Wells Fargo 2007 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2007 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.48

We continued to build our business with investments in addi-

tional team members, largely sales and service professionals,

and new banking stores in 2007. The 10% increase in non-

interest expense to $22.8 billion in 2007 from $20.8 billion

in 2006 was due primarily to the increase in salaries, incen-

tive compensation and employee benefits. We grew our sales

and service force by adding 1,755 team members (full-time

equivalents), including 578 retail platform bankers. In 2007,

we opened 87 regional banking stores and converted 42

stores acquired from Placer Sierra Bancshares and National

City Bank to our network. The acquisition of Greater Bay

Bancorp added $87 million of expenses in 2007. Expenses

also included stock option expense of $129 million in 2007,

compared with $134 million in 2006. In addition, expenses

in 2007 included $433 million in origination costs that, prior

to the adoption of FAS 159, would have been deferred and

recognized as a reduction of net gains on mortgage loan

origination/sales activities at the time of sale.

Operating losses included $203 million for 2007 and

$95 million for 2006 of litigation expenses associated with

indemnification obligations arising from our ownership

interest in Visa.

Wells Fargo is a member of the Visa USA network. On

October 3, 2007, the Visa organization of affiliated entities

completed a series of global restructuring transactions to

combine its affiliated operating companies, including Visa

USA, under a single holding company, Visa Inc. Visa Inc.

intends to issue and sell a majority of its shares to the public

in an initial public offering (IPO). We have an approximate

2.8% ownership interest in Visa Inc., which is included in

our balance sheet at a nominal amount.

We obtained concurrence from the staff of the SEC

concerning our accounting for the Visa restructuring transac-

tions, including (1) judgment sharing agreements previously

executed among the Company, Visa Inc. and its predecessors

(collectively Visa) and certain other member banks of the

Visa USA network, (2) litigation, and (3) an escrow account

that will be established by Visa Inc. at the time of its IPO.

The escrow account will be funded from IPO proceeds and

will be used to make payments related to Visa litigation. We

recorded litigation liabilities associated with indemnification

obligations related to agreements entered into during second

quarter 2006 and third quarter 2007. Based on our propor-

tionate membership share of Visa USA, we recorded a litiga-

tion liability and corresponding expense of $95 million for

2006 and $203 million for 2007. The effect to the second

quarter 2006 was estimated based upon our share of an

actual settlement reached in November 2007. Management

does not believe that the fair value of this obligation if deter-

mined in second quarter 2006 would have been materially

different given information available at that time. Management

has concluded, and the Audit and Examination Committee

of our Board of Directors has concurred, that these amounts

are immaterial to the periods affected.

Upon completion of Visa Inc.’s IPO, we will account for

the funding of the escrow account by reducing our litigation

liability with a corresponding credit to noninterest expense

for our portion of the escrow account, consistent with the

method of allocating joint and several liability among poten-

tially responsible parties in American Institute of Certified

Public Accountants Statement of Position 96-1, Environmental

Remediation Liabilities.

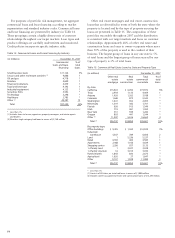

Income Tax Expense

On January 1, 2007, we adopted FASB Interpretation No.

48, Accounting for Uncertainty in Income Taxes (FIN 48).

Implementation of FIN 48 did not result in a cumulative

effect adjustment to retained earnings. At January 1, 2007,

the total amount of unrecognized tax benefits and accrued

interest was $3.1 billion, of which $1.7 billion related to tax

benefits and interest that, if recognized, would impact the

annual effective tax rate. Our effective tax rate for 2007 was

30.7%, compared with 33.4% for 2006. Income tax expense

and the related effective tax rate for 2007 included FIN 48

tax benefits of $235 million, as well as the impact of lower

pre-tax earnings in relation to the level of tax-exempt

income and tax credits. The tax benefits were primarily

related to the resolution of certain matters with federal and

state taxing authorities and statute expirations, reduced by

accruals for uncertain tax positions, in accordance with FIN

48. We expect that FIN 48 will cause more volatility in our

effective tax rate from quarter to quarter as we are now

required to recognize tax positions in our financial state-

ments based on the probability of ultimately sustaining such

positions with the respective taxing authorities, and we are

required to reassess those positions each quarter based on

our evaluation of new information.

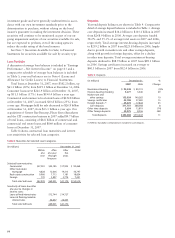

Operating Segment Results

We have three lines of business for management reporting:

Community Banking, Wholesale Banking and Wells Fargo

Financial. For a more complete description of our operating

segments, including additional financial information and the

underlying management accounting process, see Note 24

(Operating Segments) to Financial Statements.

To reflect a change in the allocation of income taxes for

management reporting adopted in 2007, results for prior

periods have been revised.

COMMUNITY BANKING’S net income decreased 5% to $5.29 billion

in 2007 from $5.55 billion in 2006. Strong sales and revenue

growth combined with disciplined expense management

were offset by higher credit costs, including the $1.4 billion

(pre tax) credit reserve build. Revenue increased 11% to

$25.54 billion from $23.03 billion in 2006. Net interest

income increased 2% to $13.37 billion in 2007 from

$13.12 billion in 2006. Although the net interest margin

declined 3 basis points to 4.75% (primarily due to lower

investment yields), the 3% growth in earning assets more

than offset the impact of the lower margin. The growth in

earning assets was predominantly driven by loan growth.

Average loans were up 9% to $194.0 billion in 2007 from

$178.0 billion in 2006. Average core deposits were up 7%

to $249.8 billion in 2007 from $233.5 billion a year ago.