Wells Fargo 2007 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2007 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

51

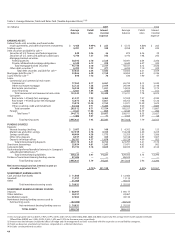

Off-Balance Sheet Arrangements and Aggregate Contractual Obligations

Off-Balance Sheet Arrangements, Variable Interest

Entities, Guarantees and Other Commitments

We consolidate our majority-owned subsidiaries and variable

interest entities in which we are the primary beneficiary.

Generally, we use the equity method of accounting if we own

at least 20% of an entity and we carry the investment at cost

if we own less than 20% of an entity. See Note 1 (Summary

of Significant Accounting Policies) to Financial Statements

for our consolidation policy.

In the ordinary course of business, we engage in financial

transactions that are not recorded in the balance sheet, or may

be recorded in the balance sheet in amounts that are different

from the full contract or notional amount of the transaction.

These transactions are designed to (1) meet the financial needs

of customers, (2) manage our credit, market or liquidity risks,

(3) diversify our funding sources, or (4) optimize capital,

and are accounted for in accordance with U.S. GAAP.

We have largely avoided many of the industry issues

associated with collateralized debt obligations (CDOs) and

structured investment vehicles (SIVs). A CDO is a security

backed by pools of assets, which may include debt securities,

including bonds (collateralized bond obligations, or CBOs)

or loans (collateralized loan obligations, or CLOs). CDOs

often can have reinvestment periods in which they can trade

assets and/or reinvest asset sales or liquidation proceeds. Like

collateralized mortgage obligations, CDOs issue tranches of

debt with different maturities and risk characteristics. We

typically have not engaged in creating or sponsoring SIVs to

hold off-balance sheet assets and we have not made a market

in subprime securities.

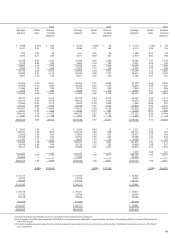

Almost all of our off-balance sheet arrangements result

from securitizations. We routinely securitize home mortgage

loans and, from time to time, other financial assets, including

commercial mortgages. We normally structure loan securitiza-

tions as sales, in accordance with FAS 140, Accounting for

Transfers and Servicing of Financial Assets and Extinguishment

of Liabilities – a replacement of FASB Statement No. 125. This

involves the transfer of financial assets to certain qualifying

special-purpose entities that we are not required to consolidate.

In a securitization, we can convert the assets into cash earlier

than if we held the assets to maturity. Special-purpose entities

used in these types of securitizations obtain cash to acquire

assets by issuing securities to investors. In a securitization,

we record a liability related to standard representations and

warranties we make to purchasers and issuers for receivables

transferred. Also, we generally retain the right to service the

transferred receivables and to repurchase those receivables

from the special-purpose entity if the outstanding balance

of the receivable falls to a level where the cost exceeds the

benefits of servicing such receivables.

At December 31, 2007, securitization arrangements

sponsored by the Company consisted of $224 billion in

securitized loan receivables, including $135 billion of home

mortgage loans and $89 billion of commercial mortgages.

At December 31, 2007, the retained servicing rights and other

interests held related to these securitizations were $10.8 billion,

consisting of $8.8 billion in securities, $1.5 billion in servic-

ing assets and $413 million in other interests held. Related

to our securitizations, we have committed to provide up to

$21 million in credit enhancements.

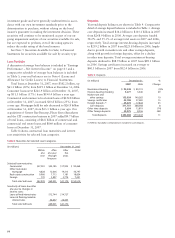

We have investments in certain special-purpose entities,

generally created by other sponsoring organizations, where we

hold variable interests greater than 20% but less than 50%

(significant variable interests). These special-purpose entities

were predominantly formed to invest in affordable housing

and sustainable energy projects and to securitize corporate

debt and had approximately $5.8 billion in total assets at

December 31, 2007, including $960 million related to CDOs.

We are not required to consolidate these entities. Our maximum

exposure to loss as a result of our involvement with these

unconsolidated variable interest entities was approximately

$2.0 billion at December 31, 2007, primarily representing

investments in entities formed to invest in affordable housing

and sustainable energy projects. However, we expect to recov-

er our investment in these entities over time primarily through

realization of federal tax credits. Our investments in CDOs,

including those special-purpose entities where we hold signifi-

cant variable interests, totaled $860 million at December 31,

2007. Table 10 reflects these investments, including the corre-

sponding asset collateral categories and related credit ratings.

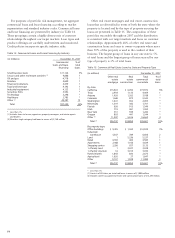

Table 10: Investments in Collateralized Debt Obligations

(in millions) December 31, 2007

Distribution of fair value by rating category

Investment grade

Cost Gross Gross Fair AAA AA to Other Total

unrealized unrealized value BBB-

gains losses (1)

Corporate credit $589 $ 1 $(68) $522 $ 13 $292 $217(2) $522

Bank or insurance trust preferred 298 1 (5) 294 257 37 — 294

Commercial mortgage 49 — (5) 44 24 20 — 44

Residential mortgage — — — — — — — —

Total $936 $ 2 $(78) $860 $294 $349 $217 $860

(1) All unrecognized losses are reviewed for potential impairment on a quarterly basis. At December 31, 2007, there was no deterioration in cash flows for any of the

investments reflected above and, therefore, no impairment charge. We have the ability and the intent to hold these investments until maturity or recovery.

(2) Approximately 90% had underlying credit portfolios that were selected by Wells Fargo credit analysts. Included $192 million of non-rated securities.