Wells Fargo 2007 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2007 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

100

Note 15: Guarantees and Legal Actions

The significant guarantees we provide to third parties

include standby letters of credit, various indemnification

agreements, guarantees accounted for as derivatives,

additional consideration related to business combinations

and contingent performance guarantees.

We issue standby letters of credit, which include performance

and financial guarantees, for customers in connection with

contracts between the customers and third parties. Standby

letters of credit assure that the third parties will receive specified

funds if customers fail to meet their contractual obligations. We

are obligated to make payment if a customer defaults. Standby

letters of credit were $12.5 billion at December 31, 2007, and

$12.0 billion at December 31, 2006, including financial guarantees

of $6.5 billion and $7.2 billion, respectively, that we had issued

or purchased participations in. Standby letters of credit are net

of participations sold to other institutions of $1.4 billion at

December 31, 2007, and $2.8 billion at December 31, 2006. We

consider the credit risk in standby letters of credit in determining

the allowance for credit losses. We also had commitments for

commercial and similar letters of credit of $955 million at

December 31, 2007, and $801 million at December 31, 2006.

We enter into indemnification agreements in the ordinary

course of business under which we agree to indemnify third

parties against any damages, losses and expenses incurred

in connection with legal and other proceedings arising from

relationships or transactions with us. These relationships or

transactions include those arising from service as a director

or officer of the Company, underwriting agreements relating

to our securities, securities lending, acquisition agreements,

and various other business transactions or arrangements.

Because the extent of our obligations under these agreements

depends entirely upon the occurrence of future events,

our potential future liability under these agreements is

not determinable.

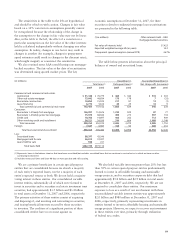

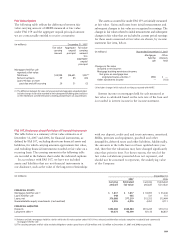

We write options, floors and caps. Periodic settlements

occur on floors and caps based on market conditions. The

fair value of the written options liability in our balance sheet

was $700 million at December 31, 2007, and $556 million

at December 31, 2006. The aggregate fair value of the written

floors and caps liability was $280 million and $86 million

for the same periods, respectively. Our ultimate obligation

under written options, floors and caps is based on future

market conditions and is only quantifiable at settlement. The

notional value related to written options was $30.7 billion

at December 31, 2007, and $47.3 billion at December 31,

2006, and the aggregate notional value related to written

floors and caps was $26.5 billion and $11.9 billion for the

same periods, respectively. We offset substantially all options

written to customers with purchased options.

We also enter into credit default swaps under which we

buy loss protection from or sell loss protection to a counter-

party in the event of default of a reference obligation. The

fair value of the contracts sold was a liability of $20 million

at December 31, 2007, and $2 million at December 31, 2006.

The maximum amount we would be required to pay under

the swaps in which we sold protection, assuming all refer-

ence obligations default at a total loss, without recoveries, was

$873 million and $599 million, based on notional value, at

December 31, 2007 and 2006, respectively. We purchased

credit default swaps of comparable notional amounts to

mitigate the exposure of the written credit default swaps

at December 31, 2007 and 2006. These purchased credit

default swaps had terms (i.e., used the same reference

obligation and maturity) that would offset our exposure

from the written default swap contracts in which we are

providing protection to a counterparty.

In connection with certain brokerage, asset management,

insurance agency and other acquisitions we have made,

the terms of the acquisition agreements provide for deferred

payments or additional consideration, based on certain

performance targets. At December 31, 2007 and 2006, the

amount of additional consideration we expected to pay was

not significant to our financial statements.

We have entered into various contingent performance

guarantees through credit risk participation arrangements

with remaining terms up to 22 years. We will be required to

make payments under these guarantees if a customer defaults

on its obligation to perform under certain credit agreements

with third parties. The extent of our obligations under

these guarantees depends entirely on future events and was

contractually limited to an aggregate liability of approximately

$50 million at December 31, 2007, and $125 million at

December 31, 2006.

In the normal course of business, we are subject to pending

and threatened legal actions, some for which the relief or

damages sought are substantial. After reviewing pending and

threatened actions with counsel, and any specific reserves

established for such matters, management believes that the

outcome of such actions will not have a material adverse

effect on the results of operations or stockholders’ equity. We

are not able to predict whether the outcome of such actions

may or may not have a material adverse effect on results of

operations in a particular future period as the timing and

amount of any resolution of such actions and its relationship

to the future results of operations are not known.

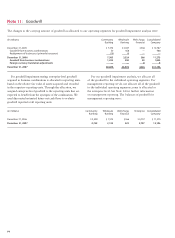

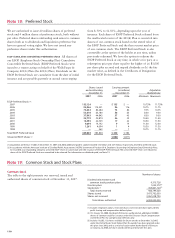

Wells Fargo is a member of the Visa USA network. On

October 3, 2007, the Visa organization of affiliated entities

completed a series of global restructuring transactions to

combine its affiliated operating companies, including Visa

USA, under a single holding company, Visa Inc. Visa Inc.

intends to issue and sell a majority of its shares to the public

in an initial public offering (IPO). We have an approximate

2.8% ownership interest in Visa Inc., which is included in

our balance sheet at a nominal amount.

We obtained concurrence from the staff of the SEC

concerning our accounting for the Visa restructuring

transactions, including (1) judgment sharing agreements

previously executed among the Company, Visa Inc. and its