31, 2007 and 2006,

and the amounts recognized in the balance sheet at

December 31, 2007, were: