Wells Fargo 2007 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2007 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

43

Earnings Performance

Net Interest Income

Net interest income is the interest earned on debt securities,

loans (including yield-related loan fees) and other interest-

earning assets minus the interest paid for deposits and long-

term and short-term debt. The net interest margin is the

average yield on earning assets minus the average interest

rate paid for deposits and our other sources of funding.

Net interest income and the net interest margin are presented

on a taxable-equivalent basis to consistently reflect income

from taxable and tax-exempt loans and securities based

on a 35% federal statutory tax rate.

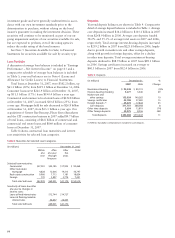

Net interest income on a taxable-equivalent basis was

$21.1 billion in 2007, up 5% from $20.1 billion in 2006.

Our net interest margin decreased to 4.74% for 2007 from

4.83% for 2006. Both the increase in net interest income and

the decrease in the net interest margin were largely driven by

strong growth in earning assets which were up 7% in 2007.

Average earning assets increased $30.1 billion to

$445.9 billion in 2007 from $415.8 billion in 2006.

Average loans increased to $344.8 billion in 2007 from

$306.9 billion in 2006. Average mortgages held for sale

decreased to $33.1 billion in 2007 from $42.9 billion in

2006. Average debt securities available for sale increased

to $57.0 billion in 2007 from $53.6 billion in 2006.

Core deposits are an important contributor to growth

in net interest income and the net interest margin, and are

a low-cost source of funding. Core deposits are noninterest-

bearing deposits, interest-bearing checking, savings certifi-

cates, market rate and other savings, and certain foreign

deposits (Eurodollar sweep balances). We have one of the

largest bases of core deposits among large U.S. banks.

Average core deposits grew 13% to $303.1 billion in 2007

from $268.9 billion in 2006 and funded 88% of average

total loans in both years. Total average retail core deposits,

which exclude Wholesale Banking core deposits and retail

mortgage escrow deposits, for 2007 grew $12.9 billion (6%)

from 2006. Average mortgage escrow deposits increased to

$21.5 billion in 2007 from $18.2 billion in 2006. Average

savings certificates of deposit increased to $40.5 billion in

2007 from $32.4 billion in 2006 and average noninterest-

bearing checking accounts and other core deposit categories

(interest-bearing checking and market rate and other savings)

increased to $241.9 billion in 2007 from $227.7 billion in

2006. Total average interest-bearing deposits increased to

$239.2 billion in 2007 from $223.8 billion in 2006, due to

a shift in the deposit mix in favor of higher-yielding savings

and certificates of deposit relative to lower cost savings and

demand deposit accounts.

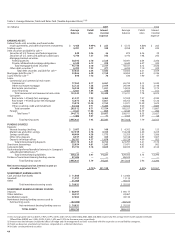

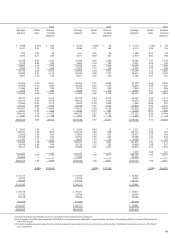

Table 3 presents the individual components of net interest

income and the net interest margin.

The income tax laws of the jurisdictions in which we

operate are complex and subject to different interpretations

by the taxpayer and the relevant government taxing authorities.

In establishing a provision for income tax expense, we must

make judgments and interpretations about the application

of these inherently complex tax laws. We must also make

estimates about when in the future certain items will affect

taxable income in the various tax jurisdictions by the

government taxing authorities, both domestic and foreign.

Our interpretations may be subjected to review during

examination by taxing authorities and disputes may arise

over the respective tax positions. We attempt to resolve these

disputes during the tax examination and audit process and

ultimately through the court systems when applicable.

We monitor relevant tax authorities and revise our

estimate of accrued income taxes due to changes in income

tax laws and their interpretation by the courts and regulatory

authorities on a quarterly basis. Revisions of our estimate

of accrued income taxes also may result from our own

income tax planning and from the resolution of income

tax controversies. Such revisions in our estimates may be

material to our operating results for any given quarter.

See Note 21 (Income Taxes) to Financial Statements for

a further description of our provision for income taxes and

related income tax assets and liabilities.