Wells Fargo 2007 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2007 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.54

Our business units and the office of the Chief Credit

Officer periodically review all credit risk portfolios to ensure

that the risk identification processes are functioning properly

and that credit standards are followed. Business units con-

duct quality assurance reviews to ensure that loans meet

portfolio or investor credit standards. Our loan examiners

in risk asset review and internal audit independently review

portfolios with credit risk, monitor performance, sample

credits, review and test adherence to credit policy and

recommend/require corrective actions as necessary.

Our primary business focus on middle-market commercial,

residential real estate, auto, credit card and small consumer

lending, results in portfolio diversification. We assess loan

portfolios for geographic, industry or other concentrations

and use mitigation strategies, which may include loan sales,

syndications or third party insurance, to minimize these

concentrations, as we deem appropriate.

In our commercial loan, commercial real estate loan and

lease financing portfolios, larger or more complex loans are

individually underwritten and judgmentally risk rated. They

are periodically monitored and prompt corrective actions are

taken on deteriorating loans. Smaller, more homogeneous

commercial small business loans are approved and moni-

tored using statistical techniques.

Retail loans are typically underwritten with statistical

decision-making tools and are managed throughout their life

cycle on a portfolio basis. The Chief Credit Officer establishes

corporate standards for model development and validation to

ensure sound credit decisions and regulatory compliance and

approves new model implementation and periodic validation.

Residential real estate mortgages are one of our core

products. We offer a broad spectrum of first mortgage and

junior lien loans that we consider mostly prime or near

prime. These loans are almost entirely secured by a primary

residence for the purpose of purchase money, refinance, debt

consolidation, or home equity loans. We do not make or

purchase option adjustable-rate mortgage products (option

ARMs) or variable-rate mortgage products with fixed payment

amounts, commonly referred to within the financial services

industry as negative amortizing mortgage loans, as we believe

these products rarely provide a benefit to our customers.

We originate mortgage loans through a variety of sources,

including our retail sales force and licensed real estate bro-

kers. We apply consistent credit policies, borrower documen-

tation standards, Federal Deposit Insurance Corporation

Improvement Act of 1991 (FDICIA) compliant appraisal

requirements, and sound underwriting, regardless of applica-

tion source. We perform quality control reviews for third

party originated loans and actively manage or terminate

sources that do not meet our credit standards. Specifically,

during 2007 we stopped originating first and junior lien resi-

dential mortgages where credit performance had deteriorated

beyond our expectations, especially recent vintages of high

combined loan-to-value home equity loans sourced through

third party channels.

We believe our underwriting process is well controlled

and appropriate for the needs of our customers as well as

investors who purchase the loans or securities collateralized

by the loans. We only approve applications and make loans

if we believe the customer has the ability to repay the loan or

line of credit according to all its terms. A small portion of

borrower selected stated income loans originated from third

party channels produced unacceptable performance in our

Home Equity portfolio. We have tightened our bank-selected

reduced documentation requirements as a precautionary

measure and substantially reduced third party originations

due to the negative trends experienced in these channels.

Appraisals are used to support property values.

In the mortgage industry, it has been common for consumers,

lenders, and servicers to purchase mortgage insurance, which

can enhance the credit quality of the loan for investors and

serves generally to expand the market for home ownership.

In our servicing portfolio, certain of the loans we service

carry mortgage insurance, based largely on the requirements

of investors, who bear the ultimate credit risk. Within our

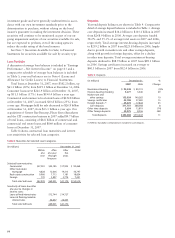

$1.5 trillion servicing portfolio, we service approximately

$115 billion of loans that carry approximately $25 billion of

mortgage insurance coverage purchased from a group of

mortgage insurance companies that are rated AA or higher

by one or more of the major rating agencies. Should any of

these companies experience a downgrade by one or more of

the rating agencies, investors may be exposed to a higher

level of credit risk. In this event, as servicer, we would work

with the investors to determine if it is necessary to obtain

replacement coverage with another insurer. Our mortgage

servicing portfolio consists of over 90% prime loans and we

continue to be among the highest rated loan servicers for res-

idential real estate mortgage loans, based on various servic-

ing criteria. The foreclosure rate in our mortgage servicing

portfolio was only 0.88% at year-end 2007.

Similarly, we obtained approximately $2 billion of mortgage

insurance coverage for certain loans that we held for investment

or for sale at December 31, 2007. In the event a mortgage

insurer is unable to meet its obligations on defaulted loans in

accordance with the insurance contract, we might be exposed

to higher credit losses if replacement coverage on those loans

cannot be obtained. However, approximately one-third of the

coverage related to the debt consolidation nonprime real estate

1-4 family mortgage loans held by Wells Fargo Financial, which

have had a low level of credit losses (0.31% loss rate (annualized)

in fourth quarter 2007 for the entire debt consolidation

portfolio). The remaining coverage primarily related to

prime real estate 1-4 family mortgage loans, primarily high

quality ARMs for our retail and wealth management

customers, which also have had very low loss rates.

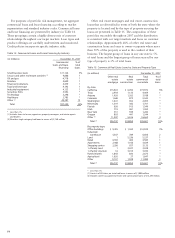

Each business unit regularly completes asset quality fore-

casts to quantify its intermediate-term outlook for loan losses

and recoveries, nonperforming loans and market trends. To

make sure our overall loss estimates and the allowance for

credit losses is adequate, we conduct periodic stress tests.

This includes a portfolio loss simulation model that simu-

lates a range of possible losses for various sub-portfolios

assuming various trends in loan quality, stemming from

economic conditions or borrower performance.